BoU Governor says loosening of COVID 19 restrictions, shrewd monetary policy decisions kept the economy ‘alive’ amidst major threats

| THE INDEPENDENT | The financial year 2020/2021 was largely challenging due to the COVID-19 pandemic hit that negatively affected all sectors of the economy, according to the Bank of Uganda annual report for 2021 released on Oct.19.

“Although Uganda gradually eased the lockdown measures during the first half of the financial year, the antecedent global and domestic supply chain disruptions led to a severe contraction in economic activity and a sudden decline in consumer demand,” reads the report in part.

It adds that the contact-intensive sectors continued to be affected by social distancing measures and heightened uncertainty.

In terms of sector performance, manufacturing and service sectors registered growth rates of only 2.1 percent and 2.5 percent, respectively, well below the historical average while the agricultural sector grew by 3.5 percent, which was below the 4.8 percent growth rate registered in the previous year.

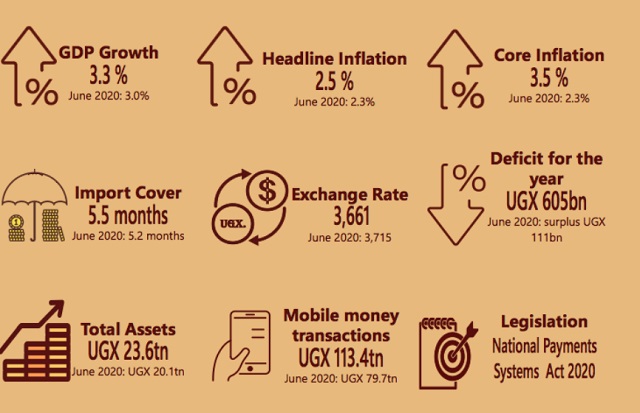

Consequently, real gross domestic product growth in FY2020/21 increased only marginally to 3.3 percent from 3.0 percent registered in FY2019/20.

Meanwhile, inflation remained benign on account of exchange rate stability and the existence of spare capacity in the economy. Annual headline and core inflation averaged 2.5 percent and 3.5 percent, a slight increase from 2.3 percent respectively registered in the previous fiscal year.

The report says, the benign inflation environment permitted the pursuance of accommodative monetary policy stance to support economic activity.

Indeed, the Central Bank Rate was maintained at 7 percent during the first 11 months of the financial year and reduced further to 6.5 percent, the lowest level ever, in June 2021.

Notwithstanding the accommodative monetary policy stance, private sector credit (PSC) growth remained subdued largely on account of risk aversion by lenders and weak credit demand, owing to the relatively murky economic environment conditioned by the COVID-19 pandemic.

Growth in PSC declined to 8.1 percent in FY2020/21 from 11.7 percent in FY2019/20.

Most of the deceleration was on account of shilling denominated lending, which grew by 9.9percent, lower than the 15.6percent growth rate registered in FY2019/20.

The growth in private sector credit also remained uneven across major sectors of the economy, with the mining and quarrying and trade sectors registering negative growth rates in the FY 2020/21.

The balance of payments recorded a surplus of US$440million in FY2020/21, largely underpinned by significant budget support inflows. Although the current account deficit widened to a record high of US$4,139million in FY2020/21, it was more than offset by the financial account inflows, leading to a reserve build-up during the year.

The deterioration of the current account deficit was driven by the widening trade deficit, partly driven by public investments, which boosted imports, while exports remained relatively subdued.

In addition, tourism receipts declined on account of the global measures to contain the pandemic.

Foreign direct investment inflows, however remained subdued on account of the global economic uncertainty. It declined to US$847million from US$967 million in the FY2019/20.

FDI is however projected to recover on account of the positive developments in the oil sector and in line with the projected recovery of the economy.

Portfolio inflows, which are more vulnerable to refinancing risks were however strong, registering a net inflow of US$116million in the FY2020/21 compared to a net outflow of US$321million in FY2019/20, as offshore investors increased their holdings of domestic debt securities.

The stock of foreign exchange reserves as of end-June 2021 amounted to USD 4,214 million, which is equivalent to 5.5 months of import cover.

Sound banking sector

The report however says, the banking sector remained sound, with bank liquidity and capital buffers well above the minimum regulatory requirements.

The asset quality of the commercial banking system also improved, largely supported by the credit relief measures put in place by BoU to mitigate the adverse economic impact of the pandemic on borrowers and the financial sector.

As of June, 2021 the ratio of non-performing loans to total gross loans stood at 4.8 percent compared to 6.0 percent in June 2020.

The Bank of Uganda continued to embrace the opportunities of the changing financial ecosystem in order to enhance financial inclusion and economic transformation.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price