Discussions centres on how to finance local governments

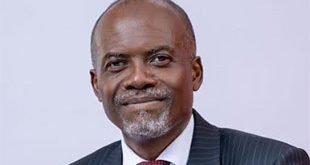

Kampala, Uganda | JULIUS BUSINGE | Optimal funding to local governments is key for the growth of local economies that feed into the national economy, according to David Bikhado Ofungi, the founder and chief executive officer of DERO and curator of the Mkutano, an annual economic forum that gathers leaders to discuss topics related to economic development.

This year’s Economic Mkutano was held in Kampala from Nov.24-25 under the theme; financing local governments’ development plans to achieve the NDPIII and the Sustainable Development Goals.

Ofungi said the ability to collect taxes, levy fees and penalties by local governments would determine their success in providing services to their people.

The challenge, Ofungi said is that most cities including the newly created ones, have ambitious plans amidst having fastest growing populations.

He said these local governments cannot raise money and fully fund their activities. He suggests the need to further embrace public private partnerships and the search for capital within the capital markets.

He also said there is need to amend the local government act to relax the restriction of how much local governments can borrow. Currently, according to the act, they can only borrow 25% of their total annual revenue.

The UN Resident Coordinator for Uganda Rosa Malango said this year’s Mkutano is quite relevant because sub-national/local governments and cities are concerned about the burgeoning infrastructure needs and the need to implement the SDGs at the local level.

Malango said, the theme is in line with the United Nations Sustainable Development Cooperation Framework for Uganda 2020-2025 and with SDG 17 that among others concerns mobilising efforts and creating partnerships for implementation of the SDGs at local level.

With only 10 of the 15 years remaining for the achievement of the SDGs, Malango said there is a global consensus that countries need to accelerate the implementation of SDGs.

“While the progress towards SDGs may vary from one goal to another, Uganda has nonetheless made significant progress towards the achievement of SDGs and has been ranked 18th among 52 African countries,” she said.

She said progress has been registered in health, gender equality, decent work and economic growth, industry innovation and infrastructure and partnerships.

She said the public and private finance will both be needed –at scale –to meet the SDGs, and that official development assistance can and should play a role in catalyzing and accelerating those flows, especially in risky and harder to reach local economies.

In order to improve financing of local governments, Malango said, there is need to improve on efficiency of collection and management of existing revenues, development of innovative alternative financing options, working towards improved legal and policy regime for local governments to tap into innovative financing options and improving on credit worthiness.

The other issues that need to be worked on are creating a business-friendly investment environment for the private sector.

The United Nations in Uganda under its current United Nations Sustainable Development Cooperation Framework for Uganda 2020-2025 is financing projects that are making significant contributions to improving Urban governance, access to investment capital for private sector, infrastructure services and the general required improvements in business environment.

“We will continue to work with Government of Uganda and the Local Governments in not only these areas but bring on board innovative financing instruments,” Malango said.

Pamela Mbabazi, the chairperson board of directors for National Planning Authority, said the major problem confronting local authorities in Uganda is the widening gap between the availability of financial resources and local spending needs.

Mbabazi said the rapid growth of the population is creating an ever-increasing demand for public services, new public infrastructure, and its maintenance as well as other social needs.

She said that during the implementation of NDPI and II, there was dwindling local revenues which are insufficient to finance local economic development and public services in local governments.

Local governments in Uganda depend mainly on central government transfers, through conditional and unconditional grants to finance wage, non-wage and development expenses.

The central government grants constitute approximately 90% of the LG revenues and the rest are from locally raised sources and development partners’ contributions.

The vast majority of the fiscal transfers to LGs are conditional in nature and are spent on priorities pre-determined from the centre. The conditional grants mainly finance wage and capital investments of the LGs.

The unconditional grants, while discretionary in nature, are spent in accordance to guidelines also determined at the centre to finance local specific priorities.

The Local Government Act empowers LGs to generate own-source revenues from property taxes, local service taxes, trading licenses, public transport, parking fees, rentals, advertising, ground rent, royalties, and hotel tax.

The current development plan-NDPIII-that is under implementation requires significant resources to the tune of Shs411.681 trillion (average 40.9% of GDP, annually) of which Shs276.878 trillion (average 27.5% of GDP annually) is contribution by the public while Shs134.803 trillion is private sector contribution (less recurrent private sector expenditure).

NDPIII has indicated that the main source of financing the Plan is through domestic revenue generation and consequently implementation of the Domestic Revenue Mobilization Strategy is given priority in order to improve tax administration, policy.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price