By Joseph Were

Reeling from a 5% drop in year-on-year net profit amid increasing costs and stiffer competition, East African Breweries Ltd who are the makers of the Bell beer brand among others in Uganda, is mooting a price hike.

‘The possibility to put up prices exists too in Uganda in light of the cost of inflationary pressures, however for now prices remain the same,’ said Sandor Walusimbi, the Head Corporate Relations at EABL.

According to its full year results ending June 30, 2009 announced last week, the Kenya based subsidiary of the London-based Diageo Plc earned a net profit of Kshs 7.1 billion compared to Kshs 7.5 billion the previous year.

The EABL Group operations consist of Kenya Breweries, Uganda Breweries, International Distillers Uganda, East African Maltings, Central Glass Industries, EABLI and UDV Kenya.

Group Finance Director Peter Ndegwa who presented the depressed results to investors in Nairobi told investors that the company needed to increase its prices to cover the escalating operating costs.

In a statement, the company said the rising input and energy costs as well as the global economic crisis led to an increase of 14% in costs of sales from Kshs 15 billion to Kshs 17 billion.

The company experienced a drop in gross and net profit, and a drop in Earning per Share on the back of high input and energy costs and completion.

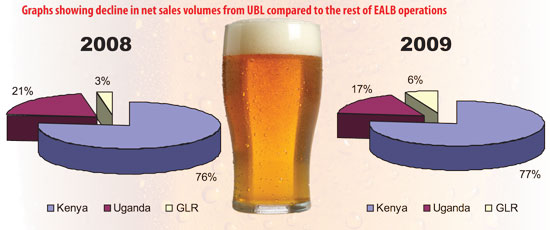

Although Uganda Breweries (UBL), the Ugandan arm of EABL, contributes less than one-third of EABL’s revenue, it saw its contribution to group net sales volumes drop from 21% last year to 17% in the year ending June 30, 2009.

The decline is blamed on heightened competition that targeted UBL’s main brands which only managed to maintain market share and grow net sales on Bell and Uganda Waragi at a high price in terms of marketing expenditure.

Although volumes grew by 23%, net sales declined by 2% while the marketing expenditure went up by a whopping 11%. As a result, UBL suffered an operation loss of 44% and a 31% loss on profits compared to last year.

In spite of the bad performance the brewer is looking at regional expansion, especially within the Great Lakes region, Rwanda, Burundi, Southern Sudan, and DR Congo, where its market share grew by 11 %.

EABL’s new Group Managing Director Seni Adetu is quoted to have said that ‘the window of opportunities for EABL is wide open’.

He said the group had performed remarkably well given the tough operating environment in the region with generally low consumer demand. This coupled with the two substantial tax increases in Kenya affected the ability of consumers to access its brands.

The group’s pre-tax profit was KShs 11.9 billion down from KShs 12.3 billion reported in the year to June 2008.

Adetu said his company was in negotiations with the Kenya government to reduce taxes on it products.

‘Because of the challenges on the cost side, we have to consider what options we have and so we will consider certain price increases. However, we will also consider what impact that will have on the consumer before we take such price increases,’ he is quoted to have said.

In Kenya, tax on non-malted beer increased by 70 % while that on spirits went up by 250 %, translating to a 33 % drop in (spirits) consumption.

But Uganda’s ministry of Finance in the 2009/10 national budget announced a 20% reduction in excise duty on beer produced and malted using locally grown barley.

The reduction would however appear to favour UBL’s local rival, Nile breweries Ltd, the subsidiary of South African Breweries Miller (SABMiller) which has aggressively pursued local ingredients in its beers.

The bad numbers for EABL come on the heels of a set-back in court in a case filed by SABMiller to block EABL’s acquisition of equity Tanzania’s top brewery, Serengenti Brewers Ltd (SBL).

SABMiller claims the deal would breach an agreement signed seven years ago that saw SABMiller sell 20% of its Tanzania Breweries Ltd (TBL) shares to EABL in exchange for a similar stake in EABL’s Kenya Breweries.

The two beer giants were at the time embroiled in a suicidal price war and the deal ensured an end to it by allowing TBL to manufacture and sell EABL brands in Tanzania.

Now however, EABL wants to go it alone in Tanzania by terminating its deal with SABMiller and instead acquiring a stake in SABMiller’s rival, SBL.

Justice Christopher Clarke in London ruled that a Diageo unit cannot buy SBL until 2011 or the resolution of a related arbitration.

SABMiller, the world’s second-largest brewer, and Diageo have targeted Africa for growth.

SABMiller said in June that it was targeting sub- saharan Africa’s US$3 billion home-brew market with cheaper beers made from domestic crops like sorghum and cassava.

‘Undoubtedly it will mean Diageo won’t continue to pursue its own path in Tanzania and will be left in an unhappy relationship with SABMiller,’ Simon Hales, an analyst at Evolution Securities told Bloomberg.

EABL remains optimistic.

‘We are confident that the Serengeti deal will go ahead,’ Adetu is quoted to have said in a statement on the company’s website.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

The decline of Uganda breweries market share in Uganda is down to poor Management by the Kenyan managers appointed by diageo in Nairobi.

These incompetent Kenyan managers attempted to copy & paste what worked in their home country to Uganda and they failed miserably. Then they destroyed an a great brand and cash cow of Uganda breweries bell lager with amateursh/naive imperialistic agenda of replacing bell lager with Kenyan Tusker lager also failing miserably.

Not only at Uganda breweries but Kenyan managers are stupid enough to destroy ugandan fresh dairy in hopes of replacing it with Kenyan brookside dairy products which also failed giving room for ugandan Jess dairy to dominate.

Kenyan managers/ people who appoint them confuse the relative large size of Kenyan economy to the skillsets of the Kenya managers forget kenya’s relatively large economy was built by British capital ,sustained by British expertise etc not native kenyan ingenuity.

Unless multinationals that hope to use Kenya as base for their east african Operation realise this they will always bleed money.

Kenyan banks like kcb, equity etc on paper have larger assets than ugandan banks make much larger profits than their ugandan counterparts but when those Kenyan banks attempt to open branches in Uganda they can replicate that success in their home country and dominate the much smaller Uganda banks..

This story is repeated with vthe various Kenyan companies including supermarket like the failed nakumatt,uchumi etc