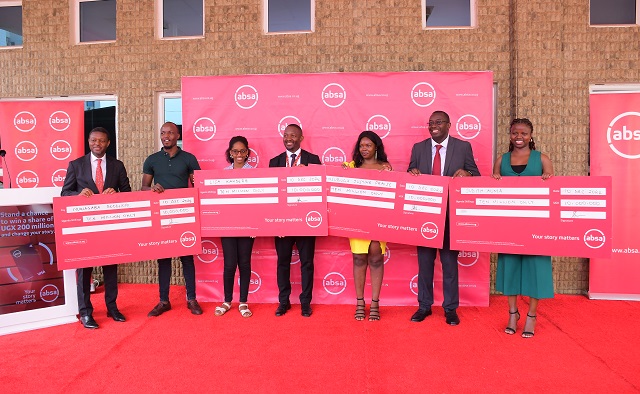

KAMPALA, UGANDA | THE INDEPENDENT | Absa Bank Uganda has today handed over cash prizes worth UGX 50 million to 5 lucky winners in the ongoing card usage campaign dubbed “UGX 200 million can change your story”. The five winners used their debit or credit cards for at least five transactions in November to pay for goods and services such as shopping, travel, among others.

During the handover ceremony, the Bank’s Executive Director and Chief Financial Officer, Michael Segwaya thanked the lucky winners for continuing to choose Absa as their banking partner of choice.

“To our winners today, thank you for embracing the use of Absa cards. With Absa’s debit or credit card, customers can conveniently pay for goods, services, subscriptions, travel, and any other expenses both in-store or online, whether in country or abroad. This campaign reflects our commitment to be a customer centric bank aligned to our refreshed brand promise of ‘Your Story Matters’. Indeed, to us, everyone’s story matters.”

The campaign is still running and Segwaya encouraged customers to continue to use their Absa cards to pay for goods and services especially during the festive season.

“The holiday season is upon us and is characterized by increased travel and shopping. Our card payments offer a seamless and secure payment experience for customers. Our point-of-sale machines are readily available around the country and can be used be it at supermarkets, restaurants and eateries, and pay for various goods and services. We encourage our customers to embrace the convenience of card payments and stand a chance to be winners under this ongoing campaign,” he added.

Sam Kiyaga, the Head of Alternate Channels at Absa Bank Uganda said that Absa cards are designed with the highest security features to ensure that customers’ transactions are safe.

One of the winners Ms. Lisa Kandere applauded Absa for its commitment to rewarding customers.

“I have been using my debit card to pay for everything from shopping to paying bills and I am glad for this festive reward from Absa. I would like to encourage fellow customers to continue using these cards because they are secure, easy to use and you could also get a reward like this before the January drought hits.”

According to the Uganda Bankers Association’s Banking Sector Report for the year 2023, there was an increase in the utilization of digital payment systems including point of sale, debit cards, mobile banking, mobile money, and internet banking.

The report furthermore indicates that there was an increase in the value of debit card payment transactions from the third quarter to the fourth quarter of 2023. The total transaction value rose from UGX.532.9 billion in the quarter to September 2023 to UGX.581.1 billion in the quarter to December 2023.

“With a focus on digital, we are also continually establishing our cyber security measures endeavoring to stay one step ahead to safeguard customer investments. This is a continuous process and we continue to put in place cutting-edge technologies, to ensure our encryption measures are not just robust for today's standards but are also prepared for tomorrow's challenges,” Kiyaga concluded.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price