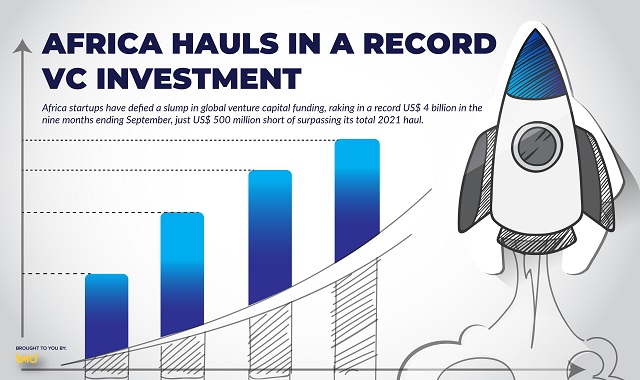

Africa startups have defied a slump in global venture capital funding, raking in a record US$ 4 billion in the nine months ending September, just US$ 500 million short of surpassing its total 2021 haul

SPECIAL FEATURE | BIRD STORY AGENCY | Africa’s VC scene remained resilient in spite of major geopolitical and financial headwinds that are precipitating falling startup valuations and sell-offs across the world.

Startup tracker, Africa: The Big Deal’s latest figures show investor appetite in the continent’s rapidly-growing tech marketplace is not waning, although there have been hiccups.

“As things currently stand, the ecosystem is on track to match or exceed the total amount of funding raised in 2021 (US$4.5 billion), which in itself is quite an achievement given global trends,” it states in part.

This is despite a lacklustre performance in Q3 where funding for startups sunk by more than a half, its worst quarter of the year.

“Q3 registered a fall of -53% YoY in the amount raised and -25% YoY in a number of deals (US$100k+, excluding grants). This relative counter-performance has many causes including the global context – which we’ll look into once the CB Insights numbers are out -, but is also the result of a slow down in ‘mega deals’ (US$100m+) announced,” the Deal states.

“Only one such deal was made public in Q3 – Bboxx’s acquisition of PEG Africa estimated at $200m – compared to four last quarter (worth US$620m) and five last year in Q3 2021 (totalling over US$1 billion!).”

Cumulatively, however, the Deal notes that despite pandemic-induced shocks and now the ongoing war in Ukraine, the continent’s startup market has been on a growth trajectory.

“The ecosystem is still alive and kicking. Indeed, start-ups in Africa have already raised over US$4 billion in 2022. Just like the US$1 billion, US$2 billion, and US$3 billion milestones, they’ve done so faster than any other year before,” the Deal states in part, noting that the market was quieter in July and August months, hence the disappointing Q3 numbers in relative terms.

“In absolute numbers, start-ups in Africa have raised more than US$850 million through 150+ deals over US$100k (excluding grants). Back in 2019 or 2020, it would have been a stellar performance, but given what the ecosystem had delivered in the past year, it feels below par.”

African startups’ 2022 performance does not come as a surprise –– the ecosystem raked in 1 billion US dollars in the first seven weeks of the year. That take was more than 25 per cent of the entire 2021 amount – and came with just over 130 deals.

It took 46 weeks (nearly a year) in 2019 for African startups to reach the 1 billion US dollar mark, 36 weeks (9 months) in 2020, and 21 weeks (5 months) in 2021.

For 2022, the overall amount (over 4 billion US dollars in 2021) was initially projected to almost double. While that overall trajectory is now unlikely, given the impact of rising interest rates on the startup ecosystem worldwide, the resilience of Africa’s startup environment has surprised many analysts.

Africa is now home to seven unicorns (startups with valuations of over 1 billion US dollars): Jumia, Interswitch, Flutterwave, Andela, Wave, OPay and Chipper Cash.

Five of these became unicorns in 2021- including two in September alone – indicating levels of interest in Africa’s startup market not seen before.

Startups in Nigeria, South Africa, Egypt and Kenya – considered the continent’s big four – gobbled up the lion’s share of startup funds raised through 2021.

Projections show that African startups will rake in more funds in Q4, the period where previous analysis shows the scene heats up.

Notably, in November 2021 alone, African startups raised 605 million US dollars, nearly half the total amount of funds raised by Africa’s startups in all of 2020 – around 1.3 billion US dollars according to data-driven research firm, Briter Bridges.

bird story agency

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price