Hoima, Uganda | THE INDEPENDENT | Uganda is optimistic that the Final Investment Decision-FID on the commercial oil and gas production will be made in the first months of this year to pave way for the construction of the final structures in the sector.

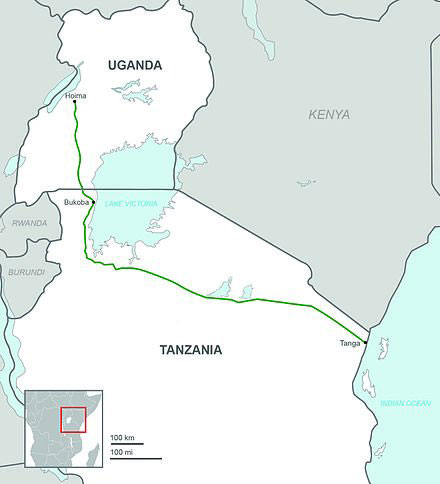

These will include the oil refinery in Hoima district valued at U$3.5 billion, two central processing facilities as well as the U$3.2 billion crude oil export pipeline from Hoima to the Indian Ocean Cost of Tanga in Tanzania.

The government, through the National Oil Company, also plans to construct the Kampala Storage Terminal in Wakiso district worth U$51 million (Shs 190 billion), which will act as a collection center for refined fuel for both the local and export markets.

It is estimated that the facilities that will facilitate commercial oil production will cost about U$15 billion. Ernest Rubondo, the Executive Director, the Petroleum Authority of Uganda-PAU, most of the hurdles in the negotiations with different stakeholders have been overcome. Uganda first confirmed commercially viable oil deposits more than 13 years go. Since then, the production date has been postponed several times, over legal and regulatory issues, disagreements between the government and oil companies over taxes among others.

The FID had been expected by the end of June last year, but a combination of falling global oil prices as well as the disruptions caused by the onset of the COVID-19 pandemic slowed down the progress. The field pipelines, the export pipelines and the central processing facilities are the main pre-requisite for the production of crude, while the refinery is expected to be completed later.

“When the dual shock of the coronavirus pandemic and the oil price slump hit us, we thought it was not the right time to promote new investment opportunities and we feared not being able to achieve the FID. We believe we should be able to take an FID on the refinery by February 2022 and it could start operating four years after that,” says Peter Mulisa, the Head of Legal and Corporate Affairs at the Uganda National Oil Company, UNOC.

The construction of the refinery and the other petrochemical industries will also, depend on the finalization of the processing facilities in oil fields as well as the export pipeline. However, Rubondo says a final decision on the crude pipeline depends on the progress of the projects upstream like the central processing facilities, so that each project developer is sure that they will be put to use immediately they are concluded.

He says what is left is the conclusion of the agreements on oil transportation tariffs and the shareholding in the Oil Pipeline Company, but that the stakeholders have already agreed on the principles.

Earlier last year, it had been expected that once Tullow Oil completed the sale of its assets to TOTAL, the FID would be made before the end of 2020, but this was not be possible. In 2018, the AGRC – a U.S.-led group of companies including General Electric, YAATRA Africa, and the Italian engineering firm Saipem – won the right to finance, build and operate a planned U$3.5 billion oil refinery.

Uganda, Tanzania and the oil companies led by TOTAL are in the process of creating the holding company for the East African Crude Oil Pipeline or EACOP, in which they will each have shares. There are also growing concerns that fossil fuels are becoming less important globally as consuming industries are increasingly opting for alternative and cleaner sources of energy like solar, wind and geothermal.

The automotive industry, the biggest consumer of fossil fuel is also moving away from fuel to electric powered vehicles. Many countries and financial companies are also increasingly withdrawing from financing of fossil fuel industries. The UK for example, announced last year that they would no longer fund such projects especially in Africa, to encourage the continent to migrate to the more climate-friendly green, clean or renewable energy.

However, Rubondo says the oil companies that are investing in Uganda are ready to sink in their money despite the low global crude oil prices and the waning global interest in the industry. He adds that the delays could not be avoided as Uganda was entering into a new industry.

****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price