ANALYSIS: By Dr. Geoffrey A Onegi-Obel

The way forward on the Uganda interest rate and middle income economy policy conundrum –

The first point to note is that the Interest Rate is the key price in any economy. As a Pricing Signal, it therefore requires careful management by the Monetary and Fiscal Policy Authorities over its short, medium and long term reach where long term is recognised by the capital markets industry as 30 Years at the very least.

The 30 Years is the minimum number of years we expect a working man or woman to work, invest and save for his or her retirement. That is where the expression ‘Lifetime Savings ‘ comes from.

The fact that we do not have a 30 year price signal is just a reflection of monetary and fiscal policy laziness – and a matter for urgent broad economic reform.

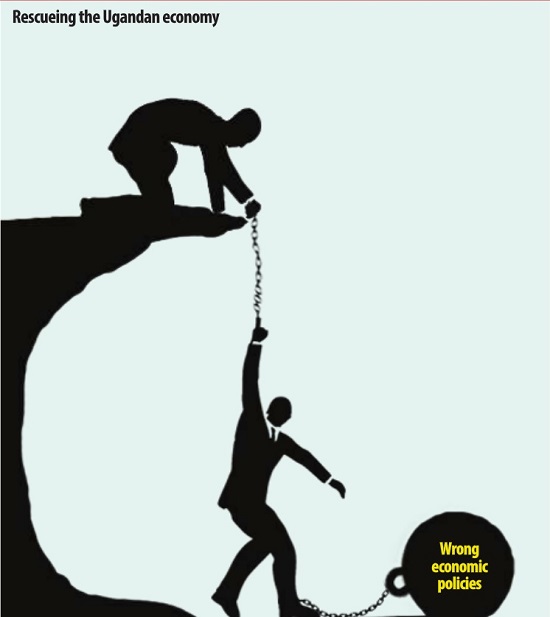

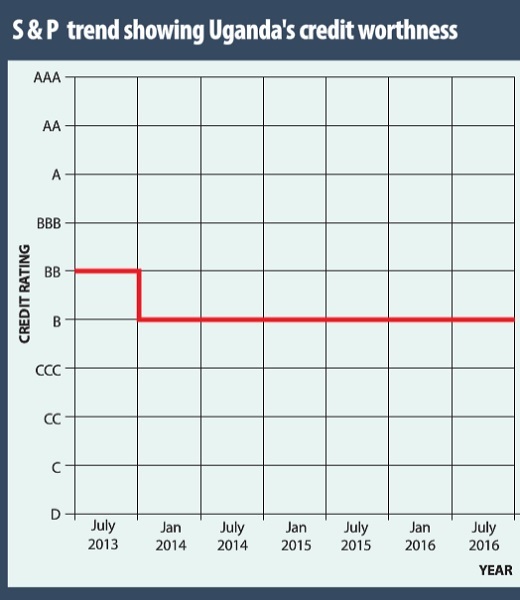

The second point to note is that we have been pricing the Interest Rate as the Key Price wrongly and we are now paying the price – with misplaced calls from ‘capping’ the rate and ‘bailing out’ businessmen who trade largely off the balance sheet. For banks, having off balance sheet transactions is actually criminal and the wrath of the central bank will come hard and fast.

No business can escape interest rate distress. Balancing the cost of borrowing and the rate of return on investment in the business is being in a constant state of interest rate distress. The solution for interest rate management is, therefore, by definition not so called ‘legislative capping’. The solution is monetary and fiscal policy reform with a view to PRICING ECONOMIC RISK CORRECTLY by the central bank – so that the government, through the Ministry of Finance, Planning, and Economic Development (MoFPPED) is never again the fierce competitor for scarce resources with its own citizens in the debt market.

There is no need for parliament to legislate an interest rate cap. President Uhuru Kenyatta of Kenya could have just told the central bank governor to bring the CBR Rate closer to the ‘real market price’ – meaning the extra points commercial banks speculatively charge should be removed so that what remains to price are risk points which can be accounted for.

But the Kenya parliament, like any other, is populist and wanted credit for a legislative solution which was not necessary so long as there was a directive for correct pricing of risk.

For example, in a mortgage contract priced at 25%, as much as 10% could be charged by banks because they are not sure of the integrity or quality of the construction; which can be broken down to 5% for possible poor cement mix, another 5% for uncertainty in the rental market etc. The real rate could then be 15% where the banks still make money.

What am I saying? I am saying the Central Bank Rate (CBR) in Uganda can be brought down to single digits. The Capital Markets industry knows how to do this. Our stabilisation economists should give the economy a break by accepting that they did their bit in stabilising the economy several decades ago.

Time has come for growth with jobs economists to partner with the capital markets industry investment bankers to step up to grow our Domestic Direct Investment [DDI] portfolio.

In Uganda, the government is needlessly the silent competitor with every borrower. Needlessly because there are well known capital markets industry solutions for financing the needs of government through financial instruments.

It has always been clear that the opponents of financial instruments prefer cash because instruments leave a trail.

But trying to solve every issue with cash is a dead end. The urgently required monetary and fiscal policy reforms in Uganda must have a healthy respect for Instruments in a growing and well regulated capital markets industry. There is no way out.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price