Experts tell Museveni, Mutebile, Muhakanizi

President Yoweri Museveni’s unchecked spending and the Ministry of Finance and Bank of Uganda efforts to clean have created a lope-sided economy that is hurting everyone.

That is the view of several economists interviewed by The Independent.

Dr. Lawrence Bategeka, formerly a researcher at the Economic Policy Research Centre (EPRC) and now the Vice Chairperson of the Parliamentary Committee on the National Economy, says any substantive economic growth needs to be inclusive.

Makerere University don Fred Muhumuza, who has advised the minister of Finance before, says the economy is currently experiencing the lingering effects of those actions.

“The situation has been worsened by corruption which has concentrated resources in the hands of a few elites,” he told The Independent.

Dr. Julius Kiiza, who teaches Political Economy of Development and Public Policy at Makerere University, is also critical.

For him, the main problem is the behavior of the elites in power.

“The central bank governor told us that there was massive expenditure of money in the 2011 elections and pledged not to repeat it in 2016,” Kiiza says, “But when an economist looks at the trend of supply of money after the 2016 elections, they tell you that more money not backed by production was again used to rent the royalty of citizens in the 2016 elections.”

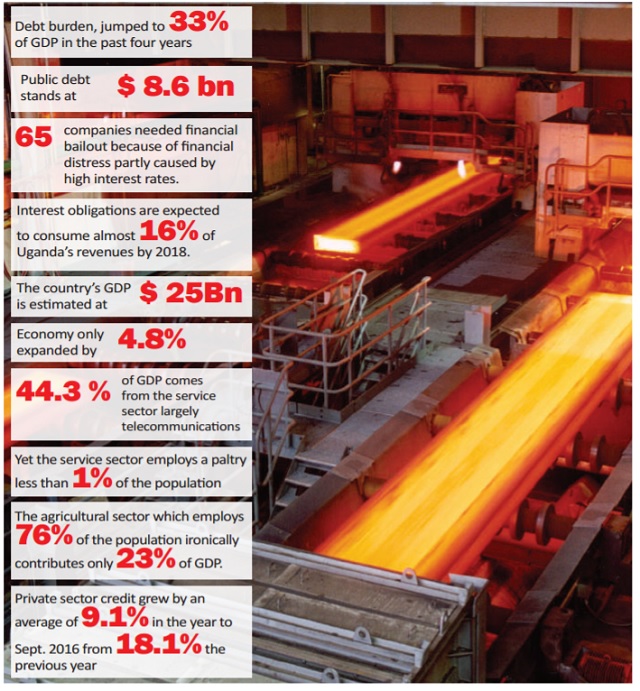

Their comments come just days after the international economy credit ratings agency, Moody’s, downgraded Uganda from B1 to B2. It cited Uganda’s debt burden which has jumped 9 percentage points to 33% of GDP in the past four years, and is projected to continue rising towards 45% of GDP by 2020.

“Deteriorating debt affordability is reflected in interest obligations expected to consume almost 16% of revenues by 2018, far exceeding the median for B-rated countries of 8%, the agency noted, “Meanwhile, low, and in some respects eroding institutional strength will challenge the government’s capacity to manage the rising debt burden.”

Bank of Uganda Governor Emmanuel Mutebile does not dispute that the economy is wobbly.

“This has been a bad year,” he said recently at the annual Bankers Dinner in Kampala on Nov. 25. His speech focused on the plight of commercial banks in 2016, but he could have been speaking about the plight of about anyone in Uganda.

It has been a bad year, many economists agree. But they are divided on causes.

The Minister of Finance, Matia Kasaija, was mid-last month compelled to give an unprecedented statement to parliament regarding the state of the economy.

Kasaija admitted the economic woes but blamed it on a difficult global environment, and geo-political conditions (civil strife in South Sudan).

Locally, he noted lower international commodity prices, a deceleration in the execution of public infrastructure projects, and post-elections related uncertainty and the recent actions of the World Bank in cancelling and suspending two crucial loan disbursements.

The minister’s statement echoed sentiments in an IMF analysis report which said the economy was not doing badly but is not in a crisis. The IMF said for the economy to recover, existing risks need to be well mitigated.

Previously, explanations like Kasaija’s and the IMF would suffice to calm fears around the economy. But in current tough times, experts are putting rosy claims President Yoweri Museveni and his technocrats at the Central Bank and Finance Ministry under greater scrutiny.

Many are pointing at actions taken by the central bank before and after the 2011 and 2016 elections to be the driver of the current economic woes.

The two elections saw both the government and opposition candidates at presidential and parliamentary elections level spend unprecedented sums of money on the campaign.

In 2011, especially, President Museveni is accused by his opponents of having raided the government coffers at Bank of Uganda during election time.

By December 2011, the massive expenditures in those elections were causing the core and headline inflation to rise at a rate of 30% and 29% respectively. The central bank reacted by rising the Central Bank Rate (CBR) to an unprecedented 23% in November 2011 from 13% in July. At the same time, commercial bank took BoU’s cue and raised lending rates to over 30%.

Commercial bank customers who acquired loans with variable interest rates suddenly found themselves having to pay higher rates. There were protests on the streets. The business community, especially in Kampala, demanded government intervention and organised a business lock-down.

Towards the 2016 elections, Kasaija requested a Shs.800 billion supplementary budget. Critics said it was again meant to finance Museveni’s campaign especially because a big chunck of it was meant for State House.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price