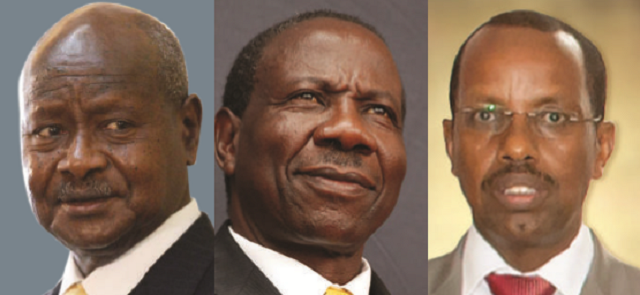

The request flew in the face of tough-talking by BoU Governor Mutebile who had just a few months earlier vowed not repeat the mistakes of 2011.

“You might remember that the economy of this country was thrown into total chaos almost after the last elections allegedly because the central bank had printed a lot of money to finance the elections,” Mutebile said, “I can assure you that the central bank did not directly print this money but where government expenditure is directed to areas that are not completely transparent, I cannot determine how much of the money that I have created ends up in political electioneering. It happens.”

He added; “And I was there as Central Bank Governor, I did not participate whatsoever but because there was some spending of government dependent on Treasury bills, which I was issuing, I was financing government indirectly. But since we understood that, we have never done again and I will not do it again.”

After the 2016 elections, the central bank and Ministry of Finance once again went on a liquidity mopping up exercise.

Commentators soon were pointing out that while the central bank’s tight monetary policy and the Ministry of Finance’s prudent post-election fiscal decisions; including tightening of the public purse to the extent of failing to pay lenders to the government, sucked up the excess liquidity in the market and stabilised the macro-economic environment, they created chaos at the mico-level.

The central bank and Ministry of Finance were blamed for putting many firms that do businesses with the government into financially distress due to constrained cashflows. This, observers argue, had a cascading effect as the stressed businesses failed to pay their suppliers, service their commercial bank loans, and invest in new ventures. The banks were soon hit with unprecedented Non-Performing Loans and in turn shrunk their appetite for lending. Soon the economy was wailing for a bailout.

Almost all the 65 companies that said publicly early this year that they needed a financial bailout said they were victims of the government failure to pay what it owed them.

Aggregate demand—the total demand for final goods and services in an economy, shrunk to its lowest. Property mogul Sudhir Ruperelia, who is ranked the rivchest man in East Africa, announced that the bubble had burst in the previously lucrative real estate sector.

“The whole of Kampala is on sale,” he told The Independent in an interview at the height of the bailout clamour, “But there are no buyers”.

Soon Sudhir’s bank, which had gained a reputation as an aggressive lender to local business, was rumoured to be in trouble. The rumour sparked a run on the bank, business shrunk and dwindling capital adequacy may have led to Bank of Uganda taking over management of Crane Bank.

This action too had a chilling effect on commercial bank business. It is almost impossible to access a commercial bank loan today.

Makerere University don Fred Muhumuza, for example, dismissed the minister of Finance’s blaming the global environment for Uganda’s economic downturn.

“On the global economic environment, we should have read the signs and prepared,” he told The Independent in a phone interview.

Muhumuza also says the current recovery efforts are misdirected.

He says that the monstrous infrastructure projects, which he describes as “money guzzlers” with no immediate benefits, will not help revive the economy

“Getting this economy to recover requires very many drastic decisions,” Muhumuza says, “We have to cut spending on projects like the Standard Gauge Railway whose benefits are in the future and yet are money guzzlers, and first address the situation of low demand.”

But he is the first to concede that such decisions are political and are “unlikely to be made”.

Putting money in the pockets of ordinary men and women on the street is a pet topic of Muhumuza’s. In it, he is a follower of former Finance Minister Ezra Suruma who also warns about ambitious infrastructure spending.

Suruma’s view is that while spending on infrastructure projects is welcome, it should not lock out other priorities; including creating employment.

He warned that government was making a mistake by planning to put all anticipated oil revenue into 20 per cent of the economy and ignoring the 80 per cent.

Suruma explained that money spent on infrastructure was externalised by the foreign firms that that get the contracts, while internally public debt was piling up.

“We are sucking much needed capital away from other sectors of the economy,” he said in an interview with the EastAfrican newspaper, “Capital is a major constraint to our development; let us solve the capital problem for the whole economy.”

Interest obligations on infrastructure loans are expected to consume almost 16% of Uganda’s revenues by 2018.

Meanwhile, Lawrence Bategeka of the Parliamentary Committee on the National Economy, says to put money in the pockets of ordinary Ugandans, policy makers at the Ministry of finance and Bank of Uganda need to stop treating the market like a magic bullet for economic management.

“You cannot abandon everything to the forces of markets,” Bategeka said, “Markets need guidance. If you say you want to export a tonne of coffee, you must make sure you have that coffee.”

He says technocrats at the Ministry of Finance and Bank of Uganda should reduce on their obsession with controlling inflation and work on policies that guide markets.

Bategeka says the current economic downturn should be seen as an opportunity.

“While there is alarm, I am particularly not worried because this is a normal economic cycle and an opportunity for behavioral change.

“People must start venturing into commercial agriculture and manufacturing.

“The rich who have been focusing on real estate whose rental values have dropped, must invest in ventures that create jobs for others who will in turn buy what they produce,” he says.

He says the pillars of the economy like coffee, tea and coffee should be revived instead of concentrating on “boda bodas and other things, most of which are imported.”

“Uganda has been an importing country for far too long and has been relying on other people’s money like donations to NGOs for a longtime,” he says

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price