Determining how much of Bujagali Sithe Global owns is critical as it determines how much it has to sell.

Fight over tariff

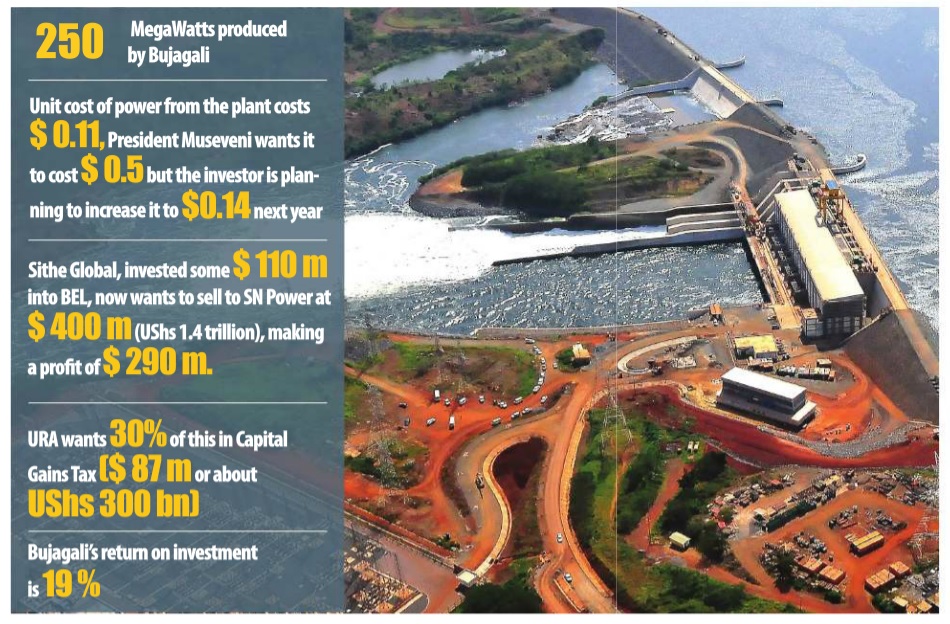

But the meeting also tackled the issue of cutting the tariff, which President Museveni is aggressively pushing. Inside sources say BEL has been looking to increase its tariff from $0.11 to $0.14 yet the President wants them to cut it to $0.05.

To push his agenda, President Museveni has previously considered letting the government to buy the stake in the dam. At the meeting, again Finance Minister Kasaija reportedly to him the government does not have that money.

But some players say, even if the government does not have the money, it can get the National Social Security Fund (NSSF), which has an asset base of shillings six trillion, to invest in the facility which appears overly profitable.

Bujagali’s return on investment is at 19 % and has indeed posted healthy profits year on year since it was switched on. In 2011, the plant made $ 20 million, in 2012, $ 32 million, in 2013, $ 66 million and in 2014, $ 42 million.

When contacted, the NSSF Chief Executive Officer (CEO), Richard Byarugaba, said they had not been contacted on the matter.

“We have heard about the transaction,” he said, “but nobody has talked to us and unfortunately, it’s not something you just jump into.”

Also while Sithe Global has stated that its business model is invest and later sale. Insiders say it tends to pick its own buyers and it has picked SN Power.

According to Thomas DeLeo, the Director of SGBH, now that they have completed their goal of proving Bujagali’s operational strength, it is time to sell. “SN Power will be the ideal partner to continue this legacy for Uganda,” DeLeo noted in a statement.

SN Power is owned by Norfund and Statkraft, which is wholly owned by the Norwegian state and has total installed capacity of more than 18,000 MW.

Both SN Power and SGBH confirmed to The Independent that they are pushing ahead with the deal.

However, apart from the concerns over shareholding and the battle over CGT, President Museveni is said to be unsatisfied that the SN Power offer does not cater for his goal of lowering the cost of Bujagali Dam electricity for the final consumer, especially the industrialists.

Currently, a kiloWatt (kWh) from the dam costs 0.11 $, which is the highest amongst sector hydro power generators in the region. Museveni wants this cost halved.

Uganda’s electricity transmitter, UETCL buys power from the Nalubale and Kiira dams at five times less the Bujagali cost; at about 2 U.S. cents. The two dams are run by Eskom Uganda; a subsidiary of South Africa’s power giant and together have an installed capacity of about 380MW.

Museveni has for some time been lamenting that his government made a strategic mistake by agreeing to buy the power generated by Bujagali at 10.1 U.S. cents.

At the time the deal was inked, Uganda was reeling from a massive electricity generation shortfall and incessant power cuts or load-shedding were the order of the day. There were riots in cities over the high cost of unreliable electricity.

At one point, the government was forced to resort to costly power was from thermal generation, which cost 30 U.S. cents per kWh. This was too costly for most consumers and the government had to subsidise them to the tune U.S$ 624 million from 2005 to 2012.

Back then, President Museveni was pushing for more power generation at whatever cost.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

“increase its tariff from $0.11 to $0.14 yet the President wants them to cut it to $0.5.” When did 0.5 become less than 0.11? Doesn’t make sense.

Interesting – these fellows: They think 5 US cts. should be written as 0.5 not 0.05 US$.

This is mediocrity passed on from poor maths at primary school level.

But that notwithstanding, the article is worth reading. It has a fair amount of detail on the economics and politics of Uganda’s electricity sector.

Pan Africanist/Solar Engineering expert – Kant Ateenyi

Mr. Matsiko, I am as confused as the President. But a little background will do. Who sold to Sithe Global and BPCL? Who was AES and what did it do? Who owned the 25% equity? In other words, who owned Bujagali before it was Bujagali Electricy Company? The other question would be, what business has the President (or Uganda) got to do with determining the prices of an entirely private business? I am coming from the station with how shares were allotted. If Uganda owns type C shares which are non-cash, what business has it got with the transfer of type A and B shares? I think there is “Katemba” (theatrics) in all this. We have been taken for a ride and someone is in his usual costume playing the part.