When Bujagali brought its 250MW online in 2012, it put an end to the insufficient power generation not the cost issue.

The same year, power subsidies were abolished and customers started paying for the tariff directly. Instead of fulfilling the earlier promise that Bujagali coming on streamwould lead to lower tariffs, there was a jump upwards of about 40% for final consumers. Since then the tariff has consistently been inching northwards.

President has since shifted his fight from increasing capacity to lowering costs. That is why he is pushing for the average cost of power to be 5 U.S. cents, about 50% less than what Bujagali is selling at.

But the proposed new investor in Bujagali, SN Power and Sithe Global, in a joint statement, told The Independent that lowering the tariff is not part of the deal.

According to them “SN Power is replacing Sithe as a shareholder,” and “Bujagali Energy Limited (BEL) is, and will remain, the owner and operator of the project.

“The Power PurchaseAgreement (PPA), a 30 year contract that governs tariff, is between BEL and UETCL. The PPA (Power Purchase Agreement) is not impacted by Sithe’s sale to SN Power.”

Indirectly, the investors are saying they have no business reducing the tariff. And they are supported by technocrats who argue that comparing the cost of Bujagali and that of Kira and Nalubaale is wrong.

“The mistake you people make is to compare Kiira and Nalubaale with Bujagali,” said Elias Kiyemba, the Executive Director UETCL, which pays power generators. “These are very different.”

Kiyemba repeated the argument that many technocrats have made. Apparently, private investors borrow at an expensive interest rate of 6-8%, a cost that is transferred to the final consumer through the tariff.

In contrast, government borrowing is either concessionary (0.78% for 40 years with a 10-year grace period) or commercial (at 3.5%).

For instance, the loan on Kiira was required to be paid in 40 years with a grace period of 10 years at an interest rate of only 0.75 percent. According to BEL, the Bujagali loan has various tranches but will largely be paid over a 20 year period with a five-year moratorium.

The second cost is the return on investment (ROI), which in the Power Purchase Agreement (PPA) for Bujagali is 19% per year.

But proponents of Museveni’s argument disagree. They argue that no agreement cannot be renegotiated. Like Museveni, they argue that government entered a bad contract with Bujagali investors. Elsewhere, they argue, return on investment is about 8-9 %.

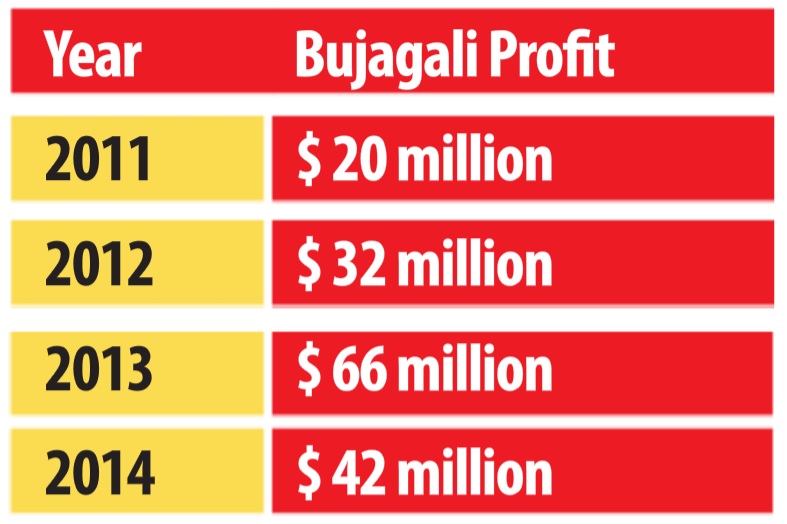

“We understand that at the time the contract was signed, the country had a problem, the economy was bad but things have changed,” said an official who is knowledgeable about the deal, “the equity has been de-risked, the investor is assured of high profits.”

The official added: “All we are saying is that can we, for instance, reduce the ROI to at least 16 percent because that would mean relief on the tariff or we can renegotiate with the financiers and reduce the interest rate and pay over a long period of time (long tenure). After all, all these loans were guaranteed by government.”

In Bujagali, the investor’s equity is only 25 percent, the remaining 75 percent was raised by lenders, which include the World Bank, African Development Bank, European Investment Bank, KfW, among others, who will be cleared in the next 12 years.

In his 2014 State of the Nation address, Museveni made the same argument: “We are going to engage the developers to find ways of refinancing this project. With our oil money this should not be a problem. However, even before our oil money, we may be able to get cheaper money to pay off this expensive money borrowed by developers.”

Museveni also said the power generated from the new dams now under construction would be far cheaper with the 600MW Karuma costing 5 U.S. cents while the 183MW Isimba’s would cost 4 U.S. cents. His handlers support these figures.

When he appeared on Capital Gang in January 2015, President Museveni again expressed concern about the cost of Bujagali power.

“We still have issues with electricity prices because of the distortion caused by the Bujagali project,” he said. “The concession for Bujagali power was not negotiated well. We will sort it out.”

Like Museveni, many consumers; especially industrialists say the high cost of electricity in Uganda has reached unsustainable levels and made local industries’ uncompetitive.

The cost of electricity amounts to about 40 percent of the total cost of production for manufacturers like steel makers who are now unable to sell their products because they are more expensive—an excuse Chinese contractors now handling major infrastructure projects are using to ship in cheaper supplies from China.

Initially supposed to cost $460m in 2001, the Bujagali venture became a bottomless pit. Its cost rose to US$580m in 2007 and finally to US$ 862m at completion in June 2012.

An energy committee of parliament even suggested that the plant had cost US$1.3bn – an extra US$438m.

Yet the largest dam in the world with an installed capacity of 21,000MW, the Three Gorges Dam in China is said to have cost about US$25 billion. Keeping other factors constant, constructing eachMega Watt at the Three Gorges dam cost about US$1.2 million but a megawatt at Bujagali cost US$3.6 million.

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

“increase its tariff from $0.11 to $0.14 yet the President wants them to cut it to $0.5.” When did 0.5 become less than 0.11? Doesn’t make sense.

Interesting – these fellows: They think 5 US cts. should be written as 0.5 not 0.05 US$.

This is mediocrity passed on from poor maths at primary school level.

But that notwithstanding, the article is worth reading. It has a fair amount of detail on the economics and politics of Uganda’s electricity sector.

Pan Africanist/Solar Engineering expert – Kant Ateenyi

Mr. Matsiko, I am as confused as the President. But a little background will do. Who sold to Sithe Global and BPCL? Who was AES and what did it do? Who owned the 25% equity? In other words, who owned Bujagali before it was Bujagali Electricy Company? The other question would be, what business has the President (or Uganda) got to do with determining the prices of an entirely private business? I am coming from the station with how shares were allotted. If Uganda owns type C shares which are non-cash, what business has it got with the transfer of type A and B shares? I think there is “Katemba” (theatrics) in all this. We have been taken for a ride and someone is in his usual costume playing the part.