Washington, U.S. | Xinhua | The United States could see a recession if rapidly rising oil prices hit a crucial tipping point, economists have warned.

Oil prices are surging worldwide, and the conflict in Ukraine has exacerbated numerous factors that have already caused record price hikes, according to experts.

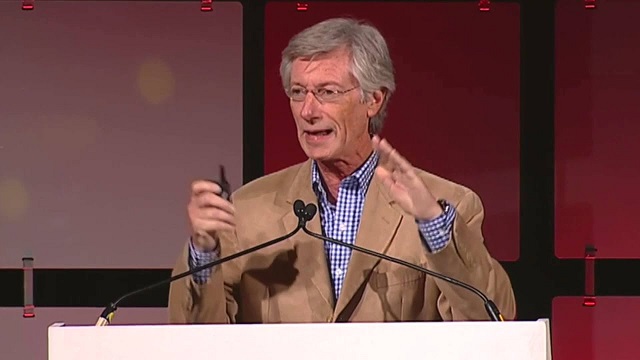

Bernard Baumohl, chief global economist at The Economic Outlook Group, told Xinhua that if U.S. gasoline prices hit four U.S. dollars and 75 cents per gallon on a national level, that’s the point at which the United States would see a change in consumer behavior – such as Americans significantly cutting their air and auto travel.

That could increase the odds of a recession, said Baumohl, who was ranked by The Wall Street Journal in 2019 as the most accurate economic forecaster in the previous year’s economic survey.

However, key is the length of time during which prices remain at the four-dollars-and-75-cents scenario, Baumohl said.

Just a few days or weeks of gas prices hitting that point may not matter, “but if we’re talking about two to three months of four dollars and 75 cents at a regular, national average, at that point the odds for recession would increase above 50 percent,” Baumohl said.

Gasoline prices increase when oil prices increase, and oil prices have been surging worldwide.

While some U.S. states – most notably California – have exceeded Baumohl’s four-dollars-and-75 cents-per-gallon breaking point, he noted that this has not yet occurred nationwide.

The U.S. national average for a gallon of regular gasoline is 4.237 dollars on Wednesday, down 15.8 percent from a week ago, but still up nearly 20 percent from a month ago, according to data from the American Automobile Association (AAA).

A number of U.S. states have been scrambling to find a solution for the record price spike, with Georgia and Maryland suspending gas taxes in recent days.

While Baumohl’s dominant scenario is that the Ukraine war will fizzle out in this year’s second quarter, and that oil prices will drop consistently below 100 dollars per barrel, he said that no one has a crystal ball.

Indeed, at present there is no end in sight for the war in Ukraine, and Western nations have limited leverage over Russia, due to European dependence on Russian energy, analysts noted.

If the Ukraine war does not come to a halt in this year’s second quarter, the United States is looking at a “totally different scenario” and at that point “we’re looking at a much higher risk of a recession, because inflation pressures will only escalate, it will not subside,” Baumohl said.

“So we would have something equivalent to ‘stagflation’ – high inflation and low economic growth,” Baumohl said, while emphasizing that this is not his group’s dominant scenario.

Baumohl’s model is also based on the assumption that there will be no more major COVID-19 outbreaks that would trigger major lockdowns, such as those that occurred in spring 2020. It is also predicated on the assumption that the U.S. Federal Reserve does not get too aggressive in raising interest rates, he said.

U.S. Federal Reserve Chairman Jerome Powell, however, said on Monday that the central bank will, if needed, move “more aggressively” to raise federal funds rate by more than 25 basis points at its policy meetings to curb inflation.

“There is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level, and then to move to more restrictive levels if that is what is required to restore price stability,” Powell said in prepared remarks for the National Association for Business Economics'(NABE) annual economic policy conference in Washington D.C.

The Fed last week raised its benchmark interest rate by a quarter percentage point to a range of 0.25 percent to 0.5 percent from near zero, a major step in exiting from the ultra-loose monetary policy enacted at the start of the pandemic.

Andrew Lipow, president of Lipow Oil Associates, a consulting firm, told Xinhua the high price of diesel fuel is already having an impact on economies in Africa, South America and Southeast Asia, which would also pose downside risks to the U.S. economy.

“If lots of countries are stretched on food and fuel, there’s less money left over to buy consumer goods,” Lipow said. “The lack of buying consumer goods can spill over into China, and if China slows down, we can ultimately be impacted (in the United States) as well.”

“Economies around the world are connected, and you’re seeing that happen right now,” Lipow said.

High gas prices are particularly painful in a nation dependent on autos for the majority of travel, trips to the supermarket and to work. Gas price increases hurt low income individuals and families the most – especially those in rural areas who must commute long distances to work every day.

“We have yet to see any material demand destruction, even at these record prices, and we would probably need oil prices to go to about 140 dollars a barrel, and at that level I think a recession would be quite likely,” Lipow said.

On Wednesday noon, the price of Brent crude stood at 122 dollars per barrel, according to Oilprice.com.

The market is very concerned that there might be a significant production disruption with reduced Russian oil, at the same time that Organization of Petroleum Exporting Countries (OPEC) members have refused to utilize their spare capacity to make up for any Russian shortfall, Lipow said.

He noted that the U.S. government has very few choices to mitigate the current situation.

U.S. President Joe Biden on Monday met with several heads of major oil companies at the White House in a bid to discuss ways to cooperate against the backdrop of high oil prices. So far, no significant solutions have come from the meetings.

Lipow recommended that the White House advocate an energy policy that includes fossil fuels, renewable energy, alternative energy such as solar and wind, as well as coal and nuclear. “The more energy options that we have, the better off we are,” he said.

*****

Xinhua

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price