Insurance brokers will need to evolve on how to engage, advise and on-board customers

Kampala, Uganda | ISAAC KHISA | Uganda’s commercial banks earned Shs12bn in commission as insurance agents for nine months to September 30, 2021, underscoring the significance of banscassurance as a new revenue stream for financial institutions.

The Insurance Regulatory Authority of Uganda (IRA) has since 2017 licensed 20 commercial banks as insurance agents following the enactment of the Financial Institutions Amendment Act 2017 as it seeks to widen distribution of insurance services countrywide and deepen penetration that remains low on the African continent.

Latest statistics from IRA indicates that banks recorded insurance business worth Shs 56.9billion in gross written premiums for the life insurance business, enabling them to earn Shs 8.99billion in commission.

Absa recorded the highest income of Shs 2.5billion, followed by Stanbic Bank with Shs2.1bn and Centenary Bank Shs 1.4bn. PostBank took the fourth spot, earning Shs 629million in commission.

On the other hand, banks underwrote non-life insurance business worth Shs 19.6billion in premiums, earning Shs 2.96billion in commission in return, with Stanbic Bank alone taking a whooping Shs 1.3bn, during the period under review.

The lenders earn 20% as commission on the total amount of money a customer pays for an insurance policy commonly known as premium.

Ibrahim Kaddunabbi Lubega, the chief executive officer at IRA revealed during the 52th CEO breakfast meeting held virtually on Jan. 20 that bancassurance is helping insurers to easily access customers.

“We continue to pledge our commitment in providing the required support to nurture this very promising distribution channel,” he said.

This development, however, is an alarm bell to insurance brokers to evolve with new products to attract and onboard customers lest lose customers to commercial banks. The insurance brokers had in the past decried the bank’s venture into territory as agents.

Insurers record growth in premiums

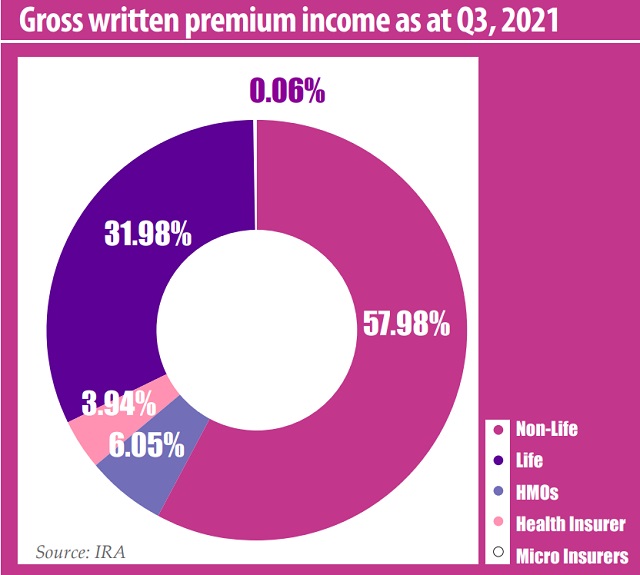

Meanwhile, the industry players recorded a 16% growth in gross written premiums for the three quarters of 2021 to Shs 911.9billion compared with Shs 780.3billion recorded for the same period in 2020 despite the negative effects of coronavirus pandemic.

The non-life business segment saw gross written premiums increase from Shs524.8billion to Shs 528.76bn while life gross written premiums increased from Shs199.5billion to Shs 290.21bilion during the same period under review.

Of this, UAP General Insurance recorded the highest gross written premiums in the non-life insurance business worth Shs125.2billion, followed up with Sanlam General and Jubilee insurance with Shs70bn and Shs69billion respectively.

Fico, Rio and AIG (prior to its exit) remained below the table in the non-life business segment which consists of 21 insurers.

In the life insurance business, Prudential recorded Shs 71.2billion in gross written premiums while its closest rivals Jubilee and UAP Life recording Shs 50.7billion and Shs46.6billion respectively. NIC Life recorded the lowest gross written premiums of Shs 2billion in a business segment that has only nine insurers.

However, Health Membership Organisation such as Case Med Care Limited, St. Catherine’s Hospital and International Medical Link (U) Ltd saw their gross written premiums dwindle from Shs 55.8billion to Shs 35.9billion.

Projection points to a 10% growth in premiums

Meanwhile, the insurance industry is projecting a 10% growth in gross written premiums for 2021. In 2020, insurers recorded Shs1trillion in gross written premiums compared with Shs 463billion more than 8 years ago, driven by increase in publicity, growth of the economy and the government’s huge investment in infrastructure projects.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price