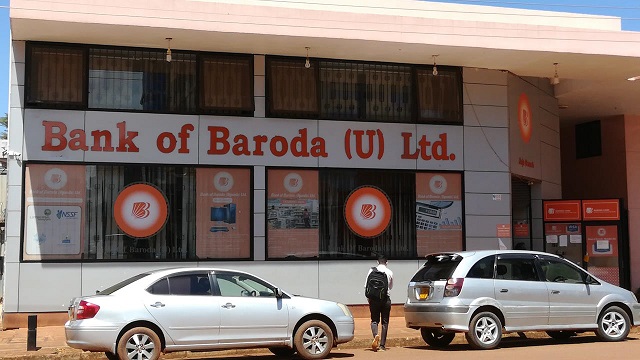

Kampala, Uganda | THE INDEPENDENT | Bank of Baroda has posted a 12.3% decline in net profit for the six months ending June 30, 2024, with profits falling to Shs 59.8 billion. This drop in profitability comes despite an increase in revenues, which was offset by a sharp rise in interest expenses during the period.

The financial results released on September 20 indicate that the bank’s interest expenses surged from Shs 38.9 billion to Shs 56.4 billion. In addition, the value of the lender’s financial assets saw a significant drop, decreasing by Shs 12.4 billion. These factors combined to weigh heavily on the bank’s bottom line.

Despite the pressure on profits, Bank of Baroda recorded an 18.5% growth in revenue, rising to Shs 145.2 billion. This increase was driven largely by a boost in interest income, reflecting the bank’s efforts to optimize its lending portfolio amid a challenging economic landscape.

The bank’s core capital to Risk-Weighted Assets (RWA) stood at a robust 30.31%, significantly above the regulatory requirement of 12.50%. This strong capital position indicates the bank’s financial resilience and its ability to absorb risks while maintaining stability in its operations.

Meanwhile, Bank of Baroda’s competitors, including Stanbic Uganda Holdings Limited (SUHL) and dfcu Bank, posted strong profit growth for the same period.

Stanbic recorded a 17.6% increase in profit after tax, amounting to Shs 235.5 billion, driven by strong revenue growth and improved asset quality.

Similarly, dfcu Bank saw a substantial 45% jump in net profit, reaching Shs 42 billion for the first half of 2024, up from Shs 29 billion in the same period last year. This was largely attributed to significant reductions in credit losses and strategic cost management initiatives.

Despite the drop in profits, Bank of Baroda’s assets grew from Shs 2.5 trillion to Shs 2.9 trillion during the period under review, further solidifying its position in Uganda’s financial sector. Last year, the bank posted a net profit of Shs 115.96 billion.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price