Some lenders have either voluntarily exited the market or offered themselves for acquisitions to meet the new capital requirements

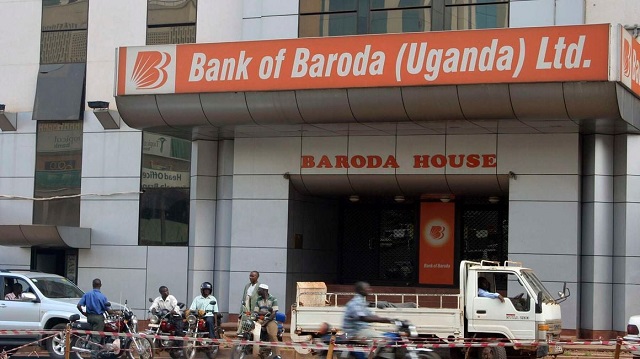

Kampala, Uganda | THE INDEPENDENT | Bank of Baroda has got the nod from the Capital Markets Authority to go ahead with the bonus issue to raise capital to meet the new central bank capital requirement.

The lender said the Uganda Securities Exchange has equally approved the listing of additional 12.5 billion ordinary shares at Shs 10 each, translating into Shs 125 billion.

“The listing date for the additional 12,500,000,000 ordinary shares is 5th June 2023. Please be informed that shareholders’ notifications will be done on or before the listing date,” the lender said in a statement on May.26.

This development comes six months since the Finance Minister, Matia Kasaija, signed a statutory instrument increasing minimum capital for banks by 500 per cent from Shs 25billion to Shs 150billion.

The new capital requirement according to the Bank of Uganda is meant to prevent commercial banks from falling off the cliff when economic shocks hit their clients.

However, this capital requirement has triggered acquisitions as lender race against time to hit the set deadline of June 2024.

Cameroonian-based lender, Afriland First Bank voluntarily exited the Ugandan market last year following nearly two years of operation citing limited customers to sustain its operation.

Top Finance Bank Uganda was acquired by Salaam African Bank (SAB), a financial firm based in Djibouti after the original investors reportedly failed to raise capital while Orient Bank was acquired by regional lender, I&M Group.

The government last revised the paid-up capital for commercial banks in 2010 while that for credit institutions and deposit-taking institutions was last revised in 2004 and 2003 respectively.

“The increase in paid-up capital is long overdue and is intended to match the dynamism in the economy, incentivize shareholder commitment, and enable institutions to withstand shocks and to converge with regional peers among whom Uganda effectively has the lowest paid-up capital,” Tumubweine Twinemanzi, the director in charge of supervision told The EastAfrican.

Bank’s profitability

Bank of Baroda recorded a growth in Profit After Tax (PAT) from Shs 90.23 billion in 2021 to Shs 122.19 billion in 20222 riding on loans extended to the customers and a reduction in operational costs.

The lender’s interest earned increased by 23.04% compared to the same period in 2021 as its operational expenses fell sharply from Shs 41.99 billion to Shs37.01 billion during the same period under review.

The lender’s credit portfolio also crossed the desired Shs 1 trillion during the year with terminal figures of Shs 1.089 trillion.

“These figures are testimony of robust system and standardized processes being implemented by the bank,” said Shashi Dhar, the managing director at the Bank of Baroda.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price