Kampala, Uganda | THE INDEPENDENT | The Uganda Bankers’ Association-UBA, has signed a collaboration agreement with technology companies which will among other things see them share information on how to tackle and respond to internet fraud.

Under their umbrella, Finance and Technology Service Providers Association (FITSPA), the companies usually referred to as Fintechs design some of the software and platforms that banks use to reach their customers.

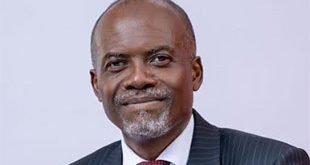

The partnership is aimed to help two associations share information, organize learning sessions to strengthen security and research said Wilbrod Owor, the executive director of UBA.

Owor told reporters at UBA offices in Muyenga on Wednesday that cyber fraud was huge and affects almost everyone. He said the partnership will help mobilize money to train people and monitor their platforms to thwart attempts by hackers.

This comes at a time when Ugandans are concerned over the amount of money they are losing in internet fraud. Online attacks by hackers saw a whopping USD 52 million (192 billion Shillings) stolen from different organizations in Uganda including banks in 2018, the latest survey shows.

This was a growth from the USD 44 million (162 billion Shillings) stolen in 2017 and USD 30 million (110 billion Shillings) stolen in 2016.

Edward Mugerwa, a cyber-security expert at Bank of Uganda said in January that financial institutions’ resilience to cyber-attacks means a lot of how ready they are.

He said attacks can be in different forms including denial of service attacks, message falsification, vandalism and false payments. Others target Automated teller Machines (ATMs) where customer details can be stolen ultimately stealing their money too.

Peter Kawumi, the Fintechs association chairman and the general manager of Inters witch said working with banks will help both parties’ research relevant products they can use to reach their customers or respond to industry issues including online security.

The partnership is expected to make banks and other financial services providers learn how to respond fast in case there is an industry attack.

******

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price