Aggressive investment

Kasi said Centenary Bank is expanding aggressively, improving their staff welfare, and increasing investment in business technology with an eye on the future.

The bank opened six branches and five offsite Automated Teller Machines bringing the total number of branches to 69 and ATM’s to 172. It also opened branches in Bundibugyo, Adjumani, kawuku, Kawempe, Nansana and Gulu Market and installed ATM’s in Masengere, Najjera, Kirinnya, Gulu and Nalumunye. Kasi said these investments and others resulted in high operating costs in 2016 and had a negative impact on profitability. He said, however, that the expenditure was in line with the bank’s mission and outreach strategy.

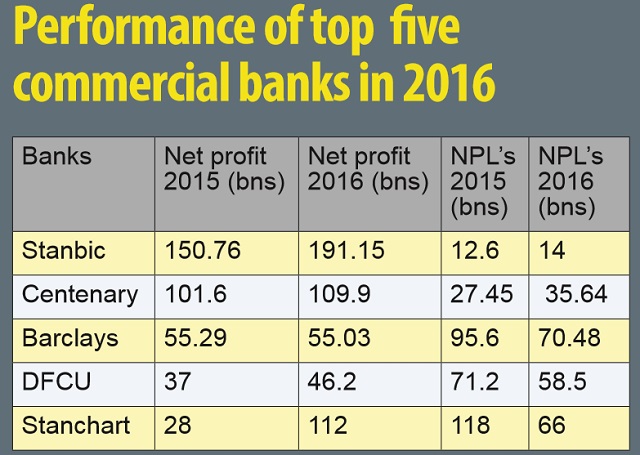

Over the same period, the bank’s Non-Performing Loans (NPL) portfolio grew by 30%, which possibly was not part of the strategy. The NPLs hit Shs35.64billion in 2016 and bad debts written off went to Shs11.23billion from Shs 7.46billion in the previous year.

Kasi say the bank plans to continue to execute a forward-looking strategy that combines financial inclusion and technology driven service delivery.

“This will result into taking advantage of more emerging growth opportunities in Uganda and also manage the ever changing customer needs, preferences and behavior,” he said.

He said the bank will also roll out agency banking and bancassurance as well as enhance its mobile banking platform by offering more functionality.

In March this year, Centenary in partnership with the Nairobi-based Craft Silicon’s ELMA platform, the engine behind the mobile banking platform Centemobile and Finance Trust Bank’s SimuYo BankYo unveiled a new functionality to enable customers to instantly transfer funds between the two financial institutions real time through an Interbank Transfer Service.

Kasi revealed that in addition to migrating to a more secure ATM card system based on PIN and Chip technology, the bank also plans to introduce a new method of identifying customers based on biometric technology.

Customer numbers grew by about 100,000 to 1.48 million over the period, and customer deposits grew from Shs1.38 trillion to Shs1.63 trillion.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price