Analysts urge government on business environment as written off non-performing loans erode bank profits

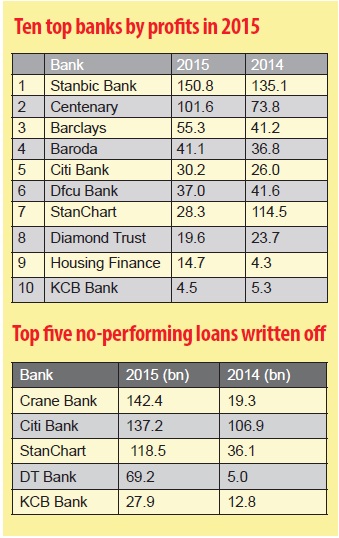

In 2015, Standard Chartered Bank, Uganda’s second-largest bank by assets, saw its profits decline by 75% compared to the previous year. The year was even worse for Crane Bank, the second biggest indigenous bank and the country’s fourth largest bank by assets. It went from a profit of Shs 50 billion in 2014 to an outright loss of more than Shs 3 billion in 2015. Four of the smaller banks also made losses – thanks to the massive non-performing loans and assets (NPAs) that were written off. The few that made profits made more money from other sources, which offset the losses from non-performing loans. Apart from the bad loans, industry analysts also attribute the murky performance of the financial services industry to the weak shilling – which resulted into huge foreign exchange losses – the anxiety over the election year, and the challenging business environment generally.

Standard Chartered Bank Managing Director Herman Kasekende attributed the heavy decline in profits to clients in the corporate and institutional segment who were specifically impacted due to the high correlation with the market conditions, which forced the bank to increase in the bad loan book. “We have identified our risk issues, and we are dealing with them assertively,” he said in a statement.

Stephen Kaboyo, the managing partner at Alpha Capital Partners, noted that the performance of the various banks is an indicator of the divergent trends in the performance of the banking industry whereby a few banks registered good results regardless of the tough operating environment and others made losses. In order to gain a good perspective, it is important to zero in on the different banking models pursued by the banks, he said. “It is clear that banks with a good foot print and micro model have done well as the cost of funding is much lower. However that said, one indicator that cuts across the entire industry is the increase in impaired loans,” he added.

Financial innovation driven by technology holds the future

He added that in 2015, constraints around credit extension to the private sector remained, which implied that there was evident lack of credit appetite from the commercial banks. This, he said, affected the loans books. “In order to go around this challenge some banks were able to focus on areas that would increase non-funded income and quite clearly some were able to achieve this as seen in the component of fees and commissions,” he added.

On the way forward, Kaboyo suggested that in order to enhance profitability, banks have to embrace and invest more in market innovative strategies that increase efficiency and improve service delivery to customers. In addition they should adopt new technologies that support Internet banking, mobile banking, credit cards, point of sale etc. “Financial innovation driven by technology holds the future by offering affordable products and services that are compatible to the needs of a rapidly growing electronic market place,” he said.

However, Gideon Badagawa, the executive director of the Private Sector Foundation Uganda, said the poor performance of the banking industry was “a true reflection of what is going on across the entire business operations in the country.”

He noted that for some time, banks had been posting good profitability. The balance sheets had been healthy while many of the businesses that do business with them had only been merely breaking even. Most of the businesses are in agriculture, small manufacturing, construction, transport and trade and commerce, all of which have no leverage for long term financing but have been subjected to expensive short term money at an average of 25%.

“You cannot make return on investment as high as this to avoid default on loans. This is where the problem is and the Standard Chartered Bank case is quite revealing. We must revolutionise the economy and reduce the cost of doing business lest we all risk going under,” he said.

He adds,“Except the foreign firms that are sourcing business capital at interest rates as low as 5%, Ugandans with our huge overheads cannot compete with them. The solution in my view is to stimulate capital markets and mobilise long term capital for our growth sectors. But for banks, fast expansion without adequate capacity to grow incomes is a killer.”

If the revenue collections by the Uganda Revenue Authority are anything to go by, Badagawa certainly has a big point. Announcing its 9 month revenues performance last week, URA bosses sounded a little worried. Collections for the third quarter (Jan-March) resulted into a deficit of Shs 242.61 bn in the third quarter (Jan-March) of the tax body.

URA is anxious that these effects could continue to filter through to the economy thus weighing down economic growth and posing a downward risk to revenue mobilization as a result of reduced profitability by corporate firms.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price