The rollout of bancassurance, however, could hurt other insurance players especially the 32 insurance brokers and agents as banks eat into their business.

For instance, in neighbouring Kenya, bancassurance expansion has been so pronounced that traditional insurance agents have been dropping out of the industry, citing a loss of business to banks.

According to the country’s Insurance Regulatory Authority, 2013 saw 593 new insurance agents registered in Kenya, almost half the number of new agents in 2012, while just under 2,000 agents dropped out of the industry altogether in 2013, substantially larger than the 758 agents who quit a year earlier.

The growth in bancassurance in Kenya and other African countries has been driven by credit life insurance, which is tied in with mortgages and personal loans; closely followed by household insurance and motor insurance, both of which are combined with specific lending facilities.

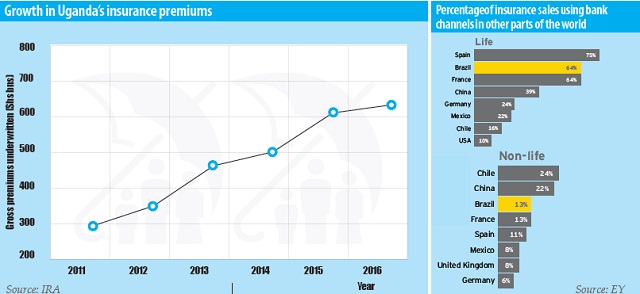

Uganda’s insurance industry has been growing over the past decade albeit at a slow base. Insurance premiums underwritten, for instance, have grown from merely Shs80.75billion in 2004 to Shs634 billion in 2016 as a result of massive promotion campaigns and affordable product innovations targeting customer needs.

Deliver products that meet consumer needs

Going forward, Leigh Allen, the manager for Global Distribution Research at the Reinsurance Group of America (RGA) says while the growth rate for bancassurance is four times faster than the growth of life insurance in general in many markets around the world, its opportunity also comes with increased competition.

“In order to differentiate themselves, bancassurers in both emerging and mature markets must deliver innovative products aligned with target consumers through efficient distribution channels,” she said, adding that channel integration consisting of in-branch sales, online/direct sales, mobile applications, ATM’s and retail shops stirs success of bancassurance.

She says the current bancassurance players are leveraging on technology to finely segment the market and create tailored products for specific groups of consumers.

Banks are analyzing customer preferences, and insurers must manufacture products in tandem with their bank partner’s recommendations and requirements, she says, adding that innovative product design should also fit the bancassurance customer’s needs.

“The success of bancassurance products requires a deep understanding of the socioeconomic segment to which a product is targeted, developed through significant consumer survey support and accurate data base information,” she said, adding that deep integration, which includes among others; shared technology, marketing, forms, training, effective sales strategies, targets and synergy between bank and insurer partners is vital to success of bancassurance.

Growth in Uganda’s insurance premiums

| Year | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| Gross Premiums Underwritten (Shs bns) | 296.83 | 351.23 | 463 | 502.65 | 611.13 | 634 |

Source: IRA

% of life insurance sales using banking channels

Spain -75%

Brazil -64%

France -64%

China-39%

Germany-24%

Mexico-22%

Chile-16%

USA-10%

% of non-life sales using banking channels

Chile-24%

China-22%

Brazil-13%

France-13%

Spain-13%

Mexico-8%

UK-8%

Germany-8%

Source: Ernst and Young

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price