Kampala, Uganda | THE INDEPENDENT | Commercial banks and microfinance institutions are yet to to officially hear about the 200 billion shillings for lending out money meant to rescue Ugandan small enterprises that were affected by the Covid-19 pandemic which was commissioned early last week.

A check at two government-owned financial institutions and one private bank showed that the managers at the banks are either unaware of the program or have not yet been given the instructions.

This comes after some entrepreneurs had reported not finding the money at their banks.

The Small Businesses Recue Fund was commissioned by the Ministry of Finance, Planning and Economic Development last Tuesday after negotiations of terms and conditions that lasted four months.

The government offered 100 billion billing shillings while the participating financial institutions are supposed to raise up to 100 billion shilling making it a 200 billion shilling-revolving fund for small entrepreneurs.

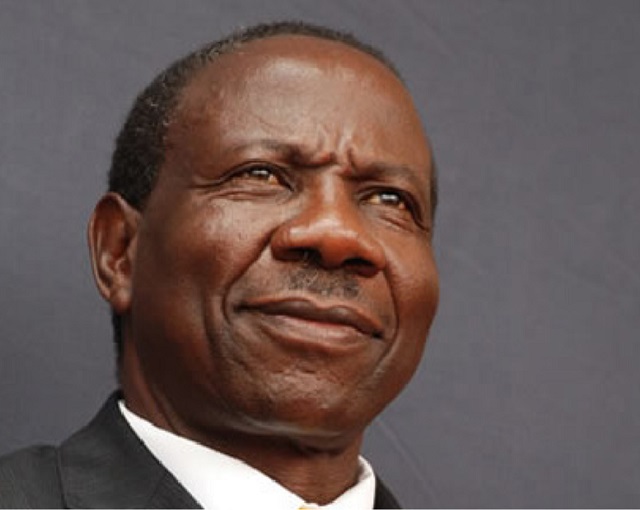

The Chief Executive Officer, Forum for Small and Medium Enterprises Uganda, John Walugembe Kakungulu, who was part of the negotiations between the ministries, the Bank of Uganda and commercial banks says they have so far not found a bank which is operating the fund.

He also says that the banks say they are waiting for instructions from their regulators.

The Ministry of Finance, Planning and Economic Developments has since said it is the Bank of Uganda which is the manager of the fund.

At the BOU, an official from the communications department said they were going to find out where the process has got stuck, and by the time of filing the story, they were yet to give an explanation.

There are also fears that the commercial lending institutions could use the opportunity to sale their own products by marketing them as SBRF.

Mr Kakungulu urged those intending to apply for the money to ensure that they state exactly which loan they are seeking for.

He specifically said the entrepreneurs should watch for the interest being charged by ensuring that that it is only half of the money they borrow that is supposed to be subjected to interest at a rate of not more than 10 percent, while the other half will not be charged.

But Kakungulu says they are hopeful that this fund will work better than the previous ones since it follows the model of the Agriculture Credit Facility so far considered the best managed.

The Associate Program Manager, Women and Economic Justice at trade development group, SEATINI, Joanita Nassuna expressed worry that like previous funds, the SBRF could only benefit Ugandans in urban areas especially in and around Kampala.

She proposes to the managers of the fund to ensure that the banks chosen are those with fare distribution of outlets particularly to take this fund as close to rural communities as possible.

Nassuna also says there should also have been specific provisions for women entrepreneurs who are the majority in the targeted group of small enterprises, yet have special needs accessing finance.

Herbert Kafeero, the communications officer at SEATINI called for more efforts in training and sensitising the low income business community on how to access these kinds of programs so that the targeted sectors benefit optimally.

****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

If bank of Uganda provides relief to banks,then they should give grace period to business owners who have loans in banks to repay until the loan is settled.