Commenting on what it means for being one of the dominant players, Somashekar said as the telecom sector matures, it leads to industry consolidation and that the consumer benefits from higher investment, modernised networks and affordable products and services.

“We are investing ahead of the curve in Uganda,” he said adding, “That assures consumers will get unmatched coverage and high speed internet everywhere.”

He, however, said growth and penetration remains a big challenge. He said the introduction of the new OTT tax is a barrier to digital inclusion and access to internet for all to achieve socio economic transformation.

Similarly, Kisekka (K2’s CEO) who previously worked at Africell as Chief Technical Officer said the local excise duty (12% on airtime) and value added tax (18%) is already too high and that adding the new OTT (Shs200 per day) and 0.5% on mobile money transactions makes the situation even worse for uptake of telecom services.

Charles Abuka, the director for statistics at the Bank of Uganda told Parliament recently that: “…the value of Mobile Money transactions declined by Shs672 billion in the first two weeks of July 2018, compared to the first two weeks of June 2018, in part, following the announcement of the Excise Duty Amendment Act, 2018.”

Olivier Prentout, the chief marketing officer at MTN told The Independent in an email response on August 06 that competition in the telecom sector will always see bigger companies that constantly invest in improving the coverage and quality of their network innovating more on their services, aggressively acquiring new sales and distribution channels and further investing in their brand to survive and grow.

“It requires a countrywide network to break even and remain in business plus a strong leadership and well thought out strategy,” Prentout said.

He said the telecoms that bridge the digital world will continue to do so to keep up pace with the needs of customers.

Prentout said all industries and consumers are now using internet and that 40% of the new jobs related to the digital economy envisaged in the next 10 years are not yet created.

Amidst these reports, the sector remains profitable for the big players.

Last year, MTN Uganda recorded a 10.7% growth in revenue from Shs 1.5trillion in 2016 to Shs 1.68 trillion in 2017, supported by growth in demand for data and digital services.

The data revenue increased by 41.4% underpinned by an increase in data traffic and good growth in data bundle adoption, the company reported.

Similarly, digital revenue increased by 16.1% supported mainly by Mobile Financial Services (MFS). MFS contributed 23% of the company’s total revenue, with the mobile money customers increasing by 27.6% to 5.2million.

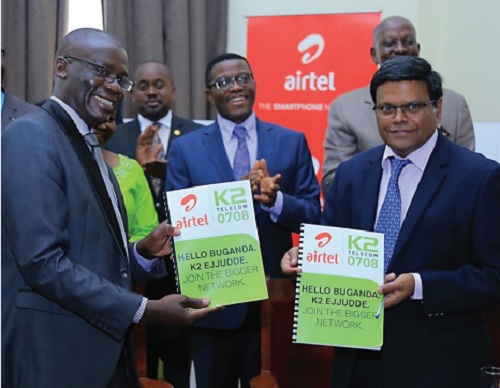

MTN had 10.7million subscribers as at the end of the first quarter of 2018. This was 700,000 more customer subscribers compared with its closest rival, Airtel that had 10 million in a market of about 23 million subscribers. The rest of the customers were shared by Africell and Uganda Telecom.

Going forward

Mutabazi said new players that intend to enter the country’s telecom industry would require heavy investments in infrastructure and promotional campaigns to attract customers to their network.

He also said focusing on data service which many players are doing, might not be economically viable given that it is a narrow market and very competitive.

For a country with 40 million people like Uganda, Mutabazi said it is normal to have at least a maximum of 3-4 players “beyond that it would be a waste of time and cannot be sustainable for small players.”

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price