Nile Breweries Limited spending US$22million to match sales growth

Kampala, Uganda | ISAAC KHISA | A few months ago, a highly respected and accomplished director for Nile Breweries Limited, a subsidiary of the Belgium based Anheuser-Busch InBev NV, popularly known as AB InBev, resigned. His name could be familiar to you – James Bowmaker.

His decision to resign in March this year was owed to the fact that his children had completed education and wanted to return home – South Africa and pursue other personal interests.

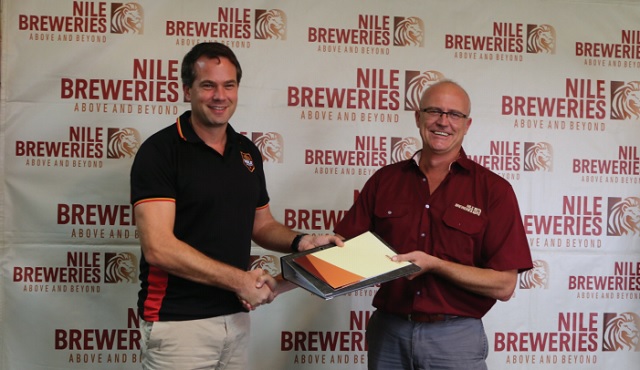

“Leaving (NBL) after seven years of being part of a great team that has grown this business, is not an easy decision, especially since I hold the country, people and products so close to my heart,” he said on April 24 at the company’s premises located in Luzira, a Kampala suburb, as he handed over the button to the new director, Thomas Kamphuis.

Kamphuis, who joins Nile Breweries Limited from the headquarters of AB InBev East Africa Business Unit (BU) based in Dar es Salaam, Tanzania, where he has been the Marketing Director for the unit, will be in charge of Uganda and the South Sudan markets.

During his first interaction with the media, Kamphuis, who has over 17 years of experience in fast moving consumer goods companies, of which 14 years have been in the beer industry, said the local population seem to be increasingly loving the taste of the company’s beers.

He revealed that it is on this basis that the AB InBev is investing US$22million through its subsidiary Nile Breweries Limited in upgrading its two plants in Jinja and Mbarara – as the world’s biggest beer-maker steps up investment on the African continent to meet booming demand.

He said the company’s current beer demand has outstripped supply, necessitating the need for a new wave of expansion.

“2017 was a remarkable year for us. We were able to grow our volume with 25% with our core brands Eagle, Nile Special and Club performing extremely well,” he said.

“This led to capacity constraints and we are upgrading our capacity in the coming months to meet the growing demand for our beer.” He, however, remained cagey on the production volumes that the new upgrade will add to the existing production capacity. As a consequence, Kamphuis said the company recorded a 19% growth in revenue last year compared with the previous year.

Five years ago the company sunk US$80 million in a new plant in Mbarara with a 65 million-litre production capacity per annum, with potential to increase to 180 million litres. This boosted the company’s production capacity to 245 million litres per annum and 360 million litres at full capacity compared with 180 million litres that was produced at its plant in Jinja, Eastern Uganda.

This, in effect, enabled Nile Breweries Limited to grow its market share from 52% to nearly 60%, according to company executives. The company exports 5% of its beer products to South Sudan, where it closed its beer production plant at the height of political instability in 2015. It also exports beer to Eastern Democratic Republic of Congo, Burundi and Tanzania.

The latest expansion of NBL’s plant comes in as many months since AB InBev’s took over the South African based SABMiller – the latter’s former parent company – at US$106bn in 2016.

Beyond Uganda

Similarly, AB InBev, whose foot print span from Europe, Asia, United States and now Africa, said in March this year it had agreed to build a US$100 million brewery in Tanzania. The plans for the plant in Dodoma, the company said, were agreed following a meeting between President John Pombe Magufuli and Ricardo Tadeu, AB-InBev’s head of Africa.

The multinational firm is also building a brewery in Nigeria that will start production by next month, adding that Africa’s fastest growth was the major factor in the decision to buy SABMiller, which had its roots selling beer to miners in 19th century in Johannesburg, according to Bloomberg.

Jorge Paulo Lemann, one of AB InBev’s billionaire shareholders, said last year that the continent’s rapid urbanisation and warm climate could eventually see it overtake the United States in beer sales. Rival company, Heineken NV has hired hundreds of sales staff and invested in growing markets such as Ivory Coast, Mozambique and Rwanda since the SABMiller deal.

Industry challenges

However, various challenges hamper the growth of the continent’s beer industry especially the impact of weaker oil and commodity prices on key economies including Nigeria, South Sudan and Angola. In the Democratic Republic of Congo, for instance, Heineken has closed facilities and taken a write-down due to high taxes and an economic slump last year, while Nestle SA left the country altogether.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price