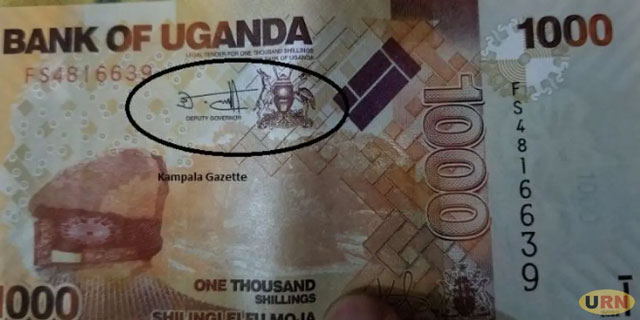

Kampala, Uganda | THE INDEPENDENT | The Bank of Uganda has clarified that the proposed replacement of the 1000 Shilling currency note with a coin will not affect its operation or legality when the coin is introduced. Rather, the two will continue being legal tender after the printing of the note stops, until it is wiped out of circulation through wearing out.

The Executive Director of Research at the Bank of Uganda Adam Mugume says that currently, they are at the initial stage of the process that includes a market survey and development of the policy, whose approval will inform the design, timelines and other aspects.

When the phase-out of the note is announced, it will not be declared non-legal tender but will circulate alongside the newly introduced coin, a reason there should be no public anxiety or panic.

The idea to abolish the 1000 Shilling note came more than a decade ago and resulted in the introduction of the coin in 2012 as a commemorative coin for the country’s 50th independence anniversary. It has since been in use concurrently with the note.

Since then, however, an idea has persisted on how to reduce the use of paper money due to several challenges, including high printing costs and health issues. Bank of Uganda says that overall the cost of printing money has been increasing with demand and expansion of the economy, despite innovative processing technology.

Bank of Uganda Deputy Governor Michael Atingi-Ego says the lower denomination notes get won out quickly because they have a higher rate of circulation compared to the bigger ones, hence the need to abolish them. He says that the 1000 Shilling notes which are issued rarely come back to the banking system and that if they do so, they are destroyed because they are too worn out to be returned to circulation, making them expensive to manage.

The value of banknotes processed increased by 614 billion Shillings or 6.8 per cent from 9 trillion in the year 2020/21 to 9.6 trillion Shillings in 2021/22. In total, coins account for about 3 per cent of the amount of money in circulation.

By the end of June 2022, coins accounted for 206 billion Shillings, up from 193.4 billion shillings as at the end of June 2021, according to data at BOU. On the other hand, notes in circulation accounted for 6.6 trillion Shillings, compared to 5.8 trillion at the end of June 2021.

The Bank of Uganda Annual Performance Report 2021/22 shows that the cost of issuing currency increased by 24.4 billion or 16.5 per cent from 147.5 billion spent in 2020/21 to 171.9 billion Shillings in the financial year 2021/22. This increase is attributed to the increased demand for cash by the public following the re-opening of the economy and the rise in inflation.

The Bank says higher inflationary pressures lead to increments in net demand for currency (more withdrawals than deposits), on top of the expansion of the economy. It calls for more sensitization of the public to adopt the electronic payment system to reduce the demand for paper and coin money and in turn, cut costs.

In 2018, the US National Institute of Health released a study finding that showed that currency notes, especially the smaller denominations were highly contaminated with disease-carrying bacteria.

A total of sixty paper notes of six denominations (1000, 2000, 5000, 10000, 20000, 50000) were collected from different food vendors around the Mulago Hospital Complex. The 1000 Shilling note was the most contaminated, while the 50,000 Shilling note was found cleanest.

Of the analysed 60 samples, 27 (45 per cent) samples contained Staphylococcus aureus, a bacterium that caused respiratory ailments.

***

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price