Kampala, Uganda | THE INDEPENDENT | Bank of Uganda (BoU) has the started process for complete closure of Crane Bank Limited, a move that will see the defunct lender’s chapter closed for good.

The Central Bank as a liquidator issued a statement on Friday. A liquidator is an officer or entity who is appointed to wind up the affairs of a company when it is closing.

Crane Bank was placed under receivership since 2016 after it failed to comply with a capital call on 1st July and some of its assets were sold to DFCU bank.

There are those assets that remain in the hands of Bank of Uganda and these will now be disposed off during the liquidation process.

The Central Bank will also verify and pay claims that Crane Bank Limited owed to different people and companies. In receivership, there is hope the company can resume normal operations and now the liquidation means Crane Bank complete closure. It is akin to burial or cremation in case of death.

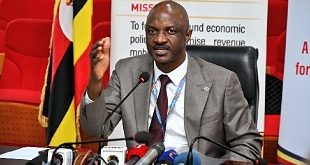

“Bank of Uganda took over management of Crane Bank Ltd. (CBL) on October 20, 2016 and subsequently progressed it into receivership on January 24, 2017,” reads part of the public notice. “In exercise of its powers under section 99 (1) & (2) of the Financial Institutions Act, 2004, BoU has now placed CBL under liquidation and ordered the winding up of its affairs. The Central Bank shall be the liquidator of CBL.”

Prof. Emmanuel Tumusiime-Mutebile, the Central Bank governor further orders in the public notice that all borrowers of Crane Bank whose loans were transferred to DFCU bank under the purchase of assets and assumption of liabilities agreement between Crane bank Limited and DFCU Bank Limited must continue to service their loan obligations with DFCU bank.

“All other borrowers of CBL, whose loans were not transferred to DFCU bank must service their loans by paying into the designated collection accounts at Bank of Uganda. CBL borrowers whose loans were not transferred to DFCU bank Ltd, can access a statement of their indebtedness from the office of the director commercial banking at Bank of Uganda headquarters,” Mutebile orders.

He also indicates that creditors of Crane Bank Limited will be notified of the procedure for presentation of their claims to the liquidator.

The governor’s notice dated 13th November 2020 follows a February 2019 report by Parliaments committee on Commissions, Statutory Authorities and State Enterprises (COSASE) which said that the closure of Crane Bank by Bank of Uganda was illegal.

The report indicated that an analysis of the bank’s liquidity from January 1st to 24th, 2017 revealed that the financial institution had recovered from liquidity distress by mid-January 2017 to the time it was disposed off on January 25, 2017.

“In fact, Bank of Uganda had stopped injecting money on January 9, 2017. Therefore the bank’s liquidity position had stabilized,” the report presented to Parliament by Bugweri County MP Abdu Katuntu read.

Katuntu also told parliament that his committee observed that BoU management did not provide a plan or assessment detailing efforts to return the bank into compliance with prudential standards despite funding with Shillings 478.8 billion.

The committee recommended that in the process of taking a decision to liquidate a financial institution, detailed plans for the revival should be exhausted before taking the most extreme action of liquidating.

Earlier on, the former Crane Bank owner, Sudhir Ruparelia had told Parliament that the agreement for the sale of Crane bank to DFCU was shoddy and fraudulent. According to Sudhir, the Purchase of Assets and Liabilities (P&A) agreement signed between BoU and DFCU did not have details of all assets and liabilities that were being taken over.

Auditor General John Muwanga also queried the failure by the Central Bank to prepare a plan to revive Crane Bank and also questioned the consideration of 200 billion Shillings from the bad books as the selling price for Crane Bank to DFCU Bank.

******

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price