The latest threat to commercial banking?

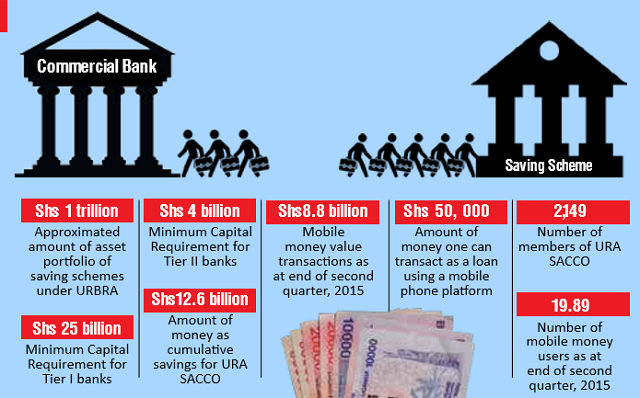

At the end of November 2016, the Uganda Revenue Authority’s staff Savings and Credit Cooperative (SACCO) held up to Shs12.6 billion on its account as the cumulative savings of its members.That amount is triple the minimum capital requirement to start a Tier II bank or credit institution in Uganda under Bank of Uganda ranking. What differentiates Tier II banks from commercial banks is the minimum capital requirement which is Shs4 billion for Tier II credit institutions compared to Shs25 billion for the Tier I commercial banks.

The URA SACCO has been operational for eight years and has 2,149 members and its manager, Aloysious Kityo, says it is a convenient way for URA workers to save because monthly saving deductions are made at source and members enjoy low interest rate on loans.

Kityo says although savings with the URA SACCO is compulsory for all staff members it has proved to be equally rewarding to them.

“We have seen a number of members open up businesses, acquire land among other assets,” he says adding, “this SACCO has done a lot to empower members develop financially.”

Unlike loans from commercial banks that are at 24% and are sometimes variable, the URA SACCO gives members loans at 14% calculated on reducing balance and fixed in nature.

In addition members earn high returns on their share capital in form of dividends of up to 23% per annum far ahead of what the market offers. It also avails its member’s avenues to acquire land in prime locations at friendly terms.

Although the URA SACCO defines the minimum saving per member per month at Shs50, 000, some members can save amounts of up to Shs3 million per month.

Kityo says the SACCO offers different loan products ranging from short term to long term loans. A member who is able to raise 30% of the desired loan amount in personal savings and shares in the SACCO can borrow at 14% per annum while those who are unable to raise this contribution are offered loans at 17% per annum.

Competition or complements

The pension sector regulator; Uganda Retired Benefits Regulatory Authority (URBRA) had by November 2016 registered 65 saving schemes of the URA type. An official told The Independent that, together, these Workplace Saving Schemes (WSS) held approximately Shs 1 trillion in assets as at end of 2015. There are, however, possibly thousands of saving schemes that are not yet registered by URBRA operating on their own.

The large numbers of members and sums of money transacted are making commercial bank managers to take note of Work Place Savings SACCOs.

Sam Ntulume, the managing director of NC Bank Uganda, a subsidiary of NIC Bank Limited of Kenya told The Independent that he would personally choose to borrow from a SACCO and not a bank. He described the SACCOs procedures as “smooth”.

He said they are not encumbered by the process of extending credit facilities in commercial banks which requires having record details of the borrower from the Credit Reference Bureau (CRB).

The CRB provides accurate information on borrowers’ debt profile for financial institutions to make key decisions but The SACCOs or Workplace Saving Schemes deal directly with their borrowers who are members.

He noted that unlike Commercial Banks, SACCOs are also easy and cheap to establish and run.

So, are Workplace Saving Schemes complements or competitors with traditional commercial bankers? No really, says Ntulume. “They can’t work in isolation; they have to keep their money with banks,” he said.

But some observers say that commercial banks that hold Ntulume’s view might be underestimating the impact Workplace Saving Schemes could have if traditional banking institutions do not innovate. Some are likening it to the onslaught made on commercial banking by mobile money transactions.

Commercial banks traditionally make money from three main sources in their business; the first is from interest paid on loans they extend to their customers and other banks, the charges they levy on their services; especially the underwriting services, and money they make on their trading in financial markets.

Typically, as Ntulume says, Workplace Saving Schemes need a resident bank where they deposit the savings of their members but they deprive banks of interest on loans since members borrow from the SACCO instead.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price