Role of central banks: Kasekende caught between bulls and bears

Central banks need to do something about market failures. The question is what?

That was the focus of discussion at the Bank of Uganda organised debate on `The Role of a Central Bank in a Market Oriented Economy’ on July 15 in the auditorium of the President’s Office building in Kampala.

On the distinguished panel was former president of the African Development Bank (AfDB) Donald Kaberuka, now Leader-in-Residence, Centre for Public Leadership at the Harvard Kennedy School, Axel Schimmelpfennig; Mission Chief for Uganda and Senior Resident Representative in South Africa for the International Monetary Fund, Adam Elhiraika; Director of the Macroeconomic Policy Division at the United Nations Economic Commission for Africa (UNECA), Prof. Benno Ndulu; Governor of the Central Bank of Tanzania. Joel Kibazo, a former Director of Communications and External Relations at the African Development Bank moderated.

All seemed to agree that central banks are now operating in a fast evolving financial landscape where they have to deepen financial inclusion, manage inflation, exchange rate stability, and the effects of globalisation on a country’s domestic fiscal agenda. Above all they also have to support economic growth and avoid rattling markets.

Many also agreed that although price stability is the dominant monetary policy objective of central banks, this role tends to be broken down or modified depending on a country’s economic aspirations.

Central banks in modern times, many agreed, should diversify their roles from the traditional principle of maintaining price stability. However, agreement on what direction the diversification should be and how extensive was not as unanimous.

Contention raged over what extent central banks should go to influence markets, how far governments should intervene, and even to what extent central banks could work with government in regard to utilisation of national reserves.

Tanzania’s central bank governor Ndulu spoke first. After summing up some of the roles of central banks in modern times, he said there has been a move away from a paradigm of market systems to government intervention.

“We are now beyond that to a point where we have to strike a good balance between market forces and the role government plays in its intervention,” he said.

Ndulu, who has been governor since 2008 and won the 2015 Africa Central Bank governor of the year, is highly respected. He also has a flair for imagery.

He likened the central bank’s role of ensuring cost effective payment systems to a “lubricant” of the smooth operation of the economy. He said they must guarantee enough currency, security and safety of payments, and manage the critical national reserves.

Schimmelpfennig from the IMF, said it is always hard finding the right policy mix for roles of central banks but he noted that it is crucial for the banks to align themselves with the national policies that promote growth.

But Elhiraika of UNECA, which was formed to encourage economic cooperation among African states, wanted a bolder and broader role for central banks in development.

He said central banks should not get lost on the principle of monetary stability.

“Market failures are here to stay. Central banks have to broaden their policy framework. They can’t focus on inflation curbing only. It is unrealistic to promote one objective. They have to broaden their development plans,” he said.

He said central banks should not attempt to define a one-approach suits all role for all countries.

“Central banks have different roles at different stages. These banks cannot have the same role in developed and developing countries,” he said.

He argued that developed nations have sophisticated financial institutions that give their main banks equally sophisticated roles and said that central banks in developing countries have to work hard to get to equally higher levels.

“We need to develop thinking on financial institutions. In Africa, we missed several opportunities because we implemented economic models that did not suit our development,” he said.

Elhiraika reasoned that African nations are not developing at the same level as that of other nations in other continents because countries in Europe and Asia have well-defined long term development plans, which are aligned with their central banks.

Going against ideology

Kaberuka also advised central banks to be pragmatic and not to allow being caught up in ideological warps.

“Shift and respond to needs, be pragmatic. Do not get caught up in these beliefs like Washington consensus,” he said, “Was there a Beijing consensus?”

Speaking about his time at AfDB, he said the bank’s core mandate was project finance. But then in 2008 Botswana approached the bank with a peculiar proposal that was not AfDB’s mandate.

“We had to slightly shift our mission by thinking pragmatically,” he said.

He revealed that in his work with the Chinese on a number of occasions, he has appreciated their strategic approach in their dealings.

“I am very allergic to ideology.”

But there were also voices of caution too.

John Rwangombwa, Rwanda’s central bank governor said that the central bank core mandate of price stability should be respected.

“Central banks act as an enabling environment by giving confidence to investors through acting responsibly,” he said.

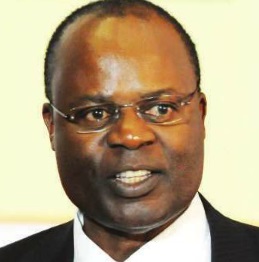

As the debate raged, Bank of Uganda Deputy Governor Louis Kasekende remained largely attentively quiet, weighing in occasionally to state a BoU position. He too prefers what he called an “evolving role”, especially for any central bank’s most important body; the Monetary Police Committee (MPC).

He said that sometimes, MPCs have gone on to integrate representatives from academia and business community to enable them widen the scope of discussions.

“We go beyond discussions in MPC to do evaluation of business community, analysis of external shocks. Even employment is also discussed in MPC,” he said, “Beyond financial stability, we are concerned with a whole lot of things, it is the reason we have programs on financial inclusion and financial literacy and development of payment system.”

He said on his recent tour of the country with other top BoU officials, including Governor Tumusiime Mutebile as part of events to commemorate 50 years of existence, they had found that the “public is very concerned about poverty and unemployment”.

He said these are areas they are working on. He said, however, BoU faces a big problem when it comes to communicating to the public.

“The challenge is how we find ways of communicating to the public on this?” he said.

Kasekende was also slightly stirred when the moderator, Kibazo, prodded the issue of a central bank’s role in handling a country’s foreign exchange reserves. Kibazo directed the question to Kaberuka, who has never been a central bank governor and was, therefore, well placed to give an academic interpretation.

And Kaberuka rose to the occasion.

“It’s okay for countries to use a bit of reserves so long as the central bank independently decides to use it for the future of the economy,” he said. According to him, it is okay as long as it is a central bank’s autonomous decision and not one forced on it by the government.

This topic was pertinent for Uganda because of the controversial decision taken by BOU Governor Mutebile in 2011 to tap from Uganda’s reserves to provide US$740 million from the reserves to the government at the height of an election. Although the official position was that the money was used to acquire fighter jets for national security, there were claims that some of it leaked into financing President Yoweri Museveni’s re-election campaign. In any case, the decision sent the economy into a tailspin from which it is yet to recover. The move also caused controversy and shook confidence in Mutebile’s stewardship of the country’s main bank. In his defence, Mutebile said he had been assured by the President that reserves would be replenished with money from the country’s anticipated oil production. It has never come.

With Mutebile away, participants looked to Kasekende to address this point during the debate. He did not.

Instead, it was Tanzania’s Ndulu who preached maximum caution on the issue of reserves. He said reserves are a guarantee to external lenders.

“Reserves are there for dealing with situations of dire consequences,” he said, “Once you start using reserves, you undermine the basis of getting finance. It is like eating your seeds when you are a farmer.”

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price