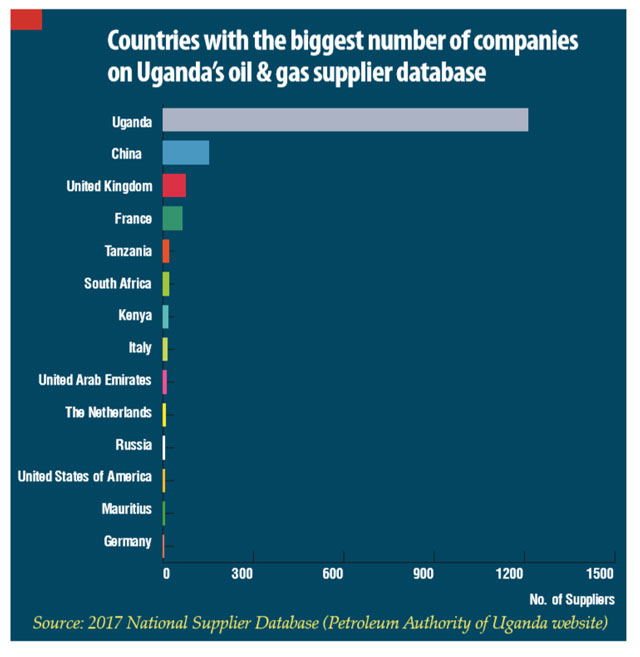

Fred Muhumuza, an economist at Makerere University says the strong showing of French, Chinese and British firms on the national oil and gas database speaks to the fact that the JV partners are here for business.

“Uganda’s local content is mainly at the level of political rhetoric because we have very weak enterprises in the country which might struggle competing with foreign-based companies,” he said.

But does the domination of Chinese, French and even British companies worry the Authority executives?

“Not really,” says Ernest Rubondo, the executive director of the Petroleum Authority of Uganda, “The PAU is supposed to ensure that the best companies are selected to offer goods and services, and not where they come from.”

“The national suppliers’ data base is an open system and the Petroleum Authority of Uganda’s role is to announce that in order to do business in Uganda’s oil and gas industry, an entity must be registered on the national suppliers’ database,” Rubondo told The Independent recently.

“The announcements are made both in country and internationally; so all companies across the world are welcome.”

Rubondo said joint venture partners have to undertake a procurement process which the authority sees.

“They have to demonstrate that they have advertised publicly (nationally and internationally) and so even if there might be more French and Chinese companies on the national supplier database, the process of identifying the company to do the work is still open.”

Foreign firms dominating database isn’t a surprise

Similarly, Aheebwa, told The Independent that it is not surprising that the response of companies intending to do business in Uganda’s oil sector has come from the home countries of the JV partners.

She said this is due to the fact that besides the authority spreading the news to potential suppliers both locally and internationally, the JV partners have also been encouraged to do this promotion in their own countries.

She, however, said PAU will ensure that every company is given a fair chance of getting the deals.

“The pre-qualifications for procurement are normally the same whether the potential supplier is from China, France or wherever,” she said.

Sector observers, however, say oil companies prefer to use the service providers that they have worked with for the last 4—50 years.

Don Bwesigye Binyina, the executive director of the African Centre for Energy and Mineral Policy (ACEMP), a Kampala-based non-profit told The Independent on Jan.11 that it is clear that the oil companies are always likely to transact with home-country affiliated companies.

“Quite often, you will notice that CNOOC is may be doing business with the Chinese company registered on the national supplier database and the French companies will be dealing with Total while the UK companies are more likely to work with Tullow.”

However, Binyina told The Independent that the proliferation of companies on the database with some being affiliated to the JV partners is most likely to bring in an element of “transfer pricing.”

Transfer pricing refers to the terms and conditions surrounding transactions in a multi-national firm. It concerns the prices charged between associated enterprises established in different countries for their inter-company transactions which at times can prove difficult to reconcile for host government technocrats.

“We need to be mindful about how strong our transfer pricing regulations are to ensure that the dealings of these home-based companies and the JV partners are at arm’s length,” Binyina says, “As long as you have weak transfer pricing laws, quite often you will have a lot of money being spent without being accounted for and yet it is money that has to be cost.”

Possible solutions

Going forward, observers say there is need to do a follow-up and see how and with whom the joint venture partners are doing their businesses.

But Aheebwa told The Independent that the authority has already anticipated the challenge and it has put in place mechanisms to deal with issues relating to transfer pricing in case a joint venture partner prefers to use its subsidiary.

“We already have several mechanisms which include an elaborate system whereby before any JV partner spends they must first agree with PAU on the relevance of the activities,” she says adding “Once we have agreed on the relevance, we have to agree on the budgeting.”

She said in instances where the joint venture partners intend to use an affiliate, the Authority will require them to produce a certificate from an auditor saying that the rate they will give their affiliate is at “no gain, no loss.”

“We also require them to prove that if they were going to use a third party the rate would be the same or relatively the same. At the end of it all, we will work with the Auditor General to ascertain that whatever has been done, there has been value for money.”

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price