Kampala, Uganda | THE INDEPENDENT | Uganda Revenue Authority (URA) will establish an office in down town Kampala, popularly referred to as Kikuubo, that is solely dedicated to providing Electronic Fiscal Receipt and Invoicing Services (EFRIS) to traders and other tax payers, Minister of State for Finance(Planning), Hon. Amos Lugoloobi, has said.

The decision made jointly by the ministries of Finance and Trade was arrived at in consultation with the traders on Wednesday, 16 April 2024, in a move to end the ongoing strike by traders.

The traders commenced their strike which has seen the majority of shops in down town closed since 08 April 2024. The traders are protesting the enforcement of the EFRIS system, saying that they were not sensitised and also lack the requisite infrastructure to use the system.

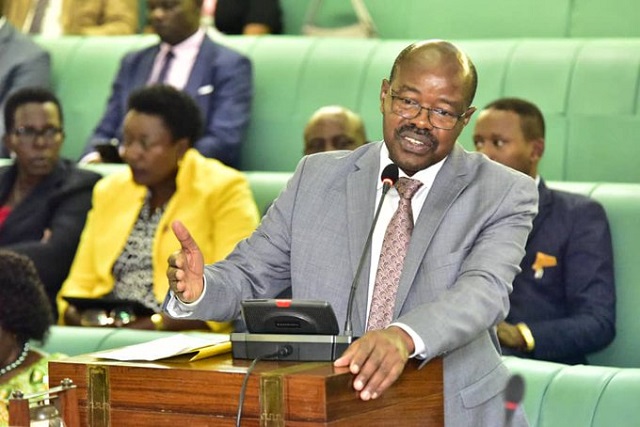

“It was agreed that traders shall immediately resume normal business as government concludes internal consultations and further engagement with the leadership of the traders. The consultations shall be concluded within two weeks,” said Lugoloobi.

He was making a statement to Parliament during the plenary sitting on Wednesday, 18 April 2024 wherein he reported that URA will continue to implement the EFRIS system but emphasis will be put on sensitisation and handholding of tax payers to appreciate the system.

“To that end, URA shall exercise more sensitivity in the enforcement of EFRIS and shall accordingly exercise restraint with regard to issuance and enforcement of penalties for non-compliance to EFRIS so as to give all tax payers time to appreciate the EFRIS system,” he said.

Lugoloobi added that the URA Commissioner General will submit a list of traders currently having outstanding EFRIS penalties to the Minister of Finance for consideration for possible waiver in accordance with the law.

Traders also requested that government should consider increasing the Value Added Tax (VAT) threshold from Shs150 million to Shs1 billion and a reduction of the VAT rate from 18 percent to 16 percent and Lugoloobi said that the Ministry will consult within the next two weeks and communicate on the matter.

“The traders also undertook to provide their input on the matter,” he said.

Lugoloobi added that some of the resolutions may change owing to a scheduled meeting between the traders and President Museveni on Friday, 19 April 2024.

The Minister of State for Industry, David Bahati, said government will make considerations on capitalising Uganda Development Bank so as to curb the high interest rates charged by money lenders, thereby affecting business sustainability of traders.

Speaker, Anita Among, challenged the Ministry of Finance to simplify tax payments, if compliance is to be achieved.

“You do not have to brutalise people to collect money. Trust in the government will be lost and yet at the same time we expect to collect this money from these people. Some people do not even know what they are paying for and the taxes they are paying,” Among said.

Leader of the Opposition, Joel Ssenyonyi, called for a halt on the EFRIS system, saying that it has not been understood by many, with traders seeing it as double taxation.

“What is so hard about government suspending it for even a month? There is nothing you lose as a government so that you can engage with traders. We can put EFRIS on halt because they are finding the implementation problematic,” he said.

Abed Bwanika (NUP, Kimaanya-Kabonera County) urged the Finance Ministry to consider reviewing the VAT during the ongoing consideration of tax bills.

He added that URA should open offices countrywide to sensitise traders on the EFRIS system.

“Even in Masaka, Mbale, Soroti, we need these offices, not only in Kikuubo. The strike is countrywide and URA should ensure that offices are everywhere,” said Bwanika.

Jonathan Odur (UPC, Erute County South) called for review of the Tax Procedures Code in which the URA Commissioner General has powers to make regulations on the operations of the EFRIS, saying that as a result, URA has instituted unreasonable penalties against traders.

“For example, the EFRIS has a timeframe within which receipts must be submitted, in the event that power is off, the trader is penalised and yet it is not their fault. We cannot run away from interrogating that instrument and where we can let us intervene because we have the original power to levy taxes. We never passed a law penalising traders for not having electricity,” said Odur.

*****

SOURCE: Uganda Parliament

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price