Public debt concerns

Uganda’s public debt stock stands at Shs56.53trillion as at June 2020. This has grown by Shs10.33trillion equivalent to 22.4% percentage growth from Shs46.20 trillion as at June 2019.

Now CSBAG says public debt service continues to exert fiscal pressure on the country’s budget, and this is manifested in Uganda’s interest payments rising from Shs1.7trillion in FY2016/17 to Shs4.1trillion in FY2020/21 (141.2% percent increment.)

The current public debt refinancing poses a potential fiscal risk to the country, it has increased from Shs5.9trillion in FY2018/19 to Shs7.4trillion in FY2020/21 translating into a 25% increase, the group says.

It argues, that it is important to note that whereas Uganda’s debt to GDP ratio remains below the 50% threshold, the country’s liquidity ratio to debt is very weak, at 22% in FY2019/20 against the IMF standard of 15% – and that this puts Uganda in a vulnerable state.

CSBAG also says that government needs to improve project identification and appraisal process, establish a project appraisal fund, restructure or renegotiate non performing projects which lock a lot of funds and have reduced fiscal space, approve projects whose counterpart funding has been secured in the budget.

On strengthening the financial sector, only 22% of Uganda’s adults use formal financial services.

Analysts say COVID-19 has adversely affected the country’s financial sector and exposed weaknesses in regulations, monitoring and lack of oversight of the sector, For example, the recent mobile money ‘fraud’ and the ongoing litigations between borrowers and different financial institutions.

In all these cases, according to CSBAG, predatory lending practices, inside bank lending, inside trading of mortgages and fraudulent borrowers are some of the key reasons why high interest rates, and less financial deepening in the sector.

The group says there is need for good business ethics and stronger consumer protection enforced by Bank of Uganda. They also say there should be a creation of a rural financial inclusion fund which will be financed by a 0.5 percent annual profit of commercial banks;

“It is the duty of government, particularly BoU to protect its citizens from unfair banking practices but above all ensure that the banking industry remains resilient and strong,” CSBAG says.

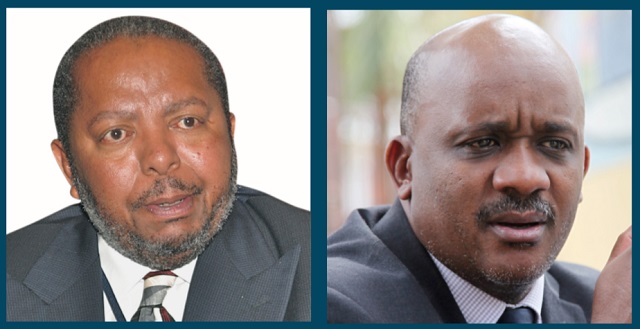

In terms of enhancing domestic resource mobilization efforts, the group says, with the new leadership at URA, there is renewed spirit of vigilance, teamwork and client-oriented service delivery.

However, the group says, there is need to increase coverage of the tax reforms to every taxpayer.

The CSO’s say Uganda’s Tax to GDP ratio which is below 13% can potentially increase to 22% without increasing tax rates but through enhancing tax administration and supporting URA both financially and technically to roll out tax reforms evenly.

Going forward, Julius Mukunda, the CSBAG executive director said, as an organisation and its constituency, they will be following up on these proposals with government as efforts to tame the spread of COVID-19 prevail.

“We are aware that election related expenditures, COVID-19 disruptions, and corruption are among the biggest risk we face as a country,” Mukunda said, adding “we call upon citizens to be vigilant in ensuring that the available resources are effectively utilized.”

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price