A policy brief by 3 top economists warns continent is in the worst crisis in 80 years

ANALYSIS | RONALD MUSOKE | Africa has long struggled with a silent debt crisis, one that has exacerbated its vulnerability to climate shocks and constrained its economic potential. It is time to give voice to these challenges and address the urgent need for debt relief as a pathway to sustainable growth.

This is the position presented by three distinguished economists in a policy brief to the Debt Relief for a Green and Inclusive Recovery (DRGR) project. The policy brief published this October is titled: “Giving Voice to The Silent Debt Crisis: How Debt Relief Can Unlock Green Growth Pathways for Africa.”

It was co-authored by Bogolo Kenewendo, the former Botswana Minister of Investment, Trade and Industry; Patrick Njoroge, the former Governor of the Central Bank of Kenya, and Alexander Dryden, an economist currently pursuing a PhD in Economics at London University’s School of Oriental and African Studies (SOAS).

Their report examines the challenging debt dynamics facing African nations and outlines several solutions that would allow African nations greater fiscal space and stability to achieve sustainable growth.

“We are entering a decade of extreme weather events from the highest recorded temperatures and frequent devastating hurricanes to ruinous floods and aggressive fires,” says Bogolo Kenewendo, who is the co-chair of the DRGR Project.

The climate crisis threatens the growth prospect of many Global South economies; however, the risk is particularly acute for African countries as 17 of the 20 countries most at risk from climate change are located on the continent according to a United Nations Economic Commission for Africa (UNECA) 2023 report.

“These climate shocks pose a risk to the economic gains made in the last decade and it is therefore urgent to finance adaptation and resilience, including through a comprehensive debt relief programme,” says Kenewendo

“Addressing these climate risks requires the region to mobilise significant financial resources to invest in climate adaptation and development; however, African economies are facing an acute sovereign debt crisis,” says the report.

Africa’s growing debt burden

The report notes how African economies have struggled with numerous external shocks over the last decade, leading to extensive borrowing from international capital markets, which offered a quick but often expensive solution to their fiscal challenges.

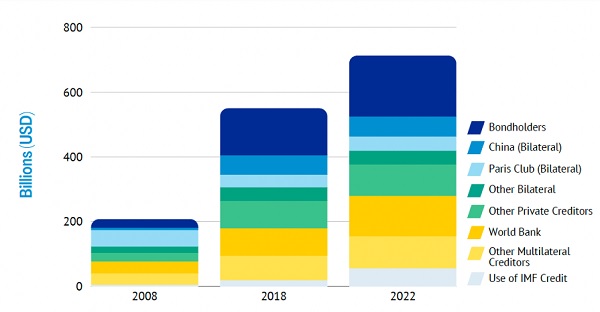

For instance, the report notes that public and publicly guaranteed debt (PPG debt) across Africa surged by 240% between 2008-2022, with countries like Senegal, Rwanda, Mozambique and Ethiopia seeing a ten-fold increase in external debt. Meanwhile, debt owed to private bondholders soared from US$25 billion in 2008 to US$187 billion in 2022, straining government finances.

The authors say the heavy debt burdens many governments face make it nearly impossible to increase spending on essential services without incurring further debt. According to the authors of the policy brief, the challenging debt dynamics have seen an increasing number of African nations defaulting on their financial obligations and their climate change investment needs. The African Development Bank (AfDB) estimated that in 2024, African governments will spend US$ 163bn on debt up from US$61bn in 2010.

“Escaping this debt cycle and providing governments with the means to unleash a positive cycle of green growth requires drastic improvements to the global financial architecture alongside extensive debt relief from both public and private creditors,” the report notes. “A comprehensive debt relief response that bolsters growth and safeguards the development and climate goals of these countries is urgently needed,” adds Njoroge.

Africa needs trillions of dollars to adapt

The report points out that implementing Africa’s nationally determined contributions (NDCs) to adapt to climate change will require about US$ 2.8 trillion between 2020-2030, but only around 10% of this funding (US$ 264bn) is expected to come from domestic public resources according to the UK-based FSD Africa, which describes itself as a specialist development agency working to make finance work for Africa’s future.

“The remaining 90% is expected to come from international sources and private sector investments,” the report notes. According to the report, of the total financing needs, loans have dominated grant funding at a rate of two-to-one, adding further pressure to Africa’s debt profile.

Other studies covering overall climate and development finance needs suggest that out of the US$ 3 trillion additional flows needed by 2030, US$ 1 trillion would be external debt from private and official sources, a G20 independent group of experts noted in 2023.

The DRGR report argues that without addressing the debt crisis, countries will be trapped in a vicious cycle of climate impacts leading to an effective ‘default on development,’ as well as chronic underinvestment and political instability.

The climate crisis

According to the report, the climate crisis is severely threatening economic growth in the “Global South,” particularly in Africa, where 17 of the 20 most vulnerable countries to climate change are located.

Since 2020, notes the report, African countries have found themselves at the epicentre of a “polycrisis.” The onset of the COVID-19 pandemic, the globalisation of inflation and subsequent interest rate hikes, as well as worsening climate shocks and the impact of rising geopolitical tensions, have left countries in a highly vulnerable position.

Since 2020, four African nations have defaulted, and the number of regional economies effectively barred from international capital markets has grown from one in 2010, to 11 in 2024.

Masaka Primary School in Butungama subcounty pupils heading home today .The School is temporarily closed.@ntvuganda @nemaug@Educ_SportsUg @MinofHealthUG@Bernardkwiri @OPMUganda@UNICEFUganda

Courtesy video pic.twitter.com/5IMt4dqgZE— NTOROKO DLG (@NtorokoD) August 6, 2024

At least 34 African countries will need significant debt relief to unlock the necessary funding for the United Nations 2030 Sustainable Development Goals and Paris Agreement targets, supplemented by other forms of low-cost and concessional financing.

External shocks from climate impacts, energy and food price spikes, and the hiking of interest rates by central banks in advanced countries have contributed to external debt levels increasing by 240% between 2008-2022, says the report.

According to the policy brief, external debt levels for African countries have increased by 240% from 2008-2022, with countries like Senegal, Rwanda, Mozambique and Ethiopia seeing a tenfold increase in external debt.

The report further notes that by 2028, 14 African countries are projected to breach solvency thresholds with a further 20 nations expected to exceed at least one of the solvency metrics used in the policy brief.

Uganda was not analysed in the report and although the country’s debt has risen markedly in recent years, technocrats in the Ministry of Finance, Planning and Economic Development have repeatedly come out to calm the public, saying the country’s debt is manageable. But some independent analysts are not convinced.

At the end of December 2023, Uganda’s total public debt stood at Shs 93.38 trillion (US$24.69bn), with external debt at Shs 55.37 trillion (US$14.64bn) and domestic debt at Shs 38.01 trillion (US$10.05bn). Uganda’s public debt was projected to reach Shs 97.638 trillion (US$25.716bn) before the start of the current fiscal year (2024/25). In nominal terms, Uganda’s public debt to GDP was estimated at 46.9% in June 2023. It was projected to end at 47.9% by June 2024.

Patrick Njoroge, the former Governor of the Central Bank of Kenya, who is also co-chair at the DRGR Project says Africa is in the worst crisis in 80 years.

“External public debt service ratios have reached record levels, and a growing number of countries risk defaulting not only on debt, but also on their development and climate goals,” he says.

Meanwhile, debt owed to private bondholders soared from US$25 billion in 2008 to US$187 billion in 2022. “Much of this debt has been borrowed on expensive terms, with over half of African nations now spending more on interest payments alone than on their public health budgets,” the report notes.

The rising global borrowing costs divert resources from crucial socio-economic priorities such as health, education, and climate resilience investments,” it adds. The increasing reliance on external funding sources is particularly concerning, given that over half of African nations spent more on interest payments than on healthcare.

Between 2020 and 2022, African countries allocated over 2.3% of their gross domestic product (GDP) to interest debt repayments–exceeding spending on health, which stood at just 1.8% of GDP according to a 2024 United Nations Conference on Trade and Development (UNCTAD) report.

While these external shocks have attracted attention, many African countries are silently struggling with dangerously large debt burdens. External public and publicly guaranteed debt in Africa have nearly tripled since 2008 according to a 2023 World Bank report.

The weight of increased debt burdens is worsened by the sharp rise in debt servicing costs, as central banks have aggressively tightened monetary policy in the pandemic era. For instance, between 2014-2022, the yield on the S&P Africa Sovereign Bond Index averaged 9.9%, however, in 2024, yields on African debt hit a record 13.5%.

Such elevated borrowing costs locked many countries out of international markets and those that have issued debt have done so at eye-wateringly high yields, notes the report. The authors of the report note that higher debt payments constrain a country’s fiscal capacity, crowding out investment in development and resilience projects, which in turn increases the nation’s vulnerability and potential losses, leading to a further cycle of economic weaknesses. The continent is thus trapped in a vicious cycle of climate vulnerability and underinvestment, making it increasingly difficult for the region to attain its climate and development goals.

Understanding the DRGR Project

The proposals made in the report aim to ensure that policymakers, thought leaders and civil society dealing with Africa’s debt crisis in the face of increased climate change risks, follow the path of green recovery and inclusiveness. These are the goals of the DRGR project which was set up at the peak of the COVID-19 pandemic in 2020 to advance innovative solutions to address the challenges of 21st century.

The DRGR Project is a collaboration between the Boston University Global Development Policy Center, Heinrich-Böll-Stiftung and the Centre for Sustainable Finance at the London University’s School of Oriental and African Studies (SOAS).

The measures they propose aim to ensure economic growth that benefits the environment and provides opportunities for the most affected. These proposals would empower indebted and climate vulnerable African countries to pursue sustainable green growth pathways by providing regional governments with the necessary tools to achieve their climate and development goals.

This requires a substantial infusion of low-cost financing, comprehensive debt relief and a fundamental restructuring of the global financial architecture.

According to the authors of the report, in order to empower indebted and climate vulnerable African countries to pursue sustainable green growth pathways, a substantial infusion of low-cost financing, comprehensive debt relief and a fundamental restructuring of the international financial architecture will be necessary.

Way forward

Going forward, the authors say, African countries will need significant amounts of low-cost finance to ensure their fiscal stability and to invest in green growth.

But low-cost liquidity will not be enough for at least 34 African countries that will need significant debt relief to unlock the necessary funding for the United Nations 2030 Sustainable Development Goals and Paris Agreement targets. Further still, these should be supplemented by other forms of low cost and concessional financing.

The authors say the case-by-case approach under the G20 Common Framework has proved lengthy and insufficient to provide the necessary debt relief for improving a country’s fiscal health.

Many countries that need debt relief will not ask for it because they know they cannot expect a swift and fair treatment. In order to address the challenge, the authors outline a series of reforms and policies aimed to assist highly indebted nations.

According to the authors of the policy brief, “African leadership, particularly in upcoming international forums, will be crucial in 2025 to champion essential reforms of the current debt and financial architecture, helping to break the vicious cycle and deliver sustainable and inclusive growth to the region.”

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price