Investors likely to preserve their savings and capital with CIS and fixed income instruments due to the current coronavirus pandemic

Kampala, Uganda | ISAAC KHISA | Uganda’s Collective Investment Schemes (CIS) have recorded more than double their assets under management (AUM) to Shs 388.5bn for the FY2019/20 as a result of an increase in the number of local investors embracing the product.

This represents a 123% surge in assets held under the CIS compared with the previous year, latest data from the industry regulator, Capital Markets Authority, shows.

CIS’ are investment products that give investors opportunity to pool savings with those of other investors, thereby creating a large pool of funds to be invested on their behalf by professional managers.

They include but not limited to savings and credit cooperative societies, local individuals, investment clubs, institutional investors and local companies.

Though CIS are structured either as unit trust schemes or investment companies with variable capital, all CIS in Uganda are structured as unit trust schemes that are managed by Unit Trust Managers such as UAP old Mutual Financial Services, XENO Investment Management and Britam Asset Management Company.

Keith Kalyegira, the chief executive officer at CMA said the investor accounts held by CIS managers increased from 5,222 to 8,904 during the period under review.

“The growth in assets under management and clients, can be attributed to increased awareness of Collective Investment Schemes among local investors, which has seen more Ugandans open CIS accounts and save through them,” he said.

He said UAP Old Mutual Financial Services held the largest assets with Shs 271.1bn during the year, followed up closely with ICEA with 62.2bn. Britam and Xeno held Shs 40bn and Shs14.8 bn, respectively.

However, the CIS’ contribution towards the Gross Domestic Product stood at 0.03%. At this level, its contribution to the economy is very low compared with Kenya and Morocco, whose CIS asset contribution to the economy stood at 0.7% and 44.8%, respectively.

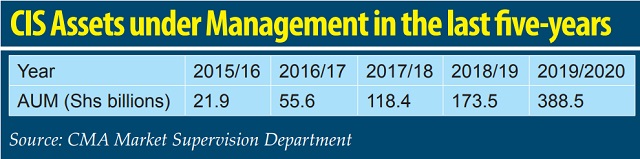

CIS have in the past five years recorded a 77.7% rise in assets from Shs 21.9bn in 2015/16 to Shs 388.5bn in 2019/20.

Relatedly, the total assets under management by fund managers stood at Shs 3.5trillion as at the end of FY 2019/20 compared with Shs 2.9trillion in the previous year. This, according to the CMA report, is attributed to increase in the number of retirement benefit schemes and recruitment of new members by schemes whose funds are being managed.

Sanlam Investment East Africa held the lion’s share of assets under its management at Shs 1.55trillion, GenAfrica Shs1.01trillion and Britam at Shs 410bn. UAP Financial Services Ltd and ICEA Investments Ltd held Shs 362.7bn and Shs 162bn of the assets, respectively.

Equity markets

Meanwhile, the Uganda Securities Exchange ended the period under review with 17 listed companies, nine locally listed. There were no new listings or de-listing during the period.

The domestic market capitalization reflecting the value of locally listed counters closed lower at Shs 4.27trillion, representing a 13.1% drop compared with the previous year. The drop was attributed to a share price losses registered on all locally listed counters with the exception of British American Tobacco Uganda Ltd whose share price remained unchanged.

The equity turnover at the USE grew by 146.1% in the FY 2019/20 to Shs 115.4bn, up from Shs 46.9bn registered in the previous year.

Share trading volume also trended upwards to 1,554 million shares in the FY 2019/20 compared with 796 million shares traded in the previous year citing increased activity on dfcu bank, Umeme and Stanbic Bank counters in the period before the coronavirus pandemic.

Future outlook

CMA executives say the pandemic has fundamentally challenged the financial and operational agility of Uganda’s capital markets industry.

“Equity markets are likely to come under pressure from muted participation by domestic and off-shore investors due to the economic uncertainty generated by the COVID-19 pandemic and geopolitical risks,” the executives said.

“On the other hand, it is too early to tell whether there will be significant reduction in investor funds being professionally managed by CMA licensed investment firms.

Suffice to note that during uncertainties, investors usually seek to preserve their savings and capital and hence turn to assets like Collective Investment Schemes and Fixed Income instruments such as government securities, the executive added.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price