After good economic performance in 2018, can the Uganda economy maintain the momentum?

COMMENT | MUSA MAYANJA LWANGA | Despite the political violence that threatened Uganda’s international image, the year 2018 was a great year for the country in terms of economic performance. Estimates show that the economy grew at above 6 percent, beating earlier forecasts. This is a growth figure that has not been achieved since 2010.

This robust growth was largely driven by favourable weather conditions that boosted agricultural production, government investment; especially in infrastructure, foreign capital investment in oil and gas, and the low inflation that facilitated a relatively loose monetary policy. Indeed, the Central Bank maintained a relatively low Central Bank Rate (CBR), enabling prime lending rates to fall to their lowest level in 10 years by the end of June 2018. This had a positive effect on the growth of private sector credit and boosting growth in private sector investment.

The question stakeholders, both in government and the private sector, are asking is “can the economy maintain this momentum?”

Monetary Policy

Early growth indicators show that the economy is indeed poised to maintain the momentum and forecast better performance in 2019. This projection is anchored on strong macroeconomic fundamentals and the expected political calm.

However, some of the challenges the economy suffered in 2018 persist. For example, Uganda’s ranking by the Word Bank’s Ease of Doing Survey deteriorated from 122 out of 190 economies in 2017 to 127 in 2018 casting a cloud on the future performance of the economy.

The shilling continued to depreciate affecting the cost of production through increased prices of imported inputs, high transport costs due to increased prices of petroleum and other oil products amplified by upward swings in the international oil prices.

In 2019, on the monetary policy side, Bank of Uganda is expected to maintain an expansionary monetary policy stance by keeping the CBR low despite a slight tightening we observed in the second half of 2018 owing to inflationary expectations.

The Central Bank is expected to lower its policy rate as inflationary pressures continue to subside. Inflation is expected to stay low ranging between 3 to 6 percent, having ended the years at 2.2 percent far below the Central Bank target of 5 percent and below the 3.3 percent registered at the end of 2017.

This is based on the assumption that the favourable weather conditions witnessed in 2018 continue boosting agriculture production as well as keep food prices low, a major driver of overall inflation. The loose monetary policy is expected to boost private sector credit and investment, leading to increased employment, increased incomes, consumption expenditure and consequently high economic growth.

Fiscal Policy

On the fiscal side, the government is expected to continue investing heavily in infrastructure; especially in the road network. This is expected to boost demand and drive growth in sectors like construction. However, on the downside, due to low domestic revenue collection, public debt and expenditures on debt servicing are expected to increase.

Private sector performance

Private sector growth is expected to be robust in 2019 stemming from increased investment as a result of favourable macroeconomic conditions, increased foreign capital inflows following investments in the oil and gas sector, and reduced cost of power due to increased generation capacity if Karuma and Isimba hydropower dams are completed.

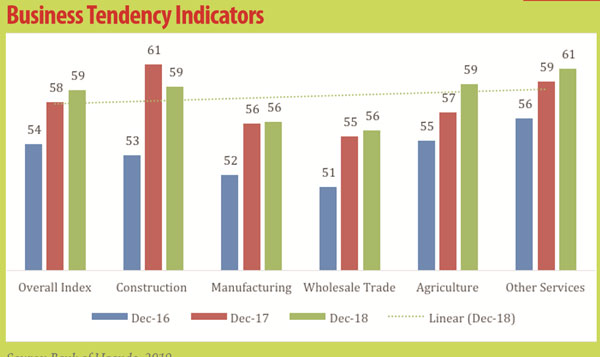

Real sector indicators show increased optimism and positive expectations regarding the health of the economy. The Business Tendency Index and the Composite Index of Economic Activity collected by Bank of Uganda have generally been improving over time. The Overall Business Tendency Index stood at 59 in December 2018 compared to 58 and 54 recorded in 2017 and 2016 respectively. Expectations in all sectors are positive with increased optimism in agriculture and whole sale trade (see figure below).

Likewise the Composite Index of Economic Activity has been on an upward trend ending the third quarter of 2018 at 218.3 way above the 202 recorded in the same quarter of 2017.

Business Tendency Indicators

Source: Bank of Uganda, 2019

What could go wrong?

This positive outlook subject to a number of risks which include weather shocks (in the form of drought and floods); pests and disease that could affect agricultural production, shortfalls in government revenue collection, political unease which could deter investors and disrupt business as we come close to the 2021 general elections, corruption and delays in public project implementation.

In addition, external factors such as political uncertainties in DR Congo, the Sudan, the war in South Sudan and other disruptions in the region could spillover and negatively affect this outlook.

Globally, the trade wars between the U.S. and China are beginning to affect world output and trade, affecting the demand for commodities.

Europe is still grappling with uncertainties resulting from the BREXIT as well as a recession in Germany, Europe’s biggest economy. Poor performance in advanced economies would not only affect demand for exports and the flow of financial capital, it could also negatively affect the level of remittances as well as the foreign aid flows to Uganda. Other factors that could derail this forecast include movements in the exchange rate and in international oil prices as well as the US policy on interest rates that could affect the flow of international capital.

What can be done?

If the projected economic growth is to be realised, government and other stakeholders need to improve complementary services that support the sector that employs most Ugandans-agriculture. This could be attained through increasing the coverage of the agriculture insurance scheme, as well as investment in the Water for Production sector in agriculture. In addition, the government needs to adopt policies that crowd in the domestic private sector; especially when it comes to the procurement of large infrastructural projects. This will have a huge multiplier effect, boost domestic demand and consequently increase economic activity. Furthermore, improvement in domestic revenue mobilisation, a reduction in domestic government borrowing, fighting corruption and improving project implementation will improve the effect of public spending on the economy.

******

Musa Mayanja Lwanga is Head of Research and Market Development, Uganda Bankers’ Association

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price