COMMENT | MARTIN A NSUBUGA | The International Women’s Day, March 8th, can be traced back to the early 1900s, with women’s movements in different countries leading protests against a wide array of “injustices”. Key among the issues raised back then, were deplorable working conditions for women.

Over the years, International Women’s day has been commemorated under different themes, with a view to highlight the key issues that affect women in their day-to-day life. This year 2021, International Women’s Day is commemorated with the theme: Building on women’s Strength for a better future in a Covid-19 world.

Uganda Retirement Benefits Regulatory Authority (URBRA) joins the rest of the world to commemorate this special day, reflecting deeply on the theme and the history of International Women’s Day.

Looking at the conditions that birthed this special day, we are reminded that good working conditions are essential for all. As an institution that regulates the Retirement Benefits Sector, URBRA understands the implications of working conditions for any worker.

Staff retirement savings key

Key among the defining characteristics of a favourable working environment, is the willingness and ability of the employer to contribute to staffs’ retirement savings. Apart from the mandatory contribution to the National Social Security Fund (NSSF), it would be ideal for the employer to devise other retirement saving mechanisms, either by sponsoring an occupational scheme or by encouraging staff to join voluntary schemes.

It’s worth noting, that over the years, employers in Uganda have become more committed to ensure a good retirement for their employees – witness the growth in sector investment portfolio; increase in sector contribution to National Gross Domestic Product (GDP); and the ever-growing number of occupational schemes – 68 and counting.

However, there is the outstanding question of how women are faring in this quest for improved retirement benefits saving.

50% of men employed, compared to 40% of women

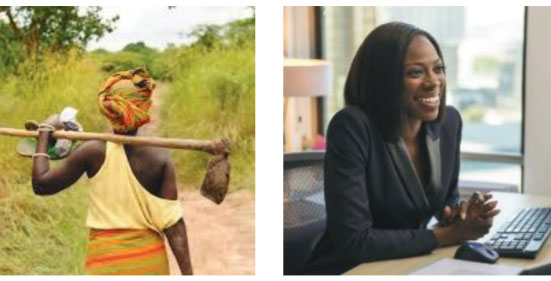

The Uganda Bureau of Statistics, in 2017 released a report titled “Women and Men in Uganda: Facts and Figures.” With regard to the national labour force, the report indicated that 50% of men were employed, compared to 40% of women. Of the employed labour force, 48% of women were self-employed, compared to 38% of men. UBOS further reported that men engaged more in paid employment, while women spent up to 30 hours a week on unpaid domestic work like colleting firewood, fetching water, taking care of children, the sick and the elderly.

The economic activities in which a person is involved, have significant implications for retirement planning and saving. People in formal employment have a more structured retirement saving plan compared to their counterparts in the informal setting.

Even among those in formal employment, the actual tasks and related emoluments have implications for retirement savings. UBOS indicates that women tend to concentrate in less-paying service work and elementary occupations rather than highly-paid professional work and key positions such as CEOs and senior officials.

But as the 2021 theme suggests, it is important to celebrate the contribution of women and build on their strengths. The contribution of women to the retirement benefits sector cannot be overstated.

Women are savers

Women are savers – the number of women in paid employment speaks to that. The sector also benefits a lot from women’s leadership – out of 210 licenced Trustees, 75 are women.

Women occupy leadership positions on Boards of Trustees, Boards of Directors. They are also involved as sector service providers. Women are educators, who unreservedly share their experiences and lessons.

During URBRA’s sensitization seminars, women speak proudly about their achievements and always state their commitment to save for old-age. There’s need to build on those strengths and achievements to ensure the Sector’s continuous development.

The gains made over the years cannot be discounted, but there is room to improve the women’s work experience, emoluments and ultimate contribution to the retirement benefits sector. There must be deliberate efforts to tackle the challenges that compromise women’s ability to contribute meaningfully to their retirement benefits.

Such challenges include frequent breaks in career to attend to social and family duties; working in the informal sector which has no structured saving plan; spending time on non-paid household chores…There should be deliberate efforts to ease the burdens that afflict women, compromising their retirement benefits savings and pensions.

*****

Martin A. Nsubuga is the Chief Executive Officer, Uganda Retirement Benefits Regulatory Authority (URBRA)

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price