Why is country mortgaging her future by relying on external borrowing rather than tax revenue?

COMMENT | MUSA MAYANJA LWANGA & FLORENCE NAKAZI | In the recent past, owing to Uganda’s many development needs including large infrastructure projects and expanding public administration costs, government expenditure has significantly exceeded revenue collection. This has compelled the government to resort to other sources to finance the deficit which has averaged about 4 per cent of the Gross Domestic Product (GDP) since 2010. As a result, Uganda’s stock of public debt has almost tripled in the last ten years from USD 2.9 billion in 2006 to USD 8.7 billion in 2016. Although this is still within sustainable levels (at about 37 percent of GDP), the pace of growth calls for an increase in domestic revenue mobilisation to reduce the growth in public debt. Revenue collection is key to the financial independence, stability, and sustainability of a nation. To reduce on its borrowing, a country must proactively and diligently ensure improved revenue collection.

The establishment of the Uganda Revenue Authority in the early 1990s, and the various reforms that followed, was seen as a milestone towards attaining fiscal independence through increased domestic revenue mobilisation. At the time, the country was debt ridden and depended largely on foreign aid to finance her budgetary needs. Following the reforms, Uganda has registered significant increases in domestic revenue collections. Net URA collections have increased over ten times from Shs1,075.15 billion shillings in 2000/1 to about Shs11,230.9 billion shillings in 2015/16.

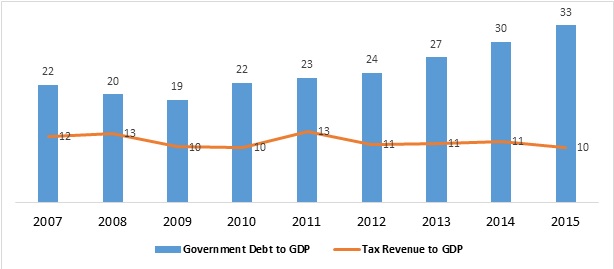

However, despite this observed growth, domestic revenue mobilisation Uganda is still below potential when other indicators such as revenue or tax to GDP ratio are considered. Statistics from the World Bank show a stagnation of Uganda’s tax to GDP ratio at about 11 percent over the last ten years (see figure below). In comparison with regional neighbours, Uganda’s tax revenue to GDP is still below the 16 percent Sub-Saharan average and lags behind her EAC neighbours too. In 2014, Uganda’s tax to GDP ratio stood at 11.4 compared to 12.4 percent, 13.5 percent and 15.5 percent for Tanzania, Rwanda and Kenya respectively.

Ratio of Government Debt to GDP Vs Tax Revenue to GDP

Source: Authors’ construction from WDI, World Bank Statistics, 2017

Why Uganda’s relatively poor performance in revenue collection?

A number of factors including weaknesses in the tax administrative system, high levels of informality, tax evasion, detrimental tax incentives and a narrow tax base have contributed to the stagnation of Uganda’s tax to GDP. Comparison with other East African Community countries shows that Uganda has a relatively higher dependency on international trade taxes. For example, in 2013, Uganda collected 11 percent of its tax revenue from customs and other import duties compared to 8 percent for Tanzania and Kenya. Given that the EAC now imposes uniform rates under the common external tariff regime, the higher ratio of international trade to total tax revenue for Uganda, would mean two things, either Uganda has a relatively higher imports ratio or her tax revenue collection from domestic taxes is still below potential. International trade taxes are highly dependent on import levels as well as foreign exchange movements. Thus, having a high share of international trade taxes to total taxes can affect the predictability of revenue collection in times of foreign exchange volatility.

Informality has also been identified as one of the most challenging factors to increasing revenue collection in Uganda. Regional comparisons show that Uganda has a higher level of informality than the other EAC countries. Having a large informal sector not only negatively impacts tax collection but also retards innovation and business growth. In 2013, over 95 per cent of firms were competing against unregistered or informal firms in Uganda compared to 69 percent and 59 percent for Ghana and Kenya respectively. In addition, 38 percent of Ugandan firms identified competitors in the informal sector as a major constraint compared to 30 percent and 27 percent for Ghana and Kenya respectively. This high level of informality partly explains the relatively low level of tax to GDP.

Although URA has made significant reforms, tax evasion and avoidance is another major factor negatively impacting on tax collection. In 2006 Uganda had the highest percentage of firms that did not report all sales for tax purposes standing at 74 percent compared to 71, 26 and 43 percent for Tanzania, Rwanda and Burundi respectively. Tax evasion is largely due to the lack of transparency from traders, informality as well as weaknesses in the tax administration system.

What can be done?

URA needs adopts a revenue system that enables it to seal all loopholes, capture all avenues of revenue streams and develop internal capacity for continuous improvement. There is a need for continuous improvement in auditing; improving staffing and leadership (by recruiting and retaining competent staff to increase productivity), improving the tax payer registry; simplifying the tax system to encourage formalisation; enabling external checks that enforce compliance, and encouraging constant innovations through research.

*****

Musa Mayanja Lwanga is Research and Policy Analyst at Economic Policy Research Centre (EPRC) and Florence Nakazi is Research Analyst at EPRC

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price