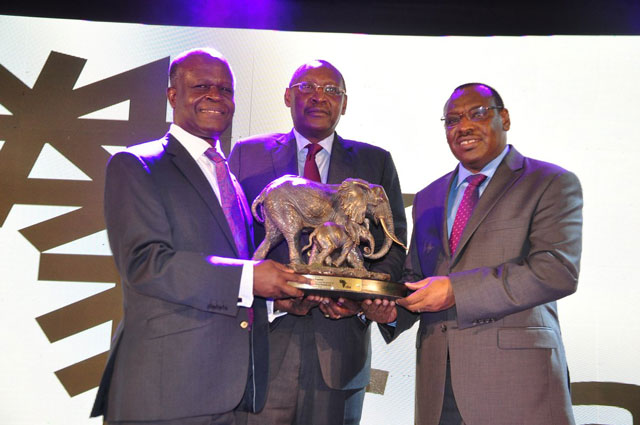

Kigali, Rwanda | ISAAC KHISA AND AGENCIES | Kenyan-based Commercial Bank of Africa (CBA) officially started its banking operations in Rwanda on March 19 following the successful acquisition of Crane Bank Rwanda Ltd, now relaunched as CBA Rwanda Limited.

Acquired from Dfcu Uganda, CBA Rwanda Ltd becomes the 16th commercial bank to enter Rwanda’s banking industry.

The move into Rwanda with three branches, increases CBA’s footprint in the continent, to five countries, which include Tanzania, Uganda, Ivory Coast and Kenya.

“Rwanda stands out amongst its peers in East Africa because the economy has grown impressively and sustainably from 2000 to 2017, with a GDP growth rate averaging 7.2% annually,” said CBA Group Chairman, Desterio Oyatsi.

“Rwanda is considered a “digitally-ready” country, as the Rwandan consumer is quite tech savvy, while the regulatory environment is conducive for investment and amongst the most progressive in Africa.”

He said the bank’s strategy has been to leverage on technology to drive financial inclusion by banking the unbanked and financially empowering people and businesses in the real economy.

CBA’s journey into Rwanda’s financial market started in February 2017, when the bank partnered with MTN Rwanda to launch “MoKash,” a pioneering mobile banking and credit product similar to MoKash in Uganda and M-Shwari in Kenya. The product currently has 700,000 customers, in Rwanda, which has a population of 12 million people.

CBA projects that its investment and presence in Rwanda will grows as it supports the country’s economic growth, whilst offering its customers innovative and differentiated services.

This investment in Rwanda is a key pillar in the implementation in CBA’s current 5-year strategic vision, which is to be a respected and significant financial services business partner in Africa.

Oyatsi said the bank is positioning itself to be the intermediator and facilitator of regional business growth by supporting business venturing across borders in the coming years.

CBA, majority owned by President Uhuru Kenyatta’s family, is said to be supported by a Group balance sheet of US$ 2.5 billion as at December 2017.The bank also boasts of over 33 million customers across the five countries CBA operates in, owing to the banks corporate, personal and ground breaking mobile-based savings & credit propositions in the respective countries.

Rwanda’s Minister of Finance and Economic Planning Claver Gatete said the government welcomes the new lender with open arms and commits to support its establishment.

He said Africa needs strong and sound financial institutions such as CBA Group to achieve the country’s development gaols.

CBA historical background

Commercial Bank of Africa was established in 1962 in Dar es Salaam, Tanzania as a subsidiary of Swiss-based Société Financière pour les Pays d’Outre-Mer (SFOM).

The SFOM consortium included Banque Nationale de Paris, Bank Bruxelles Lambert, Commerz Bank and Bank of America. Branches of the bank were established in Nairobi and Mombasa, Kenya. Another branch was opened in Kampala, Uganda.

In 1967, the Tanzanian government nationalized all commercial banks in the country as part of the government’s nationalization of large industries in its execution of the Arusha Declaration. This nationalization led the bank to move its headquarters to Nairobi.

In 1971, the Ugandan business was sold off to Barclays Bank of Uganda. This was due to the then prevailing political instability in the country.

BOA gained majority control of CBA in 1981 after BOA acquired shares held by other shareholders in the bank except for 16% that was held by local shareholder.

Between 1984 and 1991, BOA re-organised CBA, developing and installing Bank of America`s global systems and disciplines before selling its majority shares to local Kenyan investors.

The Bank of America continued to provide management to the bank via a management agreement before eventually selling the rest of its shares in 1991. Since then, CBA became a wholly owned Kenyan bank recognised for operational efficiency and quality service delivery.

In July 2005, Commercial Bank of Africa (CBA) acquired majority shareholding in First American Bank of Kenya. At that time First American owned a subsidiary in Tanzania called United Bank of Africa. This marked the bank’s re-entry into Tanzania after the 1967 nationalization of its operations in the country.

In 2007, United Bank of Africa changed its name to Commercial Bank of Africa (Tanzania) leading to the formation of the CBA Group.

In March 2012, CBA Group initiated action to acquire a 62% stake in Royal Bank Zimbabwe, a Harare-based commercial bank. However, both parties failed to finalize on the deal within given regulatory time frames. On July 31, 2012, The Reserve Bank of Zimbabwe determined Royal Bank to be insolvent. Royal Bank then surrendered its banking licence and closed down

CBA Group re-entered the Ugandan market in 2014 through its wholly owned subsidiary, Commercial Bank of Africa Uganda Limited.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price