According to the Auditor General’s report, as of June 30, 2019, government domestic arrears stood at Shs3.3 trillion – having grown by 30% from Shs2.6 trillion from June 2018.

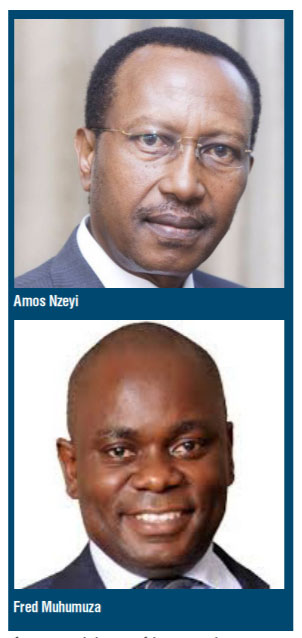

Nzeyi said there’s also need for the government to improve on efficiency in spending and pay more attention to the procurement of products and services locally as it is stipulated in the Buy Uganda Build Uganda policy (BUBU).

“For starters, there is no real figure to measure how much of government expenditures is going to local companies. In the absence of real figures, it becomes difficult to track this critical initiative of your government,” he said, “This is the time to seriously focus on how much, Ugandan businesses are benefiting from government expenditure.”

Academics like Paul De Grauwe, a Professor of European Political Economy at the London School of Economics, have recommended that in the current pandemic, national governments need to save businesses from bankruptcy by granting financial support and subsidies, assist workers by funding temporary unemployment schemes, and possibly even come to the rescue of large banks.

Writing for Project Syndicate; the publishers of syndicated commentary and analysis, Prof. Paul De Grauwe said: “Worse, all of this must be done at a time of declining tax revenues, which means that government deficits and public-debt levels will skyrocket”.

But Corti Paul Martin Lakuma, a macroeconomics expert at the Makerere University-based Economic Policy Research Centre (EPRC) says there is no need for an alarm. According to him, the government has measures in place that are equal to the current risk from the coronavirus pendamic.

“The current measures are so far the best. Other measures need to come in as days move on,” he said.

“Government cannot immediately start giving the business community or its citizens’ bailouts at this early stage. What happens if this pandemic goes on for a long time, say 18 months? Where will the government continue getting money to sustain bailouts? The best thing right now for government is to have a buffer.”

Lakuma said the government must remain steadfast or risk making big mistakes that will have far bigger implications to the economy.

He added that the government should ensure that businesses and companies remain operational to sustain the population while serious preventive measures are taken to avoid unmanageable spread of the disease.

“An attempt to have a complete lockdown will mean increase in crime rate – robbery and theft,” he said.

Comparisons from elsewhere

Elsewhere in the East African region, Kenya’s central bank freed up Kshs 35.2 billion on March 24 and made it immediately available to commercial banks to support distressed borrowers as a result of the coronavirus pandemic.

The banking sector regulator also cut interest rates by one percentage point, further easing the burden of loan repayments as the industry finds ways to shield its books from defaults expected as the country implements far-reaching measures to contain the outbreak.

The bank lowered the Central Bank Rate (CBR) to 7.25 per cent from 8.25 per cent, which effectively reduces interest rates by a similar margin.

The Kenyan lenders and other financial institutions have also proposed to restructure their loans with customers in cases where borrowers are not able to honour their obligations on time.

Under the deal, the banks will offer short payment holidays or reschedules on loans payments of up to one year.

“Banks will seek to provide relief to borrowers on personal loans based on their personal circumstances and arising from the pandemic,” said the CBK Governor, Patrick Njoroke.

Joshua Oigara, the chairman of Kenya Bankers Association and the chief executive at KCB Bank said personal customers affected by economic fallout from Covid-19 will be allowed payment breaks or flexible arrangements on home and other loans.

In the U.S., the Federal Reserve on March 22 announced that it would cut its target interest rate to near zero as an emergency action to support the economy during the coronavirus pandemic.

The swifter-than-expected rate cut is designed to prevent the kind of credit crunch and financial market disruptions that occurred the last time the Fed had to cut rates all the way to the bottom, during the global financial crisis just over a decade ago.

In addition to rate cuts, the Fed also said it would purchase another US $700 billion worth of treasury bonds and mortgage-backed securities.

The Fed also struck a deal with five other foreign central banks; the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, to lower their rates on currency swaps to keep the financial markets functioning normally.

In the United Kingdom, the government will help pay workers’ wages, in response to the economic fallout from the coronavirus pandemic.

The government plans to cover 80% of the salary of every citizen who’s unable to work, up to £2,500 per month, a figure that’s just higher than the median income. This follows a £350 billion bailout package of loans and grants to help prop up British businesses.

As the Uganda government appears unable to provide this kind of stimulus packages, the population must brace for rough times during and after the coronavirus pendamic.

Fred Muhumuza, an economics lecturer at Makerere University told The Independent that the government needs to come up with various measures to contain the economic impact of coronavirus.

“At the moment, no single measure is able to contain the impact of the pandemic. First, the government needs to ensure that the private sector remains operational. The government need to pay them all their arrears so that they have cash flow and meet their operational expenses,” he said.

“The second measure is ensuring that companies don’t lay off people through reduction in 30% income tax, deferment of NSSF contributions and the government need to spend most of its resources on only most essential items.”

Muhumuza said there’s also need for the banking regulator to lengthen the days for classifying the loan as bad debt. This is premised on the likelihood of businesses and companies facing financial difficulties because they are not able to import finished goods or raw materials to engage in production due to coronavirus.

(This week’s THE INDEPENDENT #CoronaVirus Special Edition is online-only and available to all our readers. Read the other articles in the magazine here –click)

*******

info@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

The measures discussed very commendable but sadly do not go far enough.

What about the ordinary wanainchi?

You can save all the businesses but what about the demand?

Only the USA seems to get this Rescue packaging business almost right (not perfect but best of the rest)

I see this as a once in a lifetime opportunity for Business elites (they own the microphones and newspapers) to milk taxpayers funds.

Sadly this Crisis is still playing out and there are more serious twists ahead, unimaginable today!