Cause of problems

The experts bicker over what is dragging the economy down and what needs to be done to pull it up. The main forces debating this are the politicians led by President Yoweri Museveni, the development partners, the economists at BoU, Ministry of Finance, the World Bank and International Monetary Fund and at Universities.

The development partners aka donors are led by the U.S. Ambassador to Kampala, Deborah Malac, who recently wrote an opinion piece in major newspapers titled “Without health, Uganda cannot achieve wealth”.

Malac wrote: “Building roads, railways, or airlines will not make or keep a population healthy. Hospitals, medicines, and trained health workers will, and these are the investments that should take priority”.

That line was a direct negation of Museveni’s view.

Museveni also differs from all the others because he does not agree that economic growth has stagnated and the danger of recession is real. The others, however, point at the three main economic areas of industry, agriculture, and services that are all not performing optimally.

In the figures for the two quarters of 2016/17 from UBOS, agriculture (which carries a weight of 24.7%) in the computation of GDP numbers grew by -2.2%; industry (with a weight of 17.6%) grew by -0.7% and services (with a weight of 49.1%) positively grew by 2.1%.

In an interview with The Independent on April 4, Chris Ndatira Mukiza, the director for macroeconomic statistics at UBOS first insisted on clarifying his job description.

“My job is to collect data and give it to the planners of the economy to analyse. I am just a lab technician. I don’t do the work of the Ministry of Finance or Bank of Uganda,” he said.

Mukiza then said agriculture was affected by bad weather, industry was hurt by reduced licenses issued for mining and quarrying and reduced supplies from agriculture for processing. The services sector did a bit better because of increased activity in ICT and communication and public administration activities. This sector could have performed even better if finance and insurance had not floundered.

Away from the statistics, however, the economists dig deeper at the underlying causes of the poor performance year after year.

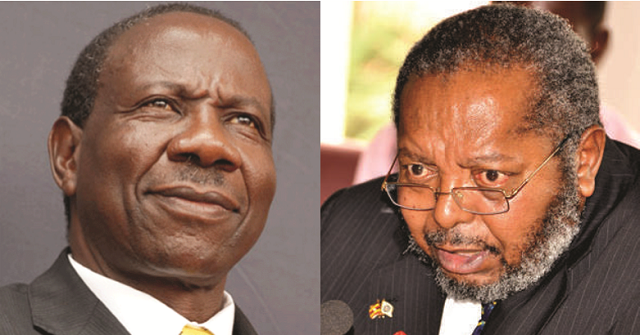

BoU’s Governor Mutebile has previously said the underlying problem is the failure to restructure the economy to strengthen its supply side. Mutebile wants agriculture to be modernised, the population to be managed in such a way that the rate of age-dependence is reduced, and the rate of private sector investment is raised.

But President Museveni, on the other hand, says the poverty numbers are misrepresented by statistical changes in items like the value of the shilling which has been depreciating against the dollar. Museveni says Ugandans might in fact be richer than is measured based on the dollar rate. In terms of what needs to be focused on, Museveni says it should be exports. He says, to achieve higher exports and improve the current account, Uganda must concentrate on building infrastructure; electricity dams, roads, Information Communication Technology (ICT), water supply networks, schools, hospitals and more. He is convinced of long term economic takeoff based on this fiscal stimulus.

As a result of this Museveni view, the budget has recently skewed steeply towards development expenditure. The focus on infrastructure has also meant aggressive borrowing by the government both domestically and externally.

Museveni’s focus on infrastructure worries some economists. It has also meant that the managers of monetary and fiscal policy must work overtime to juggle economic growth targets, macroeconomic discipline, and price stability.

BoU data indicates that the debt burden has risen by 12.7% points to 38.6% of GDP in 2016/17 from 25.9% of GDP in 2012/13 and is projected to continue rising towards 45% of GDP by 2020. Debt as a percentage of revenues has risen by 54 percentage points since 2012 and is expected to exceed 250% by 2018.

This growth in debt numbers, which is discouraged by highly respected international partners for Uganda like the International Monetary Fund prompted Moody’s recent down grade of Uganda’s long-term bond rating by one notch to B2 from B1. This means that Uganda will have to pay more for the short-term non-concessionary debt for which it has developed a high appetite.

Deteriorating debt affordability is also reflected in interest obligations expected to consume almost 16% of revenues by 2018, far exceeding the Moody’s median for B-rated countries of 8%. Moody’s said Uganda’s debt burden has “risen faster than the government’s own resources, resulting in a debt-to-revenue ratio of 236%, one of the highest amongst B-rated sovereigns.”

Uganda’s revenue-to-GDP ratio is 13.4% of GDP versus the median of 23% of GDP for B-rated countries, according to Moody’s.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price