Self-inflicted wounds

Looking at the piling debt and financing obligations, Fred Muhumuza, a development economist and former advisor to the Minister of Finance says instead of throwing money into infrastructure, the government needs to cut both its development and recurrent budget. He says this will give more space to the private sector to access more credit in the financial market.

“Our economy is private sector led and we should not kill that,” he says, adding that more credit extension to the private sector would increase production and productivity, create jobs and more tax revenues to government. Muhumuza says government spending needs to focus mainly in sectors like agriculture that would automatically support economic growth in the short term.

He says government needs to restructure its policy and institutions in a manner that fights corruption and ensures equal service delivery for all.

But Ramathan Ggoobi, a senior lecturer at Makerere University Business School says the government is preoccupied with symptoms of the ailing economy and needs to shift its focus to their real causes. He says official reasons given for the poor economic growth by authorities at Ministry of Finance, Planning and economic Development (MFPED) and Bank of Uganda (BOU), including the global financial crisis and slowdown, exchange rate volatility, drought, and others are symptoms.

“The real causes of our economic hardships are self-inflicted,” he says and lists them: increased political risk and uncertainty since 2006, resurgence of fiscal indiscipline (spending money on consumption and politics instead of production), and governance challenges, particularly corruption.

Ggoobi says countries that have mitigated the above hindering factors and other related bottlenecks (Rwanda, Ethiopia etc.) have seen their economies flourish at a time when countries like Uganda want to blame its woes on global trends.

Going ahead, he says Uganda needs to avoid past mistakes and actions like riots, demonstrations, chaotic elections, police and military guns, walk to work protests, and political defiance activities. He says these are ingredients of economic downturn wherever they happen.

Ggoobi’s workmate, Isaac Nkote, the dean for the Faculty of Commerce at MUBS says the government must deal squarely with the “increasing population and alarming unemployment rates in the country”. He says the government approach of giving cash to youth, women, and vendors is wrong. The money should go to improve and expand already profitable entities which would create more jobs and revenues to government and promote desired growth levels.

Lawrence Bategeka [an economist, Member of Parliament and vice chairperson of the Parliamentary Committee on National Economy] says the focus should be on building the human resource.

In separate interviews with senior economists on matters economy, The Independent noted generally similar answers from all: That the government must address productivity and drive growth by focusing on priorities like domestic resource mobilisation, diversifying the economy by putting major emphasis on key sector drivers for growth, accelerating infrastructure development, taking advantage of bigger regional markets, building capacity for local talent, and building institutions and making them accountable for money spent on service delivery.

The good news is that Museveni appears determined to fight corruption among public officials and increase household incomes through increased and drought resistant agronomy. He has since March been traversing the country and demonstrating hands on improved crop husbandry, including mulching, irrigation, and pest control. The bad news on this front is the farm invasion of army worms which have devastated mainly the maize crop.

Regarding corruption, so far two top officials in the Ministry of Finance and a junior minister have been arrested for allegedly soliciting bribes.

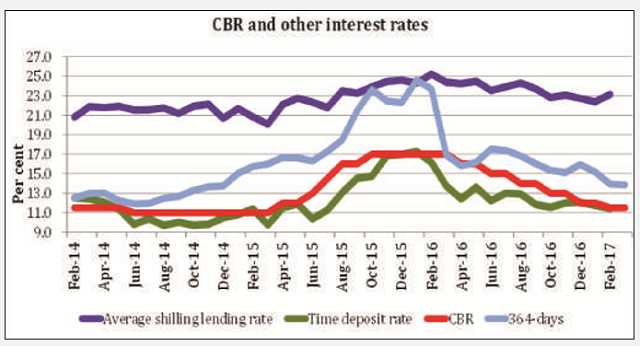

There has also been good news on the private sector credit front with commercial banks lowering lending rates in line with the indicative Central Bank Rate (CBR) which was lowered further in April to 11%. The indicative commercial bank monthly lending rate was 23% (per annum) in March. The lowest it has gone recently was 18% is 2010 and the highest was 28% in 2012. It was 24% at this time last year.

The highest lending rate of 28% in 2012 was caused by BoU’s new inflation targeting lite that shot the CBR to 23%. The aim here was to fight inflation that had touched a 30% mark, the highest since 1993.

The BoU Director for Finance Markets, Stephen Mulema, in an interview with The Independent on April 04 described the trend of interest rate reduction as “good” and a “boost to economic growth in the remaining quarters of this financial year”. But BoU’s optimism is not roundly shared since it has barely nudged private sector credit.

Commercial banks credit to the private sector has grown only marginally over the 12 months to the present from 7.2% in November 2016 to 7.5% in February 2017.

BoU’s monetary policy report (Feb, 2017) shows that slowdown in credit growth was reflected across all sectors with the exception of lending to electricity, water and personal and household loans. The report says the slowdown in growth in PSC was driven largely by provisioning for bad loans, which has heightened risk aversion in banks.

Business people accuse banks of prioritising lending to government at the expense of the private sector. Commercial banks, of course, deny this.

“Our balance sheet is huge,” says Japheth Kato, the Board Chairman for Stanbic Bank, “there is a lot of funding to lend to both government and the private sector.”

But unless the private sector credit numbers improve to spur economic activity, experts say the stagnation witnessed in the last five years, and more dramatically in the first two quarters of the current financial year, is likely to persist. In other words, you are likely to be poorer.

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price