By Patrick Kagenda

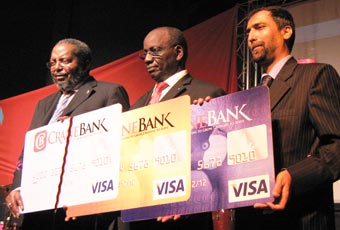

Crane Bank has launched its Visa credit card.

The new card will enable holders to use a small plastic card issued by the bank to pay for goods and services based on a line of credit from the bank as a cash advance. All card holders will receive an instant message as soon as a transaction is completed.

The credit card is different from a debit card which Crane Bank has been offering to its customers.

A debit card is also a plastic card issued by a bank but where funds are withdrawn directly from either the bank account of the customer or from the remaining balance on the card when a transaction is made.

Crane Bank managing director A.R. Kalan said The Crane Visa credit card will be accessed by the retail and corporate customers and the non- bank customers who will be subjected to the bank’s regulations.

“The Crane Visa Credit Card is more flexible than an account number and an overdraft combined because you chose what to buy, where to buy and when to buy,” Kalan said.

The visa credit card can be used at ATM`s, point of sale centers and internet banking.

Crane bank Visa credit card holders will get credit limits of Visa classic, Visa gold and Visa platinum.

Crane bank has established a 24-hour call center to address any card holder complaints that may arise and offer any assistance that may be required.

Jabu Batopo, the head of business development at Visa Kenya representing Sub Sahara Africa said Crane Bank was introducing best-practice international banking.

“Electronic payments not only modernize the economy but provide benefits of safe and secure access to financial services,” he said.

Chairman board of directors at Crane bank Joseph Biribonwa said the introduction of the Crane Visa Credit card will ease access to money by people traveling across boarders.

Central bank governor Tumusime Mutebile said crane bank has linked its customers to a global network which operates in at least 150 countries across the world with 24 million locations.

“The central bank as a regulator of the financial sector fully backs this innovative development and will give necessary support to all financial institutions which actively initiate innovations to financial products that are viewed as a means of deepening the financial sector,” said Mutebile.

He however warned that the Central Bank is mindful that such initiatives usually come along with a wide range of inherent risks which banks should carefully identify, measure and monitor, so that credible mitigation measures are initiated in order to guarantee the safety of depositor’s funds and the soundness of the entire financial system.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price