Low absorption of loans has led to an increase in the cost of loans hence leading to low returns on public investments

Kampala, Uganda | JULIUS BUSINGE | Increasing finance towards the social sectors will improve the livelihoods and incomes of most households as envisaged in the National Development Plan III.

This is the main call that members of Civil Society Budget Advocacy Group (CSBAG) are making to Parliament and government as they finalise preparations on the 2021/22 national budget.

The CSO said during a press conference on Apr.21 in Kampala that as Parliament scrutinizes and debates the budget for FY2021/22, emphasis should be on ensuring that the final budget is people centered and addresses the needs of an ordinary Ugandan.

Peter Eceru and Emmanuel Kashaija, all members of CSBAG said, key sectors of agriculture, health, and education needs priority since they are at the centre of what the ordinary citizen does.

“We have to deal with questions of recovery and health,” Kashaija said. “It does not make sense to invest heavily in security when we cannot smell it [security].”

Eceru also added that parliament should stand with the people as they wither through the COVID-19 crisis.

“We are concerned that heavy amounts are being budgeted for security yet the country is not at war,” he added.

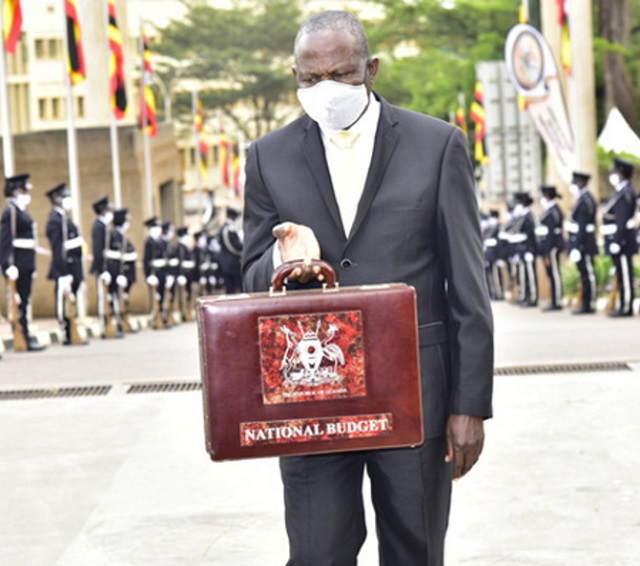

This comes at the time Matia Kasaija, the Minister for Finance, Planning and Economic Development awaits parliament’s approval of next year’s financial budget.

The government proposes to reduce its expenditure from Shs45.4tn in FY2020/21 to Shs41.2tn in FY2021/22.

However, domestic revenue is projected to increase by 16% (Shs3.1tn) – from Shs19.3tn in FY2020/21 to Shs22.4tn in FY2021/22.

Meanwhile, CSBAG members commend government for tabling the different tax bills/amendments for FY2021/22, aimed at expanding the tax base as well as seal various avenues for tax leakages.

They, for instance, commended the government’s proposal to amend section 5 of the Income Tax to require a person earning from rental income to pay for each property separately, a move expected to generate at least Shs341bn.

Cake sharing

Based on the proposals, governance and security programme is expected to get a lion’s share of Shs7.7tn or 18.9% of the proposed national budget, human capital development programme Shs6.8tn or 16.6% of the national budget and the integrated transport infrastructure and services programme Shs3.9tn or 9.7% of the entire budget.

The least funded programmes in the FY2021/22 budget shall include; public sector transformation programme which has been proposed to receive Shs324bn (0.79%), community mind-set change programme, Shs56bn (0.14%).

The group also commends the local government ministry for putting a ban on creation of new administrative units as a measure to tame the raising government expenditure.

The ministry, for example, requires Shs29.8bn to fund the 377 new sub counties that were gazetted in FY2017/18 and Shs80bn for 356 new town councils.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price