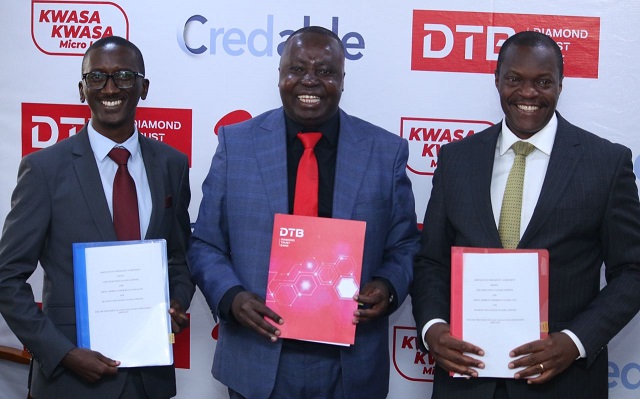

Kampala, Uganda | THE INDEPENDENT | Diamond Trust Bank (DTB) Uganda, Airtel Money, and Credable Group have signed a tripartite agreement to enhance financial inclusion in Uganda with the introduction of a mobile-based consumer banking solution called Kwasa Kwasa.

This collaboration enables Airtel Money customers to instantly access affordable, short-term loans to meet personal and business needs directly from their Airtel Uganda-enabled phones.

Kwasa Kwasa aims to bridge gaps in accessibility for individuals and small businesses that often struggle to obtain traditional bank loans. The service allows Airtel Uganda subscribers to borrow as little as Shs5,000 to a maximum of Shs2m without the need for collateral, addressing a key barrier to financial inclusion. Users can access the service via Airtel’s USSD code 1858*3# or the MyAirtel App.

At the signing ceremony, DTB’s CEO, Godfrey Sebaana, emphasized that the Kwasa Kwasa initiative aligns with Uganda’s financial inclusion goals, targeting underserved populations, particularly in rural areas and informal savings groups. “We are optimistic that Kwasa Kwasa will help us achieve our vision of enabling people to advance with confidence,” said Sebaana.

Japhet Aritho, managing director of Airtel Mobile Commerce Uganda Limited, noted that Airtel Money is committed to expanding access to credit, particularly for those who are underserved by traditional banking institutions. He welcomed DTB and Credable Group’s partnership as a significant step in that direction.

To qualify for the loan, customers must have an active Airtel SIM card, be registered for Airtel Money, and possess a valid National Identification Number (NIN). The loan features a 30-day repayment period with a 9% interest rate and offers flexibility for rollover, giving more Ugandans the opportunity to manage their finances and plan for their futures.

Before the official launch, Sebaana said, they ran a pilot for seven months and disbursed Shs32bn to 500, 000 clients. He said the successful monthly repayment rate was registered at around 64% – which he said was good enough to kick-start the product.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price