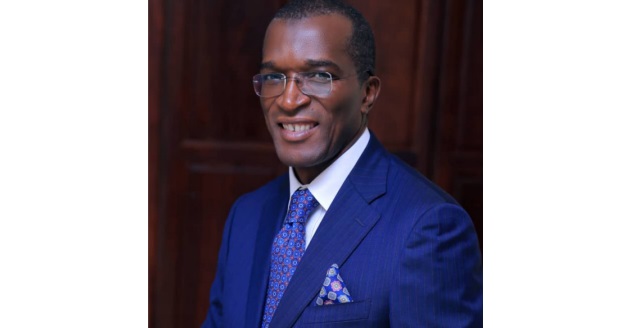

Kampala, Uganda | THE INDEPENDENT | The East African Crude Oil Pipeline secured lead insurers within the country with the approval of the Insurance Regulatory Authority-IRA. The IRA Chief Executive Officer, Alhaj Kaddunabbi Ibrahim Lubega told journalists in Kampala that the insurance question around the project was already resolved.

While there have been global campaigns urging international Insurance firms from insuring the project, Lubega revealed that EACOP has been insured by Insurance Consortium for Oil and Gas in Uganda (ICOGU). According to Lubega, ICOGU has begun underwriting the oil and gas projects in the Albertine including the pipeline from Uganda to the Port of Tanga in Tanzania.

“We have policies on the pipeline, on Tilenga, on Kingfisher and this gives us hope moving forward,” said Lubega. The revelation by the Authority contradicts a Financial Times report in mid-May indicating that American Insurance Giant Marsh McLennan had bid for and won the contract to find insurers for the East African Crude Oil Pipeline project.

However, according to IRA, one of the members of the Insurance Consortium for Oil and Gas in Uganda has been selected as the lead underwriter. The Authority’s Manager in charge of Regulation, Steven Kaddu Mukasa remained guarded when pressed to reveal the name of the purported lead underwriter from Uganda.

He insisted that the local insurance industry has taken up the risk and that their policies are under review. “And we have seen the participants because it is a consortium, we have seen the participants take up the shares that they are to take up,” said Mukasa

The global campaign against EACOP has sent banks, insurance companies, and brokers into secrecy about the oil and gas projects in Uganda. According to Mukasa, the leader of the consortium will take care of the underwriting processes and will be in charge of documentation, and will share it with other participants in the consortium.

“So I want to confirm that there is a consortium. And the arrangement has been approved by IRA,” said Mukasa in March 2019. The Insurance Regulatory Authority 2019 issued the Uganda oil and gas co-insurance consortium guidelines to guide local insurers seeking to take up jobs in the oil and gas sector.

It is anticipated that under a consortium, local insurers will be able to pool financial and technical capacity to participate in the underwriting of oil and gas risks. While the local insurers under the consortium may be able to underwrite aspects of the oil and gas projects, some of the experienced players in the insurance industry have maintained that there will still be a need to attract foreign insurance firms.

CEO of Minet Uganda, Maurice Amogola has previously indicated to URN that the risk being retained locally will be quite small in terms of the value within the oil and gas industry. Other experts have suggested that the limited number of reinsurance firms in Uganda may further limit the share of the risk to be retained in Uganda. According to the Ministry of Finance, there were only two local reinsurance firms in Uganda.

There were also plans to allow Kenya Reinsurance in the Uganda market to underwrite the reinsurance business and thereby retain within the region. While Alhaj Kaddunabbi agrees that Uganda has only two reinsurance operators, he told journalists that part of the value of the risk will be retained locally.

“The way insurance works, you avoid concentration of the risk in any market. In view of the numbers, we are looking at in the oil and gas, we don’t expect it to concentrate in any country. Many countries are going to be taking part in the premiums that are coming from oil and gas,” said Lubega.

He said it is a trend globally that there is no economy that underwrites its big risks like oil and gas. “And this is our role as the regulator to ensure that whoever underwrites, only retains what I within his capacity,” he added.

He noted that other than two reinsurance firms in Uganda, there is also Zepri or PTA Reinsurance Corporation and Africa Reinsurance Corporation, which are also taken as local reinsurance firms. “So when you have four reinsurance companies operating peacefully in your market, that is a good number,” Amogola said.

Unlike co-insurance where several insurance companies come together to issue one single risk, reinsurers are typically the insurers of the last resort. The insurance business is based on laws of probability which presupposes that only a fraction of the policies issued would result in claims.

As a result, the total sum insured by an insurance company would be several times its net worth. It is based on this same probability of loss that insurance companies fix the insurance premium. The premiums are fixed in such a manner that the total premium collected would be enough to pay for the total claims incurred after providing for expenses.

*****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price