By Independent team

Experts say Uganda assets undervalued

Government to state position on Tullow in January

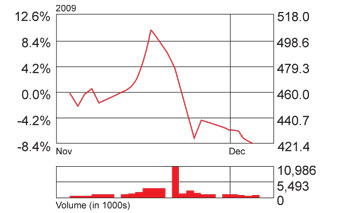

After an initial surge on speculation that its Ugandan assets may fetch a higher price than Eni had offered, Heritage Oil shares on the London Stock Exchange settled lower.

Heritage, run by Tony Buckingham, a former mercentary, signed a letter of intent last month to sell its share of the fields to Eni for US$1.35 billion plus a payment of as much as US$150 million within two years.

Heritage shares had surged as much as 4.6 percent in London trading in early December before erasing gains to close 0.4 percent lower at 431.6 pence.

But the shares fell 4.7 percent on the day Eni announced the deal, as analysts said the sale price undervalued the potential of the Lake Albert assets.

Tullow and Heritage are equal partners in Blocks 1 and 3A in Uganda’s Lake Albert.

Heritage has spent US$150 million drilling six wells in its two 50 percent-owned blocks there — 1 and 3A.

Tullow is also marketing its assets in Uganda’s Lake Albert and said in October that Uganda had approved an initial list of companies interested in bidding for stakes. It expects to announce a partner early next year.

According to reports by Bloomberg and other news agencies, After Eni announced on November 23 that it had signed a letter of intent with Heritage to buy its share, Tullow countered that it was “seriously considering†invoking its pre-emption rights to buy Tullow’s share.

Such an arrangement would mean that Tullow either matches or exceeds Eni’s offer to Heritage of US$1.5 billion.

“We would consider exercising pre-emption rights and, in the event that was successful, we would then go through a farm- out for all the assets,†Brian Glover, Tullow’s manager for Uganda, is quoted to have told Bloomberg in a phone interview, “We see Uganda as one of our key countries for future investment.â€

Oil companies are competing for new reserves in Africa to make up for dwindling resources and restricted access in other parts of the world. Eni is aiming to increase its reserves and make up for output cuts from disruptions in Nigeria.

Eni’s Chief Executive Officer Paolo Scaroni acknowledged that there are “some obstacles†standing in the way of the deal with Heritage.

“Heritage should see if there are offers that are better than ours,†Scaroni told reporters in Rome. “The government of the country where the assets are must agree on the sale,†he said, predicting that this would happen by January.

Up to 2 billion barrels of oil have been discovered by various explorers and around 1.5 billion barrels are still to be discovered in the Lake Albert Rift Basin, according to Tullow estimates. Heritage’s share of discoveries there amounts to 300 million barrels of oil.

Challenges like the absence of oil development and export infrastructure remain over its exploitation.

If Tullow exercised its right of pre-emption and effectively retained 100 percent of finds it now shares with Heritage, it would have to find up to US 4 billion to exploit them. Eni has said that it is not interested in bidding for Tullow’s Ugandan assets.

Tullow and the government have said they plan to build a mini-refinery producing between 5,000 and 10,000 barrels a day in Uganda by 2012, thermal power plant, and roads.

There are also plans to construct an oil pipeline and improve the rail system to export crude through Mombasa Kenya.

Heritage has been seeking investors to help build a pipeline from Uganda to the coast of Kenya to export crude from projects with Tullow.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price