Looming project will promote financial inclusion and economic prosperity

Kampala, Uganda | JULIUS BUSINGE | Financial institutions are carrying out a study to inform potential investors about the viability of doing business in refugee settlement areas and host communities.

Equity Bank, Financial Sector Deepening Africa, Financial Sector Deepening Uganda and BFA Global launched the study in Kampala on March 21. The other partners are Vision Fund Uganda, a microfinance subsidiary of World Vision and Rural Finance Initiative (RFI).

The study will track the income and spending habits of refugees to improve the products and services financial service providers deliver to refugees countrywide.

Executives in the organisations said through the study, refugees living in Bidi Bidi, Palorinya and Nakivale, will be engaged in the next 12 months to create a detailed picture of the financial strategies employed by refugees to build their livelihoods and manage their finances.

FSDU will use this information to enhance the development of financial sector products and services offered to refugees in Uganda. Equity Bank Uganda Limited, Vision Fund Uganda and Rural Finance Initiative are the institutions already active in these refugee settlements.

The study is being conducted as part of the Financial Inclusion for Refugees (FI4R) project spearheaded by FSDU.

Overall, executives said the study will provide evidence, technical support and grants to financial service providers and regulators to develop and deliver relevant formal financial services for refugees.

It will also reduce vulnerability for 400, 000 low income refugees and hosts. In addition, it is also intended to demonstrate refugees as an economically, viable market for financial service providers.

In an interview, Anthony Kituuka, the executive director at Equity Bank said the bank’s move to refugee settlements is informed by the bank’s main purpose of transforming the lives and livelihoods of people

socially and economically.

He said expanding opportunities would usher in wealth creation for the beneficiaries. “Everybody has a right to keep their money in a safe location and take advantage of that money to exploit opportunities,” he told The Independent.

Kituuka said that through their pilot project conducted in these settlements in November and December last year, they were able to realize that the economic potential in these areas is big. He said the bank made payments amounting to Shs2.5billion using electronic and other payment systems.

Kituuka said they have been able to provide electronic cards to several refugees as one way of promoting cashless transactions.

“Refugees are human,” he said, “We want to empower them with financial services to improve their livelihoods,” he added.

He said the lender’s future plan is to have more agent bankers in the settlements, and to help individuals open bank accounts and be able to transact from their mobile money wallets, mastercards and bank accounts without necessarily touching cash.

Juliet Tumuzoire, the head of financial services at FSDU, said in addition to evaluating the impact of financial services on refugee livelihoods in Uganda, the project could provide insights that have implications in the region.

Uganda hosts one of the world’s largest population of refugees, with the UN estimating that there are about 1.4 million refugees currently residing in the country.

Tumuzoire said that with the right services such as mobile money and savings groups, refugees can often generate enough income to support themselves and their families but also contribute positively to economic growth.

Simon Menhya, the acting commissioner for refugees in the Office of the Prime Minister said the challenges that governments throughout the world are dealing with when responding to humanitarian crises are evolving very quickly.

He said while provision of basic aid remains important, enabling refugees to access relevant services, including formal financial services, has the potential to help coordinate humanitarian efforts more effectively and increase the impact of early stage interventions.

Rashmi Pillai, the executive director for FSD Uganda said in a media statement that forcibly displaced people remain one of the most vulnerable groups in Uganda, and that they continue to remain underserved by financial service providers.

“Access to relevant financial tools will ensure that refugees are able to integrate with host communities,” Pillai said.

The findings of the study will inform the next course of action by different partnering agencies. For instance, Equity Bank will provide refugees with fully-fledged bank accounts from which to access their humanitarian aid payments.

Kituuka said they will set up an enabling infrastructure for cash-outs by extending their existing agent banking network to refugee settlements and within host communities.

Vision Fund Uganda will boost the availability of credit for savings group members, allowing them to invest in income generating activities including agriculture and trade to boost household incomes in refugee and host communities in the region.

The Rural Finance Initiative (RUFI), will provide refugees with a combination of savings and lending products.

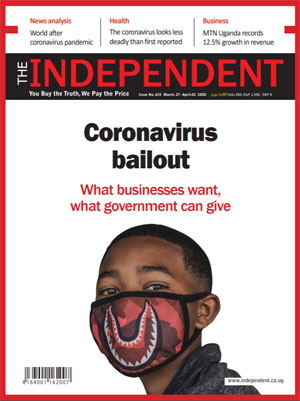

(This week’s THE INDEPENDENT #CoronaVirus Special Edition is online-only and available to all our readers. Read the other articles in the magazine here –click)

*******

info@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price