Equity Bank Uganda and FITSPA Strengthen Digital Financial Inclusion through Fintech Collaboration

Kampala, Uganda | THE INDEPENDENT | Gift Shoko, Managing Director of Equity Bank Uganda, has re-affirmed that the future of banking is not just about banks but more about strategic partnerships and shared infrastructure with FinTechs to provide seamless banking experiences.

“Equity Bank sees FinTechs not just as clients but as partners in driving financial inclusion, fostering innovation and creating efficiencies for businesses and communities across Africa,” he said.

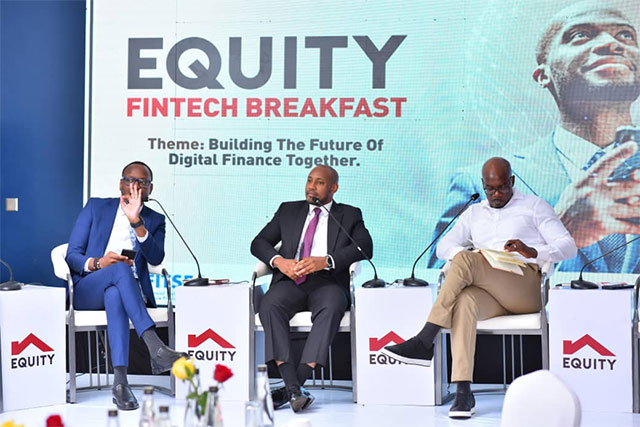

This was last Friday when Equity Bank Uganda in collaboration with the Financial Technologies Service Providers Association (FITSPA) successfully hosted an exclusive Fintech Engagement Breakfast at Golden Tulip Hotel, Kampala.

The event brought together key players from Uganda’s dynamic financial technology ecosystem including; fintech innovators, regulatory authorities such as the Bank of Uganda (BOU), Uganda Microfinance Regulatory Authority (UMRA), Capital Markets Authority (CMA), Financial Intelligence Authority (FIA) and the National Information Technology Authority (NITA).

“Equity Bank is not just account holders, we are here to be your infrastructure partners. We are opening our banking rails, APIs and payment systems so FinTechs can build on them, scale their operations, and drive financial inclusion, innovation, and efficiencies across Uganda and beyond,” said Shoko.

The engagement provided a platform for FinTech’s to explore opportunities for collaboration, address industry challenges and unlock new digital solutions provided by Equity Bank Uganda that will accelerate financial deepening and financial inclusion in Uganda.

Equity Bank Uganda, a platinum member of FITSPA since May 2023, continues to champion fintech-driven financial solutions, offering tailored banking products that cater to the unique needs of fintech enterprises.

The bank’s technology stack, integration frameworks and strategic partnerships are designed to provide FinTech’s with the tools they need to scale their services effectively.

FITSPA plays a pivotal role in shaping Uganda’s fintech landscape by advocating for a supportive regulatory environment and facilitating industry-wide collaboration.

Doreen Lukandwa, Vice Chairperson at Fitspa Uganda emphasized the importance of partnerships in driving financial inclusion:

“The future of digital finance is about working together, not alone. Equity Bank Uganda and Fintechs are joining forces to create better solutions and drive financial inclusion,” said Doreen Lukandwa.

“Equity Bank offers strong networks, and Fintechs bring innovation. By partnering, we can solve key challenges and grow digital finance in Uganda,” Lukandwa added.

Johnson Galabuzi, Head of Personal Banking at Equity Bank highlighted how Equity Bank empowers businesses and individuals through tailored financial solutions including; overdrafts, digital financing, business and agricultural support, savings and investment options, salary and personal loans and seamless mobile banking services.

“At Equity Bank, we focus on helping our customers grow and stay stable financially. Whether you are a business owner needing overdraft support, an entrepreneur using digital funds, or someone looking for smart savings and investment options, we have the right solutions for you,” said Galabuzi.

James Sserumaga, Head of Bancassurance at Equity Bank, highlighted the growing connection between technology and financial services, emphasizing the vast opportunities for FinTech’s and businesses to leverage integrated systems..

He also addressed the challenges faced by business owners, particularly in relation to complex risks such as cyber threats and payment failures.

He stressed the need for collaborative solutions that understand these risks and provide comprehensive coverage:

“Equity Bank Uganda invites you to collaborate, let’s build a framework to cover our exposures. Cyber and commercial risks are high and our processes and platforms need protection. Few meet cyber requirements alone. Together, we can create a fallback position,” Sserumaga said.

The event underscored the need for seamless integration between banks and FinTech’s to expand digital payment services, enhance cross-border transactions and develop innovative financial solutions tailored to the needs of Ugandans.

Equity Bank Uganda also highlighted revenue opportunities for FinTech’s including mobile money partnerships, forex services and co-branded financial products.

An official said that with over 50 branches, 8,000+ Equi-Duukas, 2,420 POS terminals and digital banking solutions like; Eazzy247, Equity Bank continues to lead the charge in deepening financial accessibility across Uganda.

“As Uganda’s FinTech sector grows, Equity Bank and FITSPA have re-affirmed their dedication to promoting an ecosystem where technology empowers businesses, individuals and communities to participate in a more inclusive financial future for Ugandans,” the official said.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price