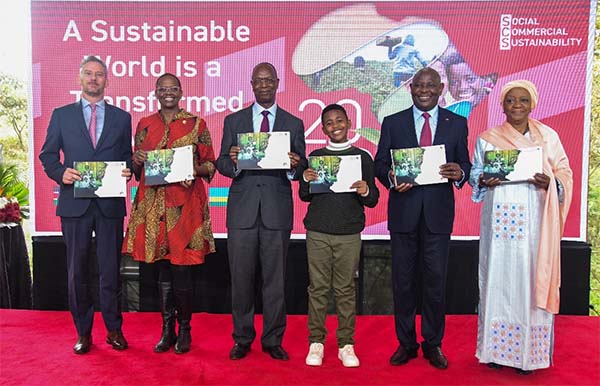

Nairobi, Kenya | THE INDEPENDENT | Equity Group has unveiled its third annual sustainability report for the year 2023, themed “A sustainable world is a transformed Africa.” The theme points to the significant role that global substantiality practices can have on transformation of the African continent, a challenge that Equity Group has undertaken to lead.

This landmark report exemplifies Equity’s unwavering commitment to socio-economic and environmental transformation across its entire business. It showcases Equity’s dedication to sustainable business practices and the integration of Environmental, Social, and Governance (ESG) aspirations into core operations including the integration of the Task Force for Nature Related Finance Disclosures as a new focus beyond climate risk management.

In the report, Equity Group stresses that their sustainability approach comprises three main components.

First, the promotion of environmentally friendly business operations, including energy efficiency, water and waste reduction practices in their offices and branches.

Second, Equity Bank commits to the continuous improvement of their business approach and market offerings to ensure they reflect best practices for Environmental, Social, and Governance (ESG) criteria.

This includes offering sustainable finance, credit and investment products as well as continuing our long-standing practice of promoting financial inclusion, maintaining stringent ethical standards for all our operations and being a responsible employer.

Third, the bank recognises that deepening sustainability cannot be achieved by any single institution. Equity’s strategic ambition envisioned in the Group’s Africa Recovery and Resilience Plan (ARRP) which aims to achieve long term transformation of the continent, requires the support and participation of diverse stakeholders.

That is why the group are intentionally pursuing partnerships and collaborations with other stakeholders, including development finance institutions, governments, development partners, industry bodies, commercial entities, and our customers, with the aim of fostering positive collective action. These valuable strategic partnerships with Development Finance Institutions (DFIs) and social institutions have enabled them to deliver a wide variety of social and commercial outcomes

Speaking during the unveiling of the report, Equity Group Managing Director and CEO, Dr. James Mwangi, stated, “Today, our business model encompasses a tri-engine approach with an economic focus, a social focus, and a nature, and environmental focus, all working to achieve positive impact. We have not only applied our efforts to realizing social impact, but also have a strong focus on environmental and nature stewardship, promoted through an intentional approach to addressing our own footprint and imparting knowledge to de-risk and empower our broader ecosystem. Additionally, we understand that a sustainable future requires mindful consideration of our impact on the planet, and this report demonstrates how Equity is leading the charge in this effort.”

The 2023 sustainability report unpacks how Equity is walking the talk within its business operations across the seven markets it runs offices in; Kenya, Uganda, Tanzania, South Sudan, Rwanda, DRC and in Ethiopia where it operates a representative office as it aims to deepen environmental stewardship.

The comprehensive report encompasses the entirety of Equity Group, comprising Equity Group Holdings Plc, alongside its esteemed banking subsidiaries in Kenya, the Democratic Republic of the Congo (DRC), Uganda, Rwanda, South Sudan, and Tanzania. Additionally, it includes the Representative Office in Ethiopia, the Equity Group Foundation (EGF), and the subsidiaries Equity Investment Bank, Equity Bancassurance Intermediary Limited, Finserve Africa Limited, Finserve Africa Trustees Limited, Equity Life Assurance (Kenya) Limited, and Equity Group Insurance Holdings Limited.

The 2023 Sustainability Report epitomizes Equity Group’s proactive approach to driving positive change in society and continues to attract global accolades with Brand Finance ranking the Bank as the Second Strongest Banking Brand in the World and as the Most Valuable Brand in East and Central Africa.

In addition, the International Finance Corporation (IFC) ranked the Group as the global leader with the highest number of climate-related transactions among 258 financial institutions worldwide. The Group also earned the recognition of Euromoney as the Best Bank for Corporate Social Responsibility in Africa for 2 years running.

Baraka Moruri, the Little Mr. Environment Kenya 2023 said, “I started my journey a few years ago and so far I have been able to plant 7,900 trees. The support I have received from my school and my society is pushing me forward. Let’s just not plant trees, let’s also nurture them until they are able to stand by themselves.”

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price