The groundbreaking insurance plan, first of its kind on the Uganda market aims to alleviate the financial burden that comes after hospitalization, ensuring that families can focus on recovery rather than worrying about expenses.

Kampala, Uganda | THE INDEPENDENT | Equity Bank Uganda has in partnership with Liberty Life Assurance launched an affordable hospital cash insurance product called Equi-Life that will enhance financial security and healthcare access for its customers and the general public.

“We recognize the challenge faced by individuals especially those in the informal sector when it comes to unexpected expenses associated with hospitalization. The Equi-Life insurance product offers a safety net to protect our customers, and it will provide critical financial relief for their families,” said Equity Bank Managing Director Gift Shoko at the launch at Sheraton Hotel today.

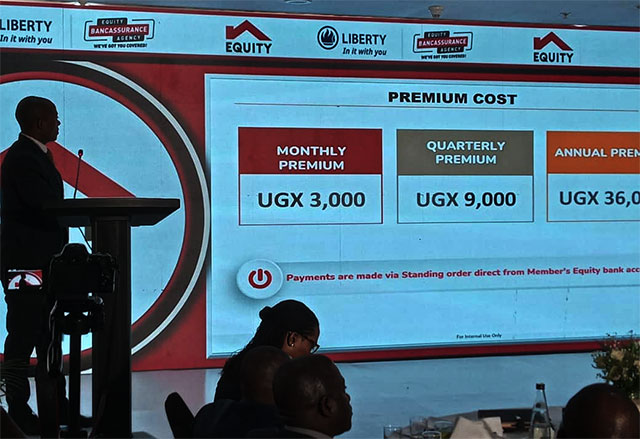

The new insurance product allows customers to pay as little as sh3000 per month, securing coverage for up to 20 days of hospitalization after discharge, and a death benefit (Mabugo) of up to sh3,000,000. The groundbreaking insurance plan, first of its kind on the Uganda market according to Gift Shoko, aims to alleviate the financial burden that comes after hospitalization, ensuring that families can focus on recovery rather than worrying about expenses.

Shoko pointed out the Bank’s commitment to providing integrated financial services that not only bring business success but also give dignity and transform the lives of its customers.

Liberty Life Assurance also reaffirmed its dedication to providing accessible and meaningful insurance solutions.

“Liberty Life Assurance is proud to collaborate with Equity Bank to introduce a product that truly meets the needs of the underserved. Hospital cash insurance ensures that customers can access financial support when they need it the most,” said Joseph Alimeida, Managing Director Liberty Life Assurance.

Customers who enroll in the scheme will receive a daily cash benefit of sh50,000 for every day spent in the hospital, up to 20 days on hospitalization, easing the burden of lost income and medical bills after discharge from hospital. In addition, the policy includes a death benefit to provide further security to beneficiaries.

We are excited & honored to have the talented @IamVinka sign on as the official brand ambassador for our #EquiLife insurance product.

During the official media launch, @IamVinka shared her excitement for coming on board saying,

“I know the #EquiLife product is going to… pic.twitter.com/5P4oSYhEIM

— Equity Bank Uganda (@UgEquityBank) April 3, 2025

The Equi-Life insurance product is designed for individuals in the informal sector, small business owners and low-income earners to support them with expenses after hospitalizations, during their recovery process.

With healthcare risks and costs on the rise, this innovative partnership between Equity Bank and Liberty Life Assurance is a timely intervention to support financial well-being among Uganda’s micro-level earners, experts said. Customers can sign up for Equi-Life product at any Equity Bank EquiDuuka or at the nearest Equity Bank branch.

According to officials, enrolling is simple; existing customers or a new customer can enroll from any of the EquiDuuka Agent by filling a single form. Customers can also make their monthly payments at any Equity Bank Agent points.

“This partnership will build the financial resilience of our customers & millions of Ugandans & together we can create a Uganda where every hardworking person is protected & empowered.

And as @turaco_insure our promise is to make sure that there is no long waiting period for… pic.twitter.com/o2inJLcbL2

— Equity Bank Uganda (@UgEquityBank) April 3, 2025

What they said

“What happens when the hustler of the family in Uganda falls sick? What happens to his business when he falls sick?”. This was a guiding question when the sector leaders put their heads together to come out with Equi-life.

The three partners stressed that Equi-Life insurance is designed for individuals in the informal sector, small business owners and low income earners to support them with expenses after hospitalization.

This ground breaking Insurance plan on the Ugandan market will alleviate the financial burden that comes after hospitalisation ensuring families can focus on recovery than expenses

“When the hustler falls sick and can’t work, it takes a toll on the business, so we thought of a product that is affordable and sustainable for the everyday person that provide for themselves and their family on a day to day basis. This solution reflects our partners’ commitment to Uganda’s hustlers, the backbone of our economy, we’ve designed this product to address two key needs: healthcare access during hospitalization and livelihood protection in case of death,” said Equity Bank MD Gift Shoko.

Joseph Alimeida, Managing Director Liberty Life Assurance, added that “We conducted research to understand what people need when facing life’s issues, and surprisingly, 70% of respondents cited health concerns as their top struggle. When you make financial freedom possible for people who are hustling in life, it is a very positive thing because you are alleviating that burden of medical bills from them.”

Cedrick A. Todwell, Director Business Development Turaco, said “Insurance penetration is low due to optimistic bias, but this partnership aims to build financial resilience for Ugandans. “We promise swift claim processing for the Equi-Life product.”

Rising music star Victoria Nakiyingi aka IamVinka is the brand face of Equi-life. She said, “I know the Equi-Life product is going to transform not just my life, but the lives of Equity bank customers and I can’t wait to use my influence to spread the word and get people to sign up for this amazing product. Let’s do this!”

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Hey,past insurance products have been this good but insurance companies have proved too smart to trust when it comes to honoring their commitment as detailed in the policies . Without naming any ,this resulted in loosing trust in the insurance schemes that only operated well when many of us subscribe to it rather than a few. How will equity ,my trusted banker for over 20yrs , avoid getting trapped in scams that have made me lose trust in insurance companies?