Museveni intervenes

On Oct.10, President Museveni intervened first with a meeting with Finance Minister Matia Kasaija. It appears Kasaija saw it as too tall an order for him.

The President then directed the Prime Minister, Dr. Ruhakana Rugunda to handle the matter. Ruganda convened a crisis meeting at his office. In attendance was State Minister for Planning David Bahati, who represented Kasaija; BoU’s Justine Bagyenda, who represented Governor Tumusiime-Mutebiile; and Crane Bank bosses; Sudhir Ruparelia, Alex Rezida (board member), and P.K Gupta, the acting MD.

At this meeting, Sudhir asked Dr. Rugunda if it was possible for the government to offer him an emergency bail-out loan to recapitalise the bank. Sorry, the government does not have money, Sudhir was told. In effect, the meeting ended without any concrete way forward for Sudhir and his embattled bank.

“I came to this meeting with nothing and I have left with nothing,” the crest-fallen Sudhir reportedly remarked as he left the meeting.

However, the behind-the-scenes negotiations did not stop. On Oct. 12, Central bank bosses, obviously under more pressure, called Sudhir, saying they were willing to lend him money but on condition that he offers substantial security.

Another meeting was hastily convened with Sudhir, Secretary to the Treasury Keith Muhakanizi, and Bagyenda and Bank Governor Tumusiime Mutebile. At this meeting, Muhakanizi said the government was indebted to Sudhir to the tune of $4 million (about Shs 13.5 billion), which it was willing to pay up for the tycoon to save his bank. But it was too late.

It was at this point that messages started emerging on social media calling on people to withdraw their cash from the embattled bank.

As the social media storm on whatsapp, Facebook and Twitter picked steam, the queues of panicking customers lining up to withdraw their cash started growing longer.

On Monday Oct. 17, another crisis meeting was convened. In attendance were Finance Minister Matia Kasaija, BoU Governor Mutebile, and his Deputy Louis Kasekende. Only days before the Monday meeting, on Saturday to be exact, Crane Bank had hit the lowest ebb – failing to honour its customers. During the Monday meeting, Sudhir told the BoU bosses to their face that they had hamstrung him for three months.

Barely two weeks earlier, reports had emerged in the media that Sudhir was in negotiations with a strategic investor to buy the bank. Indeed, international banking investor, Atlas Mara had formally given Crane Bank up to Oct.31 as the deadline for their transaction to be finalised. Before that, Sudhir was not supposed to negotiate with any other investor. Atlas Mara had offered to buy the bank at $215 million. Sudhir was holding out for $320 million. Several months earlier, he had been offered $400 million by Credit Suisse to take over the bank. He declined the offer. Now, he was kicking himself for not taking the offer.

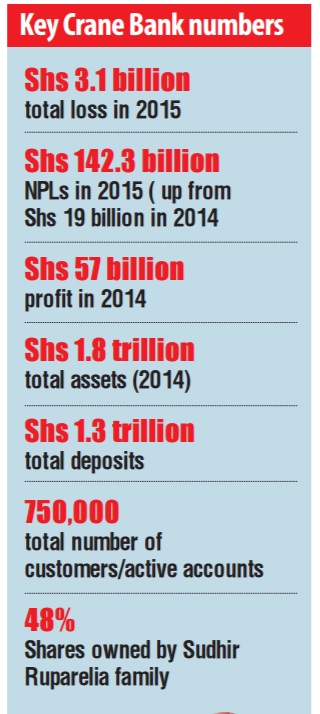

But as the negotiations between the investor and BoU were going on, the bank’s liquidity woes were getting from bad to worse. The bank needed Shs 500 billion to re-capitalize. But it could not be raised on short notice. Even the $4 million that the government was offering was a mere bucket in an ocean. At this point, it was as if Sudhir had already given up spiritually on the bank.

By the time the final meeting was held on Oct.18, there was an insurmountable mountain to move. BoU couldn’t find Shs 500 billion to lend to one bank. Even if it had it, it is illegal to give it out just like that.

The only option available for the Central bank was to issue a Shs 400 billion bond on behalf of the government. However, this was a very tall order also as it would require Parliamentary approval in accordance with the Finance Management Act. But there was problem; Parliament was on recess. It would thus take a number of days to pull it off. It was a dead end. Yet, the liquidity hemorrhage was only getting worse by the hour. Finally on Oct.20, the BoU chiefs had no choice but to announce that they had suspended the Crane Bank board, the acting MD and put the bank under statutory management.

Long road ahead

Indeed, while Sudhir and his managers made mistakes, with hindsight, analysts say BoU also made its own blunderes. Why didn’t they take over the bank earlier? They say BoU created uncertainty by stopping Crane Bank from transacting to generate revenue while allowing it to remain operational. Why force the bank to continue incurring heavy overhead costs yet it was not generating revenue?

Given that Crane Bank is one of the three Domestic Systemically Important Banks (D-SIBs), along with Stanbic and Standard Chartered, the BoU chiefs knew that the well-being of these banks was crucial to the stability of the financial system. So they could have acted negligently in their handling of Crane Bank over the past three months.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

It`s a pity. failure like this is ususallly never down to only 1 reason, but to a number of reasons that present themselves in quick succession. It was a beacon to indigenous banking.

This is sad but we believe God for much better in the banking sector and an elevation in our economy.