URA at 25: Experts salute URA but warn of a mountain to climb to lift tax:GDP ratio from miserable 12%

On September 20, Uganda Revenue Authority (URA) across the country replaced their shirts and tops with T-shirts inscribed with the words: “Believe there is good in the world” and headed for the streets. The mission was not to collect taxes but to ‘give back’ to their community. The employees contributed their own money and identified communities that would benefit from their voluntary work and generosity. Some painted Zebra Crossing points, donated to hospital patients, visited babies’ homes and cleaned markets in addition to cleaning hospitals, and handing out goodies to the needy and traffic policemen. This CSR activity, one of the many as the revenue body marks 25 years of existence, was symbolic of how far URA has come. In the past, the public knew tax collectors as a corrupt and avaricious bunch whose only interest was self-enrichment through extortion and stealing taxes. That is the image URA had for the better part of its 25-year existence.

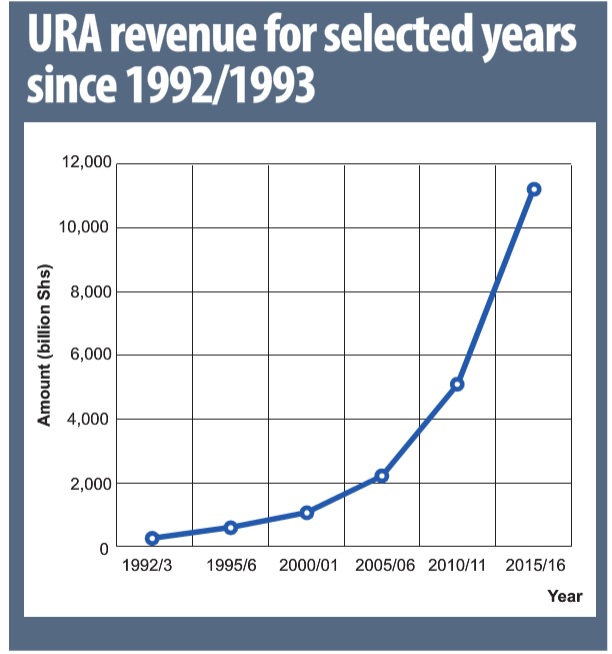

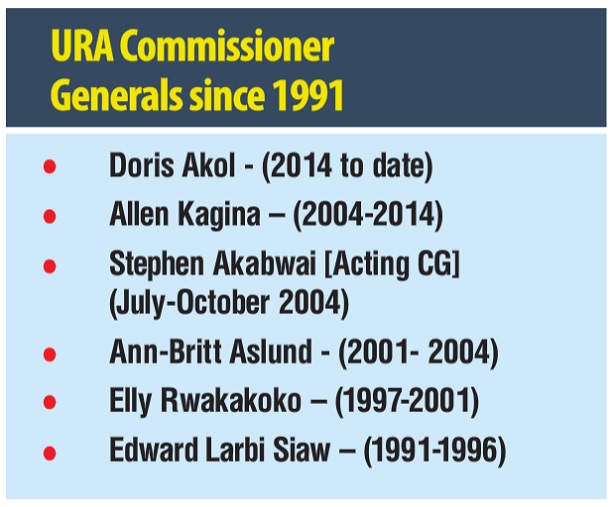

But just over ten years ago – in 2004 to be precise, Allen Kagina was appointed commissioner general and with a resolution to change the public image of URA, took the bulls by the horns with her dedicated and highly qualified team. The transformation has been phenomenal as the tax body has in just over a decade managed to win over the hearts and minds of tax payers in particular and the public in general. Today, if there has been any government institution that has made great strides in contributing to national development, URA is in a class of its own. Not only has it almost multiplied tenfold the revenue collected since 1991, it has also re-defined the way business is done in Uganda. From a paltry Shs 180 billion in 1991, tax revenue currents stands at Shs 11,230.8 billion. Consequently, URA is now a continental model for excellence and keeps hosting delegations from around the world who seek to benchmark from its experience. URA is indeed the top performer in the EAC region where all the tax bodies are integrated.

Smuggling, which used to be a huge leakage on the revenues, has been contained, and tax education campaigns have demystified taxation. It has also gone high-tech and most of its transactions and interactions with clients are online further making life easier for the taxpayers and closing loopholes for corruption. The re-branded URA has consequently attracted several high profile donors who have injected millions of dollars into its systems. Today, more than 70% of the national budget is financed by tax revenue compared to only 10% in 1991.

The e-tax payment system has simplified tax-payment procedures while the introduction of the Electronic Cargo Tracking System (ECTS), which enables electronic monitoring of cargo in transit and is designed to ensure that cargo is not diverted, has also been a revolution. It consists of an electronic seal, which is monitored by cargo owners, transporters and customs agents. It can be accessed online and allows cargo owners and customs agents to get real time information on the location of the cargo.

The creation of a Single Customs Territory has generating remarkable results. Under the system, goods are cleared at the port of entry. As a result, the average time for goods to move from Mombasa Port to Kampala dropped from 18 to four days.

Sarah Banage, the URA assistant commissioner for corporate and public affairs, says massive taxpayer education campaigns – a high priority activity at URA – is one of a number of approaches that they are using to win over the public and other stakeholders.

Also, URA has put much emphasis on developing capacity through building a professional a well-motivated workforce supported by high-tech ICT systems and platforms.

Gideon Badagawa, the executive director of the Private Sector Foundation Uganda (PSFU), is full of praises for the tax body despite the intermittent revenue shortfalls in recent years. “They are doing a good job despite the shortfalls in revenue collection, which are not of their making but a result of the economic situation because the tax base is very weak today,” he says.

“What is needed is to further strengthen tax education to address compliance and the law. However URA`s biggest challenge today are the big people who are not paying taxes and its lack of increasing the formal economy.”

Stephen Kaboyo, the managing partner of Alpha Capital Partners, an investment advisory firm, also commends URA a job well done and the reforms in tax administration, which he says have played a key role in improving the country’s revenue mobilization efforts but it still has a high mountain to climb as taxation has not reached optimal level, tax to GDP ratio is just a little over 12% – the lowest among Uganda’s peers – the tax base remains narrow, which leads to high taxation of a few people, which breeds tax evasion.

“The slow tax revenue growth means that we should not expect fiscal consolidation soon and the fiscal deficit will take longer to shrink and of course fiscal capacity is a major constraint to economic growth. Going forward, URA must continue to modernize tax administration systems and make it responsive to the demands of a growing economy,” he says.

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price