Kampala, Uganda | THE INDEPENDENT | Officials from the Privatization Unit on Thursday failed to prove to parliament’s Public Accounts Committee (PAC) over the non-payment of salary-related taxes to a tune of 6.4 billion Shillings.

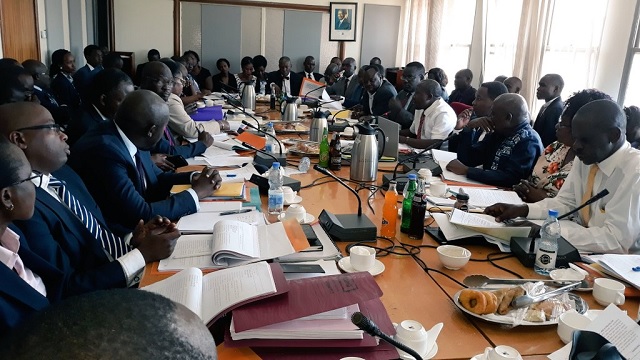

Led by Finance Ministry Under-Secretary Betty Kasimbazi, the officials and others appeared before the committee chaired by Budadiri West MP Nathan Nandala Mafabi to answer to audit queries raised in the Auditor General’s report for June 2018.

In the report, Auditor General John Muwanga noted the escalating outstanding commitments under the Privatization and Utility Sector Reform Project (Operations Account) that has increased from 4.81 billion at close of the financial year 2016/2017 to 6.43 billion shillings as at 30th June 2018.

He reported that the bulk of the outstanding commitments relates to unpaid taxes in lieu of Pay As You Earn (PAYE) which increased from 3.42 billion to 6.02 billion shillings. Muwanga said that the continued failure to pay salary related taxes could result in litigation and fines by the Uganda Revenue Authority (URA).

Tasked by Nandala to explain why PAYE is not remitted, Christopher Mugisha, a Senior Accountant in the Finance Ministry Privatization Unit attributed their failure on budget constraints. He said that salaries are paid partially hence the reason not to pay PAYE.

Mugisha’s response was queried by MPs including Kashari North MP Wilberforce Yaguma and Kalungu West MP Joseph Ssewungu who said that PAYE is deducted at source whether salaries are partially paid. These were backed up by Nandala.

Mugisha said that they have requested for funds to enable settle the liability. However, Nandala insisted that whenever salaries are paid whether partially, PAYE should be deducted automatically.

The committee directed the Privatization Unit to present before PAC the payroll of its staff on the next interface with the committee. He also demanded for documents in regard to URA’s action on the matter.

According to the Income Tax Act, an employer has to deduct PAYE and remit it to URA, maintain employees’ records and account for the tax deducted on a monthly basis. Employees are obliged to declare total income from all sources including business income. An employer who fails to comply becomes liable to pay the tax along with any penalties and interests.

*****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price